Vanguard All-Equity ETF (TSX:VEQT) has become a favourite for Canadian investors who appreciate its broad market access and low fees, providing a slice of the global economy through over 13,000 stocks.

While no one can predict the future of the market with certainty, the historical trajectory of global equities suggests potential for growth. Here’s a straightforward take on what the future might hold for this popular asset allocation exchange-traded fund (ETF).

VEQT: Return predictions

While no one can foresee the exact returns VEQT will generate over the next five years, historical performance gives us clues. Looking back at similar fund compositions and global market behaviour, a reasonable estimate might put VEQT’s annual growth between 6% and 8%.

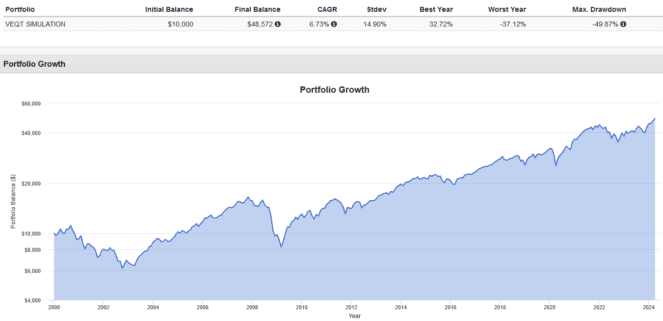

Past backtests, incorporating a similar mix of 45% U.S., 30% Canadian, 18% developed international, and 7% emerging markets stocks, have shown an average annual return of around 6.73%.

Though slightly conservative, this figure reflects a period heavily influenced by significant market downturns like the dot-com bust and the 2008 financial crisis. Keep in mind, past performance doesn’t guarantee future results, but it helps inform our expectations.

VEQT: Fee predictions

VEQT’s expense ratio of 0.24% is competitive, but there’s room for improvement, especially compared to similar ETFs charging around 0.20% or less. For a $10,000 investment in VEQT, you’re currently looking at a cost of $24 in fees annually.

Given Vanguard’s history of leading the charge in reducing fees, it’s reasonable to anticipate that as the ETF grows in size and faces stiffer competition, we could see these fees get even lower. Fee reductions would be a boon for investors, enhancing the appeal of VEQT.

VEQT: Dividend predictions

VEQT offers a dividend yield of 1.72%, which is distributed annually. This is somewhat unusual in the ETF space, where quarterly or even monthly distributions are more common. The frequency of payouts doesn’t significantly impact the overall financial benefits, but from a psychological standpoint, investors might appreciate more frequent distributions.

Regular dividends can provide emotional encouragement to remain invested, particularly through market downturns, as they serve as a tangible reminder of the returns their investments are generating. It wouldn’t be surprising if VEQT adjusted its dividend schedule in the future to align more closely with investor preferences for more frequent payouts.

The Foolish takeaway

The exploration of VEQT’s future is an interesting exercise, but for those invested in the ETF, it’s best not to dwell on these speculations too much. VEQT is designed for the hands-off investor who is looking to capture the long-term average market return without much hassle and at a low cost.

The key to success with VEQT is to remain invested, reinvest dividends, and let compound interest work its magic over time. Focusing too much on short-term predictions can detract from the simplicity and efficiency that VEQT is meant to offer. So, keep calm and invest on!