With the Bank of Canada delivering two jumbo 50-basis-point (0.5%) rate cuts in 2024 to rescue our floundering economy and bail out the federal government’s reckless fiscal decisions, Canadian utility stocks might be catching your eye.

Beyond their defensive, non-cyclical, low-beta nature—making them perfect for recessions—utilities are also typically heavily indebted, for good reason. Thus, as interest rates fall, this could provide a much-needed tailwind to the sector.

Utilities rely on significant capital expenditures to build new infrastructure and expand their rate base, which is how they grow earnings long-term. Since they operate in regulated markets, utilities can only raise rates so much, so this manner of growth is necessary.

While you can pick individual utility stocks, I prefer a more diversified approach with a sector exchange-traded fund (ETF). However, as you’ll see, not all utility ETFs are created equal—choosing the right one matters.

The usual suspect

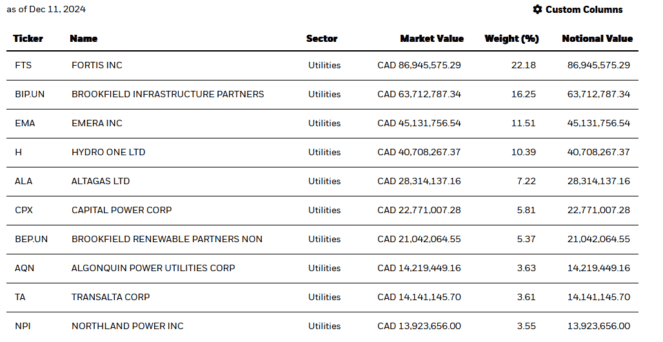

The largest utility sector ETF in Canada is iShares S&P/TSX Capped Utilities Index ETF (TSX:XUT), with $386 million in assets under management.

While it might seem like the obvious choice, it’s not one I’d recommend. The issue isn’t even the 3.91% dividend yield, which is modest but acceptable, or the 0.61% expense ratio, which is a bit steep but typical for the category. My main concern is the concentration.

The top four holdings in XUT make up 22.18%, 16.25%, 11.51%, and 10.39% of the ETF, respectively. This means you’re not really owning the sector—you’re just heavily betting on four companies.

This lack of diversification is risky in a sector like utilities, where climate risk can significantly impact performance. For example, a utility company heavily concentrated in Ontario could face serious setbacks if the province experiences an extreme weather event or policy changes.

Diversification across provinces and types of utilities (like electricity, water, gas, and renewables) is critical to mitigate these risks, and XUT doesn’t really deliver that.

The better alternatives

If you’re looking for better utility ETFs than XUT, I’ve got two options that are far more diversified and tailored to either income or growth.

First up is Hamilton Utilities YIELD MAXIMIZER™ ETF (TSX:UMAX).

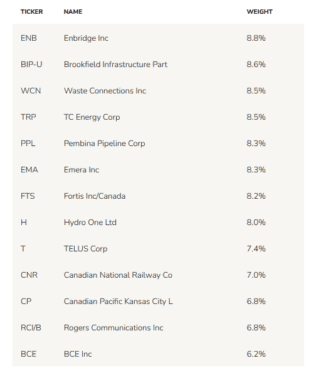

This fund holds an equal-weighted portfolio of 13 Canadian stocks, including the usual suspects in gas, water, and electricity utilities. But it goes a step further, expanding into quasi-utilities like pipelines, telecoms, railways, and even waste management companies. This broader, infrastructure-focused approach adds balance and diversification.

What sets UMAX apart is its high-yield strategy. To boost income, it employs a covered call strategy, selling at-the-money calls on 50% of the portfolio. While this caps some upside, it significantly enhances income generation. As of Dec. 12, UMAX delivers a jaw-dropping 13.91% yield with monthly payouts.

For utility investors who are more focused on growth than income, a great alternative is Hamilton Enhanced Utilities ETF (TSX:HUTS).

This ETF replicates the holdings of Solactive Canadian Utility Services High Dividend Index TR, offering a broader and more balanced approach than XUT.

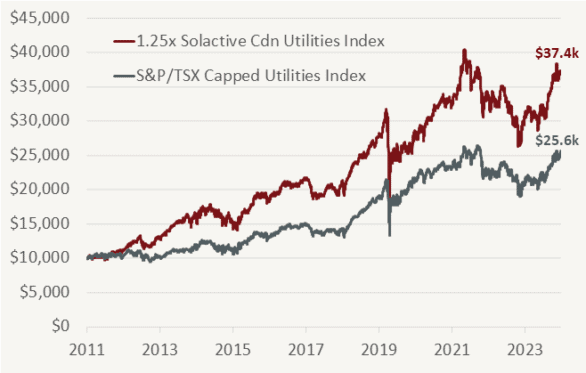

HUTS skips the covered call strategy and instead uses leverage to amplify returns. By borrowing 25% cash via a margin loan, it operates at 1.25 times leverage, magnifying both potential gains and risks. This approach also increases the yield, which currently stands at 6.89%.

Historically, leveraging the Solactive Canadian Utility Services High Dividend Index TR by 1.25 times has delivered strong returns.