The straightforward answer to whether Vanguard Total Stock Market ETF (NYSEMKT:VTI) can be a millionaire maker is yes, under the right circumstances and over the correct period, thanks to the magic of compounding.

This article will take you on a historical journey, tracing the performance of VTI’s mutual fund counterpart, VTSMX, all the way back to its inception in 1993. That’s over 30 years of data we have to work with today!

We’ll explore how this broad-market exchange-traded fund (ETF) has the potential to turn diligent savers into millionaires, highlighting the importance of time, patience, and consistent investing in achieving financial milestones.

What the data says

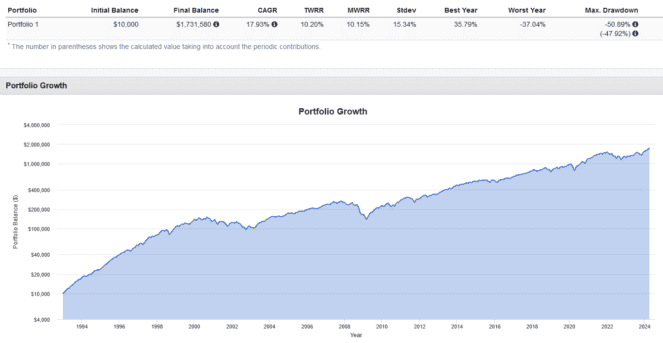

An initial investment of $10,000 in VTSMX back in January 1993 could have grown to an impressive $1,731,580 by March 31, 2024, but this success hinges on a few critical actions from the investor:

- Promptly reinvesting dividends upon receipt.

- Consistently contributing $500 monthly, totalling $6,000 annually, which is under the current $7,000 TFSA limit.

- Maintaining the investment through the downturns of 2000, 2001, 2002, 2008, 2018, and 2021.

By following this strategy, the investor’s returns would have compounded at an annual rate of 10.15%, solely from the ETF’s performance. Including the periodic contributions, the compounded rate jumps to 17.93%.

However, this journey wasn’t without its trials; at the worst point, the investor would have seen a 50.89% drop in their investment value and experienced average annual fluctuations of 15.34%.

The risk here is to be expected — you’re being compensated with market returns over the long run to absorb and weather this volatility. This is the price to pay for returns that exceed those of bonds and cash.

The Foolish takeaway

The key takeaway here is that success in investing comes down more to behaviour than the specific investments chosen, assuming sufficient diversification is attained.

It’s crucial to focus on consistent investing, reinvesting dividends, avoiding market timing, and maintaining investments during downturns. Sometimes, the hardest thing to do is sit on the sidelines and let time pass.

Now, for those looking to invest in VTI, a Registered Retirement Savings Plan account is recommended to avoid the 15% foreign withholding tax on dividends. This is because it is a U.S. ETF. However, you’ll need to convert Canadian dollars to U.S. dollars.

However, for Tax-Free Savings Accounts, where this tax advantage doesn’t apply, investors might consider VTI’s Canadian counterpart, Vanguard Total U.S. Stock Market Index ETF (TSX:VUN), to save on currency-conversion fees.