It’s been more than three years since meme stock GameStop (NYSE:GME) captured global headlines with its dramatic short squeeze in January 2021.

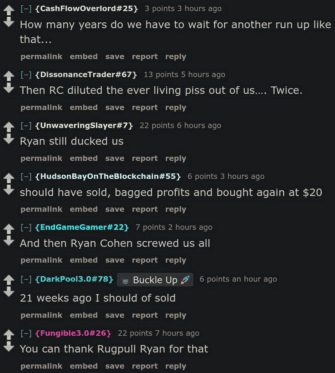

Despite the time elapsed, a devoted – some might say almost cult-like – group of investors (the “apes”) continues to baghold their shares. You can find them at r/Superstonk on Reddit. Dan Olson even did a documentary on them called “This is Financial Advice” – it’s a fascinating watch.

It’s a startling testament to how phenomena like groupthink and the sunk cost fallacy can compel investors to hang onto suboptimal investments long past their prime, resisting the often prudent decision to cut losses. Diamond hands go broke. Bulls make money, bears make money, apes get slaughtered.

Anyways, here’s why I’m personally bearish on GameStop, and which other stock I think is more promising as a long-term, buy-and-hold forever investment.

Why not Gamestop?

Despite the fervent loyalty of its ape shareholders, GameStop’s path forward remains precarious, largely due to a conspicuous lack of strategic direction and inability to execute on a turnaround / pivot.

Under CEO Ryan Cohen, numerous initiatives aimed at revitalizing GameStop have fallen flat. The much-hyped NFT marketplace was shuttered, efforts to morph into an e-commerce titan via distribution centres fizzled out, and Playr, its venture into Web 3.0 gaming, has yet to make a significant impact.

Notably, the company has ceased providing forward guidance during earnings calls, leaving investors in the dark about future plans. What does this say to shareholders? “We don’t care enough about you to tell you what we plan to do.”

Further straining investor relations, Cohen has repeatedly diluted shareholder value through multiple at-the-market offerings whenever the stock has a decent run-up, amassing a $4 billion war chest – funds that have yet to be effectively deployed.

These actions have done little beyond padding the balance sheet, while strategic missteps continue to pile up: employee benefits have been slashed, underperforming stores closed en masse, and GameInformer, a beloved gaming magazine, was abruptly discontinued, sparking outrage among gamers and journalists alike.

With the upcoming generation of gaming consoles expected to eschew physical discs, GameStop’s traditional retail model faces an existential threat, underscored by a stark 31.4% year-over-year decline in quarterly revenue and a troubling $33.1 million operating cash flow deficit.

The company’s narrow profit margins are currently sustained only by interest from its cash reserves – a precarious foundation that’s likely to erode as interest rates decline. It’s basically a money market fund with the overhead of retail stores.

Adding to the company’s challenges, Cohen’s tenure as CEO has been marked not only by failed business initiatives but also by a divisive online presence.

His frequent, often controversial tweets – including unsolicited political commentary and trivial personal posts – have likely alienated a substantial segment of potential GameStop patrons that vote Democrat.

This lack of professional focus and clear leadership direction only further cements my bearish outlook on GameStop as a viable long-term investment.

What to invest in instead

Instead of clinging to the uncertain prospects of GameStop, I find far more assurance in investing in the enduring value of The Coca-Cola Company (NYSE:KO).

Founded in 1886, Coca-Cola is not just a business – it’s a global institution. With a sprawling portfolio of beloved brands, Coca-Cola enjoys unparalleled recognition and consumer loyalty across the world.

One of the key strengths of Coca-Cola lies in its impressive dividend history. The company is a celebrated ‘Dividend King,’ having raised its dividend for 62 consecutive years, a testament to its stable and growing profitability. Currently, you get a 2.7% yield. What does Gamestop pay? Nothing.

Moreover, Coca-Cola’s penchant for stock splits – turning a single share from 1919 into 9,216 shares today – exemplifies its shareholder-friendly ethos. Financially, Coca-Cola also boasts robust margins that GameStop can only aspire to, with a profit margin of 22.9% and an operating margin of 32.5%.

In essence, the choice is clear. Would you rather invest in a company with a proven track record of growth, stability, and shareholder returns, or roll the dice on a struggling retail chain with an uncertain future and a mercurial CEO who can’t stop diluting shareholders?

For me, the answer is straightforward – I’d much prefer to own a world-renowned beverage maker over a video game pawnshop on the brink of irrelevance.