Traditionally, many investors focus their attention on the large-cap behemoths of the S&P 500 index. While these companies certainly have their merits, there’s a world beyond them teeming with potential, ready to energize your investment portfolio.

An exciting realm that is often overlooked by investors is small-cap stocks. These small companies, typically with a market capitalization of between $300 million and $2 billion, may not boast the same headline-grabbing stature as their larger counterparts but can hold substantial potential for growth.

Today, I’ll be demystifying some crucial research about small-cap stocks. Don’t worry; I won’t be using any complex finance lingo. I’ll make sure you understand everything in simple, easy-to-follow terms and provide an exchange-traded fund, or ETF, pick I think is great for small-cap exposure.

Does size matter?

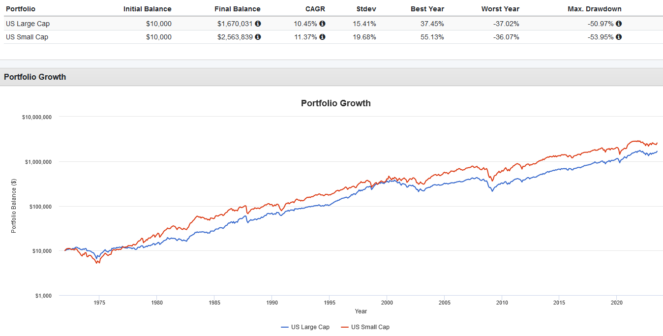

Yes, but not in the way you think! Historically, small-cap stocks have dramatically outperformed large-cap ones, as seen in this decades-long backtest below of U.S. large-cap versus small-cap returns:

Why is this so? Well, way back in the 1990s, Eugene Fama and Kenneth French, two renowned economists, found that small-cap stocks have historically outperformed large-cap stocks over long periods. They termed this finding the “size” risk factor.

Now, what does this mean for you as an investor? To put it simply, the Fama-French research suggests that small-cap stocks, despite their inherent volatility and risks, have the potential to offer higher returns over longer periods of time.

Picture this: You’re in a race between a sturdy but slow elephant and a nimble, fast, but slightly unpredictable hare. The elephant, moving steadily, represents the large-cap companies. They’re typically safer bets, offering steady but often slower growth.

The hare—agile and quick—symbolizes the small-cap stocks. They might be a bit unpredictable, but they have the potential to sprint ahead. By diversifying your portfolio and including some of these smaller, faster “hares,” you could potentially boost your overall returns.

Of course, it’s important to balance this with the understanding that higher potential returns also come with higher risk. As with all investments, it’s crucial to thoroughly research each small-cap stock and consider its fit within your broader portfolio and investment strategy.

Why use an ETF?

Small-cap stocks can be less liquid than their large-cap counterparts, and sometimes there isn’t alot of analyst coverage on them. This can make it hard for you to pick the best ones. By buying an ETF, you can outsource the stock-picking to a professional.

My favourite small-cap ETF is BMO S&P US Small Cap Index ETF (TSX:ZSML). This ETF tracks the S&P SmallCap 600 Index, which you can think of as the little brother of the larger, more well-known S&P 500 Index. As its name suggests, the index holds around 600 small-cap U.S. stocks.

What I like in particular about ZSML is its low expense ratio. Right now, the ETF charges just 0.23%, or around $23 in annual fees for a $10,000 investment. This is a great price to pay for 600 stocks, especially when it comes to less liquid small caps.