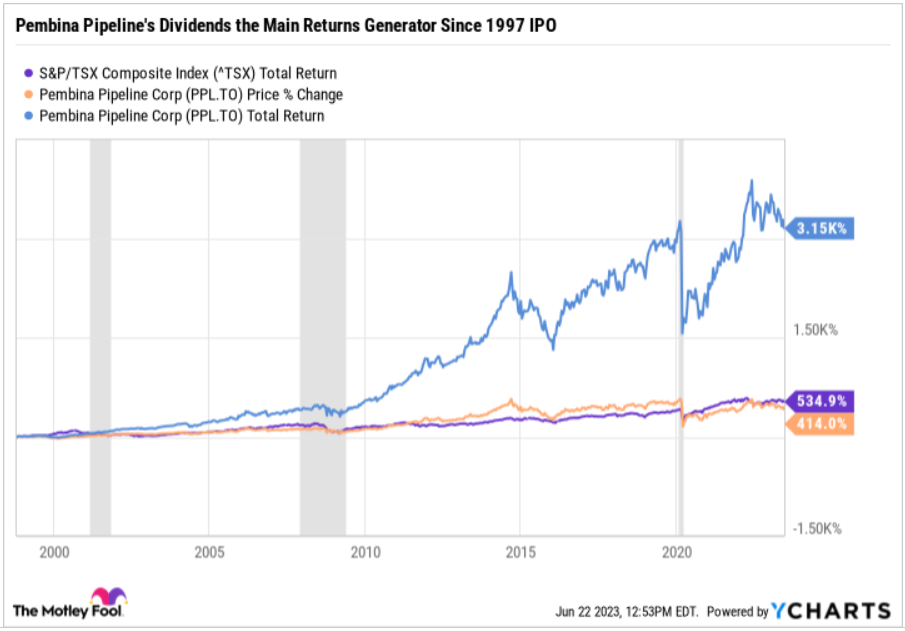

Dividend investing can be a wildly winning strategy for long-term investors. Investors who acquired crude oil pipeline and commodities trading giant Pembina Pipeline (TSX:PPL) stock soon after its initial public offering (IPO) in 1997 could be sitting on more than 3,000% gains today. Most of the gains came from dividends and dividend reinvesting. They’ve done well.

Fast forward to June 2023, and a $22 billion Pembina Pipeline is dangling a juicy 6.5% annual dividend yield to new PPL stock investors. An investment in the dividend darling could add a significant source of passive income to a retirement portfolio. However, total investment returns do matter, and Pembina Pipeline stock has underperformed the broader market over the past 10-year and 5-year investment horizons. Has PPL stock turned into a value trap?

Before we make an attempt to address the value trap fears, let’s evaluate whether a new investment in Pembina Pipeline stock, solely for the dividend, is an idea worth one’s consideration.

Should you buy Pembina Pipeline stock for the dividend?

Dividends are the main source of investment returns on Pembina Pipeline stock. New long-term-oriented investors may buy PPL stock today and expect to enjoy more dividend-driven returns in the future. The dividend is well covered by growing free cash flows, and the company has been distributing excess cash flows back to investors through stock repurchases since 2022.

Dividends lifted PPL stock’s total returns from a “mere” 414% capital gain to a staggering 3,160% total return for investors who acquired shares at its IPO in October 1997.

Dividends on PPL stock turned a potentially underperforming stock into a wild outperformer. Price appreciation on PPL stock was lower than the total return on the S&P/TSX Composite Index of 535%. Without its dividends, Pembina stock could have underperformed the TSX over the past 26 years.

Looking ahead, a starting yield of 6.5% on Pembina Pipeline stock could be what an investor needs to sleep well at night during the twilight years.

That said, past performance does not guarantee future returns, and this could be true on PPL stock.

Dividends haven’t been as powerful as to help Pembina Pipeline stock outperform the market over the past 10 years. Shares delivered a 119% total return during the past decade. A passive investment that mimics the TSX could have returned more than 122% in total returns over the same period.

This underperformance raises a good question: Could PPL stock be a value trap?

Could Pembina Pipeline stock be a value trap?

There’s a growing divergence between PPL stock’s valuation direction and the company’s revenue, earnings, and cash flow generation lately. Shares trade at a low price-to-earnings (PE) multiple of 8.2, far below an industry average above 11. A value trap is an investment that appears too cheap to ignore, but never recovers to its “fair” value during one’s investment horizon. Investors lured by its compelling value may remain locked in a poor performer that has no catalyst to push or pull it up to fair value.

Down 9% year to date, Pembina Pipeline stock trades 12% cheaper over the past five years despite growing revenue by 58%, generating 123% higher annual net income, and growing free cash flow by 110% during the period.

The stock could fall further if its largest revenue segment continues to shrink in the near term. The company’s Marketing and New Ventures segment generated 73% of total revenue last year, and sales are dropping in 2023 as oil and gas prices weaken. Natural gas prices have dropped by 42% so far this year.

A 23.8% drop in first-quarter 2023 revenue, year over year, didn’t help its case.

That said, the decline was partly influenced by volume declines linked to a temporary pipeline outage, and an accounting change that reclassified a subsidiary to an equity-accounted investee.

Management remains innovative, though, and the company is engineering a new source of long-term growth that may revalue PPL stock higher.

Pembina Pipeline’s new growth project

Pembina Pipeline’s recently announced partnership with Marubeni Corp. to build a low-carbon hydrogen and ammonia project targeting exporting to the Japanese and Asian markets could be a new source of revenue, earnings, and cash flow growth the company needs to support dividend growth and drive its stock price higher in the long term.