Yes, the title is not clickbait. Let me show you how, historically, with enough time in the market and a low-cost S&P 500 index fund, you could turn $100 a month—roughly the cost of skipping a night out or your daily coffee habit—into a million-dollar retirement. It’s not magic, just the power of compound growth.

What is the S&P 500?

For those of you new to investing, the S&P 500 is an index—a benchmark of rules that determine which stocks to include and how to weight them.

In this case, it tracks 500 of the largest and most liquid U.S. companies. The index committee selects these stocks based on earnings quality, and they’re weighted by market capitalization—the bigger the company, the more influence it has on the index.

Why is it so notable? The S&P 500 gives you a snapshot of how the U.S. market is performing at any time. It’s transparent, mostly objective, and serves as the backbone for many mutual funds and ETFs that aim to replicate it.

Show me the money!

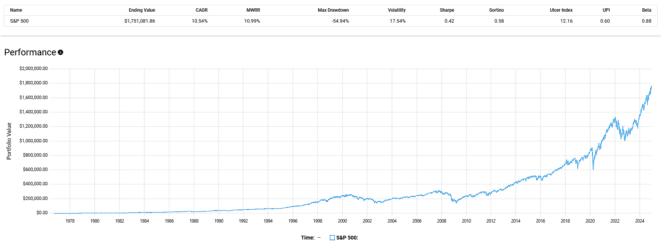

From August 31, 1976, to December 10, 2024, consistently investing $100 a month into a Vanguard S&P 500 index fund, reinvesting dividends along the way, would have compounded to a staggering $1,751,081.86, delivering a 10.54% annualized return.

But don’t think this journey was smooth sailing. In 2008, for example, you’d have seen your investment drop by a brutal -54.94%. And on any given year, the S&P 500 fluctuated an average of 17.54% up or down.

Yet, if you held firm, the S&P 500 worked its magic. The companies in the index kept growing earnings, buying back shares to increase value per share, and paying dividends that were reinvested.

This steady combination of corporate growth, shareholder rewards, and the power of compounding turned simple monthly contributions into a life-changing sum.

How to invest in the S&P 500

For Canadian investors, one of the easiest and most cost-effective ways to invest in the S&P 500 is through the BMO S&P 500 Index ETF (TSX:ZSP).

This ETF replicates the performance of the S&P 500 while charging a minimal 0.09% expense ratio—just $9 annually for every $10,000 invested.

Over the past decade, with dividends reinvested, ZSP has delivered an impressive 15.23% annualized return, making it a straightforward and efficient way to capture the long-term growth of the U.S. market.