Enbridge (TSX:ENB), known for its robust forward annual dividend yield of 7.52%, might appear at first glance to be an attractive option for investors seeking steady income.

However, when it comes to stock performance, the appeal of a high dividend yield doesn’t always translate into superior returns compared to the broader market.

In recent years, despite its generous dividend payouts, Enbridge’s stock performance has not outpaced the overall growth of the S&P/TSX 60 index. This observation might seem counterintuitive to investors drawn to the stock for its income potential.

To shed light on this discrepancy, I’ve put together a data-driven analysis. This breakdown looks at Enbridge’s stock performance since 2018, comparing it with the TSX’s performance.

The historical data

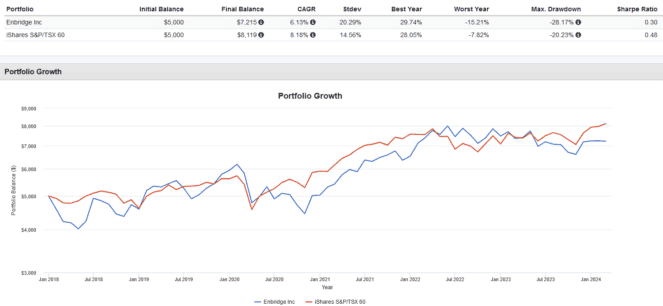

From 2018 to the present, if you had invested $5,000 in Enbridge, your investment would have grown at an annualized rate of 6.13%, reaching $7,215. However, when comparing Enbridge’s performance to broader market benchmarks, the picture starts to change.

Over the same period, iShares S&P/TSX 60 Index ETF (TSX:XIU), a fund that tracks the performance of the 60 largest stocks listed on the Toronto Stock Exchange, delivered an annualized return of 8.18%, bringing the total value of a $5,000 investment up to $8,119.

Moreover, XIU achieved its higher returns with considerably lower risk. The standard deviation, a measure of the volatility of returns, was 14.56% for XIU compared to 20.29% for Enbridge. This indicates that Enbridge’s stock experienced more significant fluctuations in its price, presenting a higher risk to investors, despite its attractive dividend yield.

The data-driven analysis underscores a vital investment lesson: while high dividends can contribute to an investment’s total return, they don’t guarantee superior performance compared to the broader market. In this case, even with dividends reinvested perfectly, Enbridge underperformed the TSX 60 index and did so with a higher level of risk.

Why you shouldn’t chase yields

The key takeaway from comparing investments like Enbridge versus broader market exchange-traded funds (ETFs) is a vital lesson about dividend investing: unless you’re utilizing the dividends for immediate income, pursuing high-yield stocks solely for the purpose of reinvesting dividends might not be the most strategic choice.

This approach often overlooks the fundamental principle that dividends aren’t simply “free money” but rather a distribution of a company’s profits to its shareholders, which, in turn, affects the company’s valuation.

When a company pays out a dividend, it’s redistributing a portion of its profits back to shareholders rather than reinvesting those funds into the business for future growth. This distribution leads to a reduction in the company’s retained earnings, thereby affecting its overall market valuation.

Practically, this means that all else being equal, a stock’s price typically drops on the ex-dividend date by an amount roughly equivalent to the dividend paid.

Consider the example of Berkshire Hathaway (NYSE:BRK.B), a company that famously does not pay dividends. Instead, it reinvests its profits back into the company, focusing on growth and value creation.

This strategy has made Berkshire Hathaway one of the best-performing stocks over the long term, demonstrating that a company can deliver significant returns to its investors without directly paying out dividends.