The Canadian railways are the pulse of economic activity, transporting more than $250 billion of goods annually from a diversified list of sectors. Canadian National Railway Co. (TSX:CNR) is one of two Canadian railways that have enjoyed the benefits of this industry – a duopoly with strong barriers to entry. CNR stock reflects this reality as a high return investment.

Let’s take a look at where CNR stock will be in the next few years.

Efficiencies

The operating ratio, which is defined as operating costs divided by revenue, is a measure of efficiency. The lower this ratio, the more efficient the operations. Over the years, CN Rail has worked hard to bring this ratio down. In 2012, its operating ratio was 66.2%. In its latest quarter, it was 64%. This is a testament to the improvements that have taken place at the railroad and the shareholder value that has been created.

But this is not the full story. In fact, the second quarter of 2024 was actually a disappointing one. This was due to many one-time, unusual factors, including planned and unplanned maintenance, and labour uncertainty. The good news is that these issues have largely been resolved. As a result, CN’s operating ratio for the second half of 2024 is expected to be below 60%.

This will go a long way in boosting CNR’s stock price in the next year.

Earnings growth at CNR

Looking ahead a bit further, CNR management is expecting earnings per share (EPS) to increase at a compound annual growth rate (CAGR) of 10% to 15% from 2024 to 2026. CNR stock is currently trading at 18 times next year’s expected earnings. This compares to CP Rail, which is trading at 22 times next year’s expected EPS, despite similar earnings growth rates.

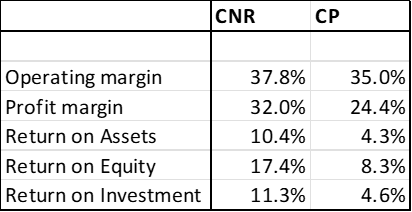

This valuation discrepancy becomes even more surprising when we consider the comparative profitability metrics between the two railroads. A quick look at the table below really highlights the big discrepancy in profitability and return metrics – CNR is outperforming by a wide margin.

CNR stock in five years

Right now, CN Rail is benefitting from the rapidly growing propane export business. Over the next five years, this is expected to remain a growing business. CN Rail is preparing for this, increasing its capacity and efficiencies.

The consumer business has been more of a mixed bag, with weakness showing up due to a less healthy consumer. Looking ahead to the next five years, this should be offset by falling interest rates. More importantly, as I touched upon earlier in this article, CN Rail has exposure to a list of diversified industries. This includes less economically sensitive industries like the grain/fertilizer industry and petroleum and chemical industries.

Beyond all of that, amongst the factors I think will boost CNR stock in the next few years, we have CNR’s growing dividend. In fact, management has guided to dividend growth of 7% in 2024. This comes after a 57% growth rate in its annual dividend in the last five years, or a CAGR of 9.5%.

The bottom line

CNR stock has been a top stock for the last few decades. Looking ahead, I think we can expect this to continue as the company continues to reap the rewards of a growing economy, a protected business, and continued efficiencies. This will translate into continued strong returns for CNR’s stock price.