The urgency to invest for the future is often emphasized in financial circles, making it an overwhelming and uncomfortable topic to tackle, especially if you’re swimming in a sea of debt.

You’re not alone if you’re grappling with this dilemma. According to TransUnion’s second-quarter (Q2) 2023 Credit Industry Insights Report, Canadian household debt has surged by 4.2%, or $94.8 billion, compared to the previous year. Canadians now shoulder a collective debt burden of a staggering $2.34 trillion.

Facing this sort of financial pressure, it’s easy to feel disheartened and stuck. But don’t lose hope — there’s a way out. Today, I’ll give you a straightforward, actionable game plan to help you pay off your debt and get you on track to investing for a secure and comfortable retirement.

Here’s my personal financial roadmap that might turn the tide in your favour, helping you to move from debt laden to financially liberated in 20 years.

How to pay off the debt

Paying off debt is going to require hard work, discipline, and some honest soul-searching. There’s no magical solution; instead, it’s a multi-pronged approach, tackling different variables to get your debt under control. Here’s a four-part game plan to help you do just that.

Adopting an all-cash diet: Set yourself a strict monthly budget for variable expenses—those are costs that aren’t fixed. This includes groceries, entertainment, and clothing. The rule is simple: only use cash for these transactions. If you run out of cash before the end of the month, you’re not allowed to reach for a credit card. This exercise forces you to confront your spending habits head-on and makes you think twice before making a purchase.

Make more than the minimum credit card payment: Only making the minimum payment on your credit card won’t cut it if you’re serious about debt reduction. The minimum payment barely covers the interest, meaning your debt will continue to grow, and it could take years to pay it off. By paying more than the minimum, you chip away at the principal amount, which not only reduces your debt faster but also lowers the interest you’ll pay in the long run.

Consolidate debt: If you have multiple debts with varying interest rates, consider consolidating them into a single line of credit or a credit card with a promotional rate. This simplifies your debt management by combining your debts into a single monthly payment and can potentially reduce your interest rates, saving you money and speeding up your debt repayment.

Pick up gig work: This option may not be the most glamorous, but it’s practical. Taking on gig work or a part-time job will provide extra income to throw at your debts. Every dollar you earn is a dollar less you owe, and it’s certainly better than accumulating more interest on your debt.

Investing for retirement

Once your debt is under control and you have a three- to six-month emergency fund saved up, you’re ready to invest. For a real shot at getting rich in 20 years, I would do this:

- Make the maximum allowable TFSA contribution every year.

- Invest in a low-cost index fund tracking the S&P 500.

- Reinvest dividends promptly, but otherwise, leave it alone.

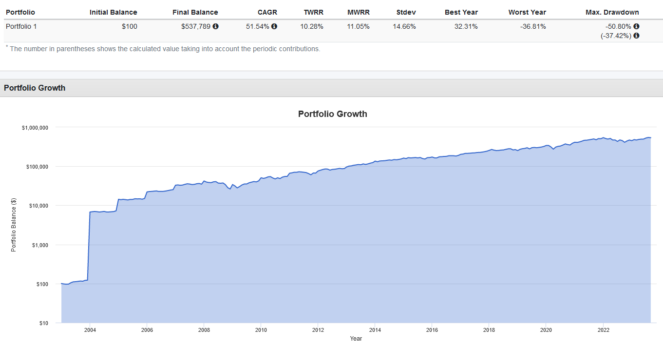

That’s it. Here’s how that would have worked out historically for an investor from 2003 to present holding an S&P 500 index fund, starting with just $100 but adding $6,500 (2023’s TFSA contribution) every year thereafter and reinvesting dividends for 20 years:

The result: $537,789, of which only $130,000 came from annual TFSA contributions. The rest was the result of compounding.

To put this strategy into play, consider Vanguard S&P 500 Index ETF, which you can then augment with some Canadian stock picks (and the Fool has some great suggestions below!)