Energy and mining companies comprise roughly one-third of the entire TSX. It’s no wonder that the Canadian investing universe is dominated by companies related to oil, gas, gold, silver, etc.

Many investors have turned to buying dedicated funds that promise exposure to these commodities. Buying “directly” into resources has become possible due to advent of ETFs, allowing quick, cheap, and easy exposure.

However, in his latest whitepaper, legendary investor Jeremy Grantham (co-founder of GMO LLC) outlines his case for investing in commodity-linked equities rather than the commodities themselves. His argument is compelling. The data uses the U.S. stock market for comparison, but the results should be fairly similar using Canadian indices.

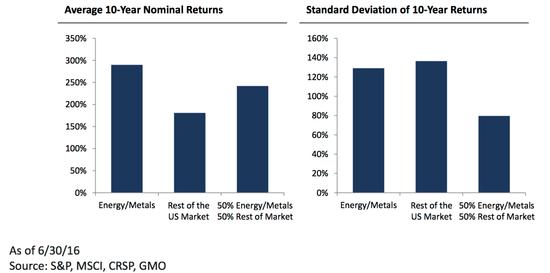

Here’s the data:

1. Resource companies outperform resources

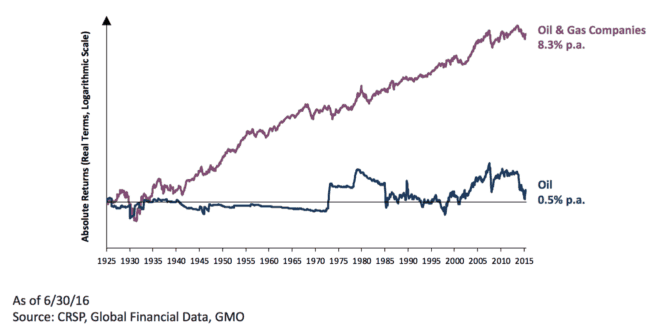

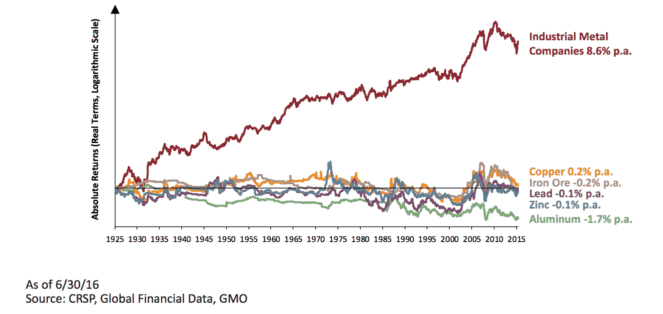

Oil prices have barely risen in real terms since the 1920s. Meanwhile, oil and gas companies have generated real returns of more than 8% per year. A similar trend can be seen with metals companies.

According to Jeremy Grantham, “The public equity market has clearly been far superior to direct commodity investment historically.”

2. Resource ETFs are not what you think

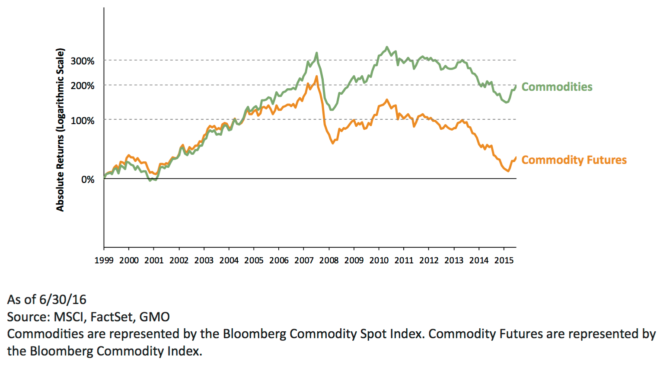

Most resource ETFs don’t actually own the underlying commodity given the major costs involved, including storage and transportation, perishability issues, taxes, etc. Instead, they buy futures and simply “roll” these contracts over before they expire.

When they sell out of an expiring contract and roll into a longer-dated contract, there is almost always both frictional costs and tracking error. Over decades, this can reduce your returns significantly.

3. Don’t worry about losing the diversification benefits

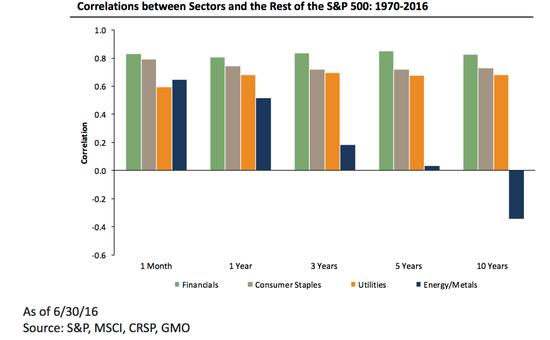

There’s plenty of data showing that resources are negatively correlated with the stock market overall. This provides some great diversification benefits in volatile markets. Investing in companies that deal with commodities gives you very similar benefits.

Over any period one year or longer, energy and metals companies have significantly more diversification benefits than traditionally “counter-cyclical” sectors like consumer staples or utilities.

Investing with a long-term framework has proven to be both a winning and lower-risk strategy. Over rolling 10-year periods, energy and metals companies have nearly doubled the market’s average return (even when including the recent downturn!) while showing lower volatility.

Consider these two companies instead

Are you looking for resource companies to invest in? Try these two proven winners.

Tourmaline Oil Corp. (TSX:TOU) has a low cost of production for natural gas with big upside if prices improve. “If gas got to $4, we will have tremendous earnings–it’s been painful with various oversupply scenarios. In the long term, we truly believe gas is going to get there,” its CEO believes.

Meanwhile, Agnico Eagle Mines Ltd. (TSX:AEM)(NYSE:AEM) should move strongly with the future direction of gold prices. Its CEO is also bullish on gold prices. “I think in this cycle, they will ultimately set an all-time high,” he commented, adding that Agnico is “one of the very few companies that can see its output 30-40% higher in five years from now from stuff we already own.”