Wealthsimple Trade

Good for: No-commission investing

What we like

If you’re looking for low cost, it doesn’t get lower than $0 per trade and no account maintenance fees. With Wealthsimple Trade you don’t get the robust platform, data, and educational tools that you will get with some other brokers, but some investors don’t need that. And did we mention the $0 trade commission? Investors do have to pay an exchange rate fee when trading USD-denominated stocks (the corporate exchange rate + 1.5%), but that’s not unusual for any Canadian broker. Do note though Wealthsimple allows trading in most U.S. stocks, it doesn’t have complete coverage, so if you have or plan to have an extensive U.S.-equity portfolio, this may not be your best choice.

Read our full Wealthsimple Trade review.

Trading commission:

$0.00

Account maintenance fee:

None

Our bottom line

Wealthsimple Trade does not charge any fees when you trade stocks or ETFs, making it the only Canadian broker to do so. Combine this with its easy-to-use mobile application, no minimum balance requirements as well as the opportunity to add cryptocurrencies as an asset class to your DIY portfolio and we can see why it has gained solid traction among Canadians.

The top feature of a Wealthsimple Trade account

The top feature of a Wealthsimple Trade account is also one of its most obvious features: there is no commission for trading! That’s a feature that’s hard to beat.

But I’ll give you a bonus top feature as well, since recently, Wealthsimple Trade became the first Canadian broker to offer fractional shares. This makes purchasing and selling stocks with higher prices accessible to investors with a more limited amount of capital.

Wealthsimple Trade is the only domestic platform where you can buy fractional shares in stocks of Canadian and U.S.-based companies.

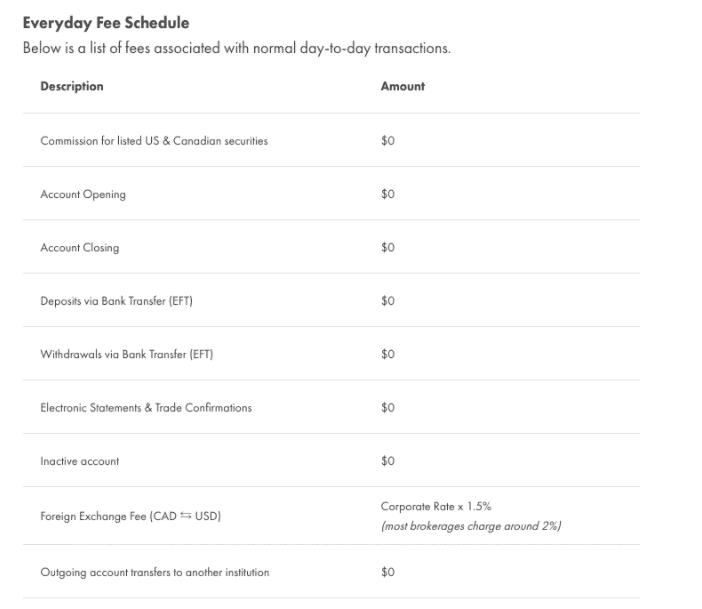

Commission costs

Wealthsimple Trade is also the only trading platform in Canada that does not levy a commission on users for trading stocks and exchange-traded funds or ETFs. Comparatively, its competitors charge at least $4.95 per trade. So, you can get access to a variety of stocks and ETFs listed on Canadian and U.S. exchanges without any trading commission.

Of note, if you trade in the U.S. Dollars, the broker will charge you a currency conversion fee plus an additional 1.5% per trade. For example, if you want to purchase US$1,000 of a particular asset and the exchange rate for converting CAD to USD is 1.2. After accounting for a 1.5% currency conversion fee the total exchange rate is 1.218. So, the total transaction will cost you $1,218 indicating you paid $18 in total currency conversion fees.

It should be noted that a currency conversion fee is fairly standard among Canadian brokers, and many charge a higher fee, often 2% or more.

Fees you should know about

In addition to foreign exchange fees, Wealthsimple Trade generates revenue from users who upgrade to the premium account. Here, traders will be charged a subscription fee of $3/month plus taxes.

Premium subscribers get access to additional features such as unlimited real-time quotes as well as $1,000 instant deposits. By comparison, in the free account, any deposit over $250 takes up to three business days to be reflected in your account.

Wealthsimple explains that when you upgrade your account, the user will be requested to provide account details for billing purposes. The subscription fee will be charged to this particular account every month. In case the billing account has insufficient funds to cover subscription fees, Wealthsimple may cancel your upgrade without prior notice.

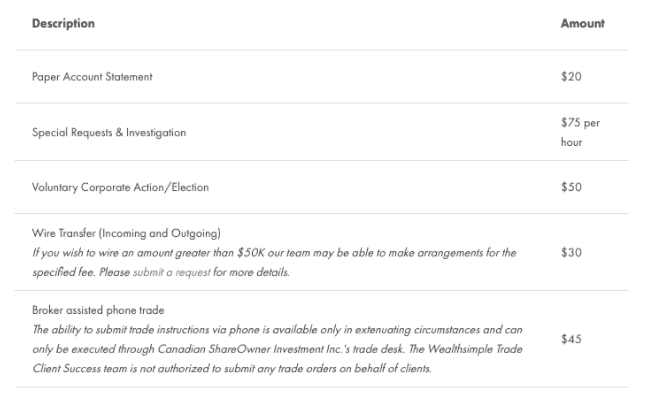

There are other transactional fees applicable in case users have requested additional services. A paper account statement, for instance, will cost you $20 while special requests and investigations will be charged at $75/hour and a voluntary corporate action/election attracts a $50 fee.

A broker-assisted phone trade costs $45. However, Wealthsimple explains that such a trade will be executed only in “extenuating circumstances”.

Buying shares and ETFs with a Wealthsimple Trade account

Canadian investors have access to a wide variety of financial instruments such as shares and ETFs. You can purchase any stock or ETF traded on exchanges that include the TSX, TSXV, NYSE, NASDAQ, and NEO. However, you will not have access to over-the-counter stocks or those listed on exchanges such as CSE. Wealthsimple Trade does not allow you to trade mutual funds or subscribe to an initial public offering.

You can hold your investments in registered accounts such as a TFSA (Tax-Free Savings Account) or an RRSP (Registered Retirement Savings Plan) or any other non-registered account. But it does not allow trading inside other accounts such as RESP, LIRA, RIF, and LIF.

Wealthsimple Trade does not charge you for any account withdrawals or deposits which means you can easily move your investment capital. However, as seen above there is a delay in deposits if you are not a premium subscriber.

Wealthsimple Trade platform

Wealthsimple Trade offers two different platforms for investors that include mobile and desktop. After you login into your desktop account, you can select “trade & crypto” after which you will be taken to the trading platform.

Here, you can take a look at your portfolio, trading activity as well as the option for fund withdrawal or deposits. Users can search for a stock ticker or name in order to see if it’s available to buy or sell. You are also allowed to track stocks and ETFs by creating a watchlist.

The mobile platform is also easy to use and straightforward, and is even more intuitive compared to the desktop version. Here, you can browse stocks based on activity and performance as well as category or trading volume. You can filter stocks and ETFs based on certain criteria such as “Most Active”, “Top Gainers” and “Top Losers”.

Wealthsimple’s research offerings

While the desktop and mobile platforms provide basic features such as a stock’s price chart, it is devoid of any tools that will help you make an investment decision. A long-term investor would like to analyze multiple ratios such as price to earnings, price to sales, EBITDA margin, and many others. However, Wealthsimple does not provide any analysis tools to investors. Further, the price quotes of stocks and ETFs are also delayed by 15-minutes unless you have a premium subscription.

Things to watch out for

Unlike most other brokerages, Wealthsimple Trade has a few restrictions on the types of stocks you can purchase. As seen earlier, investors will not gain exposure to exchanges such as the CSE. You are also not allowed to subscribe to IPOs or partake in high-risk sophisticated instruments including futures and options.

Alternatively, Wealthsimple Trade is the first domestic brokerage to offer the option to buy and sell fractional shares in certain U.S. and Canadian stocks. So, while the price of Amazon, for example, is above US$3,000 as of this writing, you could still get exposure to the tech giant with just $100 in your trading account.

Service and support

Similar to several other broker platforms, Wealthsimple Trade has also focused on enhancing its customer service and improving engagement which will help it reduce overall churn rates. Users can use the online chat option to interact with Wealthsimple’s customer service team. You can also call them on their customer support number or reach out to them via an online form as well as by email.

Pros and Cons of the Wealthsimple Trade platform

Let’s see what are the advantages or disadvantages of using Wealthsimple Trade.

Pros:

- Commission-free trading

- No minimum account balances

- Easy to use mobile and desktop applications

- Supports registered accounts such as TFSA and RRSP

- Easy account opening procedure

Cons:

- Costs associated with a USD account

- Long fund deposit cycle

- Limited investing tools

- Does not support accounts such as RESP

- No exposure to futures, options, mutual funds, or bonds

- Supports a limited number of stock exchanges

Is Wealthsimple trade a good option for you?

Wealthsimple Trade is ideal for investors looking to buy stocks and ETFs. Its commission-free trades remain a top feature, though there are plenty of other reasons to like this platform. The platform itself is not complicated, which makes it attractive for new and experienced investors and the ability to buy fractional shares provides investors with lower levels of capital the ability to by fractional shares in high-priced stocks.

With that in mind, investors interested in the broadest selection of stocks, or hoping for a variety of research and tools included in their broker platform, may be disappointed. So as always, it’s important to consider your personal needs in determining whether this is the right choice for you!

Wealthsimple Trade

Good for: No-commission investing

What we like

If you’re looking for low cost, it doesn’t get lower than $0 per trade and no account maintenance fees. With Wealthsimple Trade you don’t get the robust platorm, data, and educational tools that you will get with some other brokers, but some investors don’t need that. And did we mention the $0 trade commission? Investors do have to pay an exchange rate fee when trading USD-denominated stocks (the corporate exchange rate + 1.5%), but that’s not unusual for any Canadian broker. Do note though Wealthsimple allows trading in most U.S. stocks, it doesn’t have complete coverage, so if you have or plan to have an extensive U.S.-equity portfolio, this may not be your best choice.

Read our full Wealthsimple Trade review.

Trading commission:

$0.00

Account maintenance fee:

None

Some offers on The Motley Fool are from our partners — it’s part of how we make money and keep this site going. But does that impact our reviews? Nope. Our commitment is to you. If a product isn’t any good, our review will reflect that, or we won’t list it at all. Also, while we aim to feature the best products available, we do not review every product on the market.