It’s been over three years since the memorable GameStop (NYSE:GME) frenzy shook the markets, yet the echoes of meme stock mania are still very much alive.

There’s a still dedicated group out there, self-dubbed the “apes,” who are steadfast in their belief that big returns are just around the corner. Amidst hopeful discussions, they continue to hold, with some enduring significant losses, all in anticipation of the “Mother of All Short Squeezes,” or MOASS.

In a similar vein, those who ventured into AMC Entertainment (NYSE:AMC) have found themselves navigating through turbulent financial waters. If you were among those who decided to invest $1,000 into AMC five years ago, back in 2019, let’s take a closer look at how that investment would stand today.

A lesson in bagholding

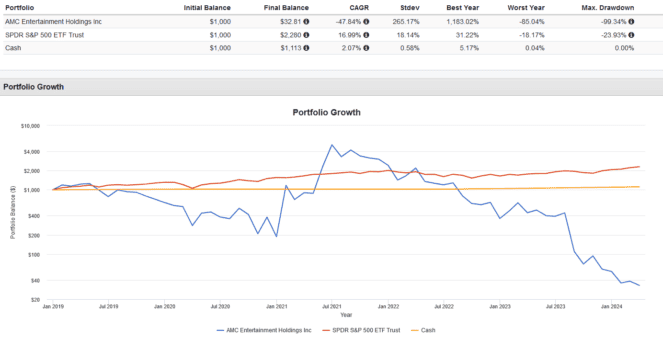

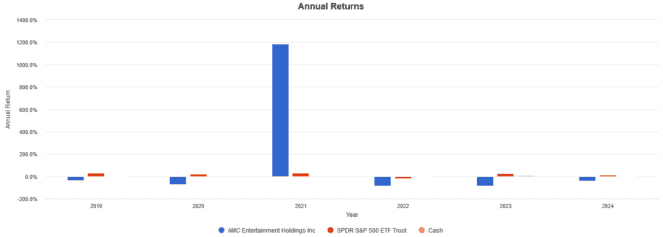

Here are the results for a hypothetical AMC investor who invested $1,000 in January 2023 and held until the present, compared to the returns of risk-free cash and the S&P 500 Index:

Even despite the pump in 2021, our AMC investor would have seen their initial $1,000 investment turn into just $32.81 at an annualized loss of -47.84%. During this time, cash returned 2.07%, while the S&P 500 returned 16.99%.

To put it bluntly, investors that either blindly held cash or invested absentmindedly into an index fund would have beaten the AMC investor.

What caused this gross underperformance? Well, a series of inauspicious events occurred:

- The outbreak of COVID-19 in 2020 decimated AMC’s revenues due to the nature of its business (in-person movie theatres).

- A 10:1 reverse split in AMC shares followed by ongoing dilution of its shareholders, which was needed to shore up AMC’s balance sheet.

AMC fundamentals are not looking great. The company currently has an operating margin of -3.93% and just 884.3 million in cash against $9.14 billion in debt. Ask yourself: would you want to be an owner of this company? Because that’s what buying shares would make you.

Forget AMC. These stocks are better

In the search for a U.S. stock that combines the essence of a remarkable business with a reasonable price tag, I’d like to pivot away from the speculative fervour surrounding AMC and highlight two dividend-paying stalwarts from the consumer staples sector.

Let’s consider Procter & Gamble (NYSE:PG), a cornerstone of countless households worldwide. This company is behind household names such as Tide, Pampers, Gillette, Oral-B, and Crest. Recently, Procter & Gamble announced a 7% dividend increase, marking the 68th consecutive year of dividend growth. The company boasts an operating margin of 27.42%, showcasing its operational efficiency.

Another exemplary pick is Coca-Cola (NYSE:KO), a beacon of enduring value and brand strength. With 61 consecutive years of dividend growth, Coca-Cola continues to quench the world’s thirst with its vast portfolio of beloved beverage brands. The company’s financials are impressive, with an operating margin of 22.49%.

The lesson here is straightforward: instead of gambling on the uncertain futures of highly speculative stocks in cutthroat industries, it’s wiser to align your investments with quality, blue-chip companies. These firms not only have a proven track record of rewarding shareholders but also boast diversified and resilient brand portfolios that stand the test of time.