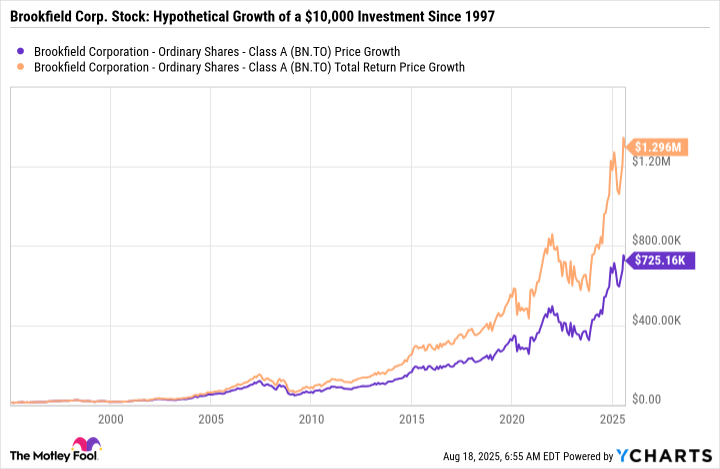

A humble $10,000 investment in Brookfield Corporation (TSX:BN) three decades ago with dividends fully reinvested would be worth a staggering $1.3 million today. That’s a mind-bending 12,800% total return. The obvious question for investors today, as Brookfield implements its latest major strategic shift, is simple: Can this alternative asset management giant keep delivering for long-term-oriented shareholders? Based on its relentless evolution and ambitious new plans, the answer looks like a resounding yes.

Source: Getty Images

Beyond real estate: Brookfield turns to AI and retirement savings

Brookfield Corporation’s journey started firmly in real estate. But the key to its phenomenal success hasn’t been sticking to one playbook; it has been an uncanny ability to pivot towards where the global economy is heading next. Think pipelines, electricity transmission, then renewable power, data centres, and telecom towers. Today, Brookfield’s spotlight is firmly on two massive, somewhat interconnected trends: the artificial intelligence (AI) revolution and the transformation of retirement savings.

The AI powerhouse play

Recognizing the explosive demand for computing power driven by artificial intelligence, Brookfield is launching a dedicated AI infrastructure strategy. This multi-year strategy isn’t just about buying server racks. Management’s plan involves building massive “AI factories” — integrated sites combining power generation (drawing on Brookfield’s global renewable expertise), data centre shells (leveraging its real estate prowess), and the actual computing equipment. This positions Brookfield squarely at the epicentre of providing the essential backbone for global AI development, a service in skyrocketing demand from tech giants, governments, and corporations worldwide. This initiative perfectly utilizes the asset management giant’s decades of experience in real assets and operating complex infrastructure.

Wealth solutions: Brookfield’s new growth engine

Perhaps the most significant strategic evolution is Brookfield’s deepening commitment to its Wealth Solutions (insurance) business. Initially seen as a complementary arm, it’s now becoming foundational. The recent $3.2 billion acquisition of the UK’s Just Group, a leader in pension risk transfer, exemplifies this. This deal significantly accelerates Brookfield’s growth in one of the world’s fastest-growing retirement markets, instantly adding roughly $40 billion in insurance assets.

Why is this so powerful? The UK deal adds significant scale and stability to Brookfield as insurance provides a massive, stable, and long-duration pool of cheap capital to invest. The deal unlocks synergistic benefits as Brookfield invests it in asset classes it knows best – real estate, renewables, and infrastructure – and enhances total returns to BN stock investors as management targets 15% returns on equity without marginal increases in business risk.

Is Brookfield stock a buy?

Investing in Brookfield stock today is like betting on a slow but consistent chameleon. It’s a bet on sustained, high-quality capital growth driven by exceptional management and strategic agility. The company’s current pivot, leveraging its core real asset expertise to dominate AI infrastructure funding and become a major force in managing retirement wealth, looks like another growth masterstroke in the making.

Early investors in Brookfield stock could have grown a $10,000 investment into a $1.3 million position, with full dividend reinvestment, over the past three decades.

While past performance is no guarantee of future success, and economic shifts or execution missteps will always remain risks to observe, Brookfield’s 30-year history is defined by successfully navigating change and building immense value for stock investors.

With its sights set on the next frontier of AI and the vast pension market, Brookfield Corporation appears powerfully positioned for its next richly rewarding act. For long-term investors seeking exposure to global infrastructure megatrends and exceptional capital allocation, BN stock deserves serious consideration. The millionaire-maker engine might just be revving up again.