For Canadians seeking passive income, real estate investment trusts (REITs) are some of the most attractive choices out there. Unlike companies (which can choose to pay dividends), REITs are required to pay out their earnings to their investors.

Diversified REITs can be a great and easy way to invest in different property types, such as healthcare facilities, offices, residential properties, or retail in a single solution, but there are also specialized REITs that can give you exposure to a distinct, targeted property type.

Here’s we’ll look at a retail-specific REIT.

Investing in retail with First Capital Real Estate Investment Trust

First Capital REIT (TSX: FCR.UN) gives investors exposure to Canada’s retail properties by investing in high-quality grocery-anchored shopping centres in targeted urban and top-tier suburban neighbourhoods. This approach aims to ensure that First Capital’s properties are occupied by tenants that provide essential products and services to customers.

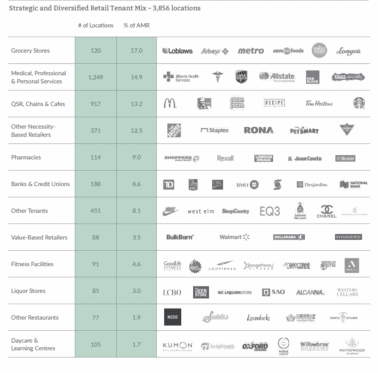

Given that the large-scale grocers in Canada hold significant share in the overall retail market, using them as anchor tenants gives First Capital some certainty regarding property occupancy and utilization. The secondary tenants occupying the firm’s properties are varied and include pharmacies, banks, and fitness centers. The company aims to create a diverse mix of tenants in its properties to meet the needs of local shoppers.

Who are First Capital REIT’s tenants?

As of June 30, 2025. Source: First Capital REIT Q2 2025 earnings report

Currently, the REIT’s occupancy rate is an industry-standard 97.2%, which is to be expected since tenants are mainly corporate and/or small- to medium-sized businesses. There’s a flip side to leaning so heavily on these types of tenants, though.

Risks of investing in First Capital REIT

Given that the firm’s business model focuses on grocers and the surrounding retail sector, an economic slowdown could significantly impact it. A recent, though extreme, example of this is what happened to First Capital during the Covid 19 outbreak. The REIT halved its dividend payouts in 2021 and 2022 to maintain financial flexibility.

FCR.UN’s dividend

These days, First Capital pays a $0.0742 monthly distribution, yielding approximately 4.59%. At present, the trust’s payout ratio is 84.7% of adjusted funds from operations (AFFO), a metric which reflects the actual cash a REIT has available to dividends, after accounting for the maintenance and upkeep needed to keep properties generating income.

Industry experts consider AFFO a more accurate measure of a REIT’s ability to sustain its dividend because it better captures the REIT’s recurring, cash-based nature. Given that REITs are required to pay out 90% of all payable earnings to investors, First Capital’s current payout ratio leaves room for reinvestment and operational flexibility.

Is First Capital REIT a good investment?

Despite uncertainty in the broader economy this year, First Capital’s share price has steadily increased, rewarding investors who have held onto it. Since the REIT’s current price is only just now nearing its pre-pandemic levels (i.e., 2015-2020), I think the stock has the potential for further appreciation. Additionally, because First Capital has consistently paid dividends, with the management team only reducing them out of financial prudence for two years, it seems like a safe bet for divided income.

Investing takeaway

For investors seeking a consistent source of cash flow, First Capital is worth considering, given the economic importance of its properties within the communities its serves and the significance of its anchor tenants. With the firm’s properties maintaining a high occupancy level and its continued expansion into more communities, this is one REIT to keep top of mind.