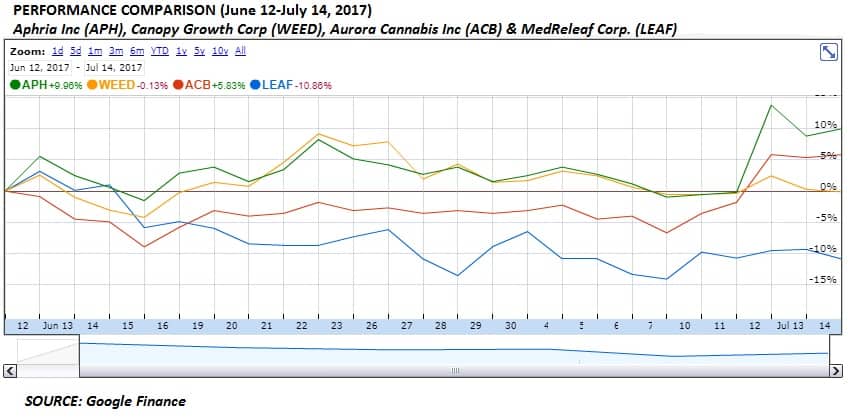

MedReleaf Corp.’s (TSX:LEAF) stock price is currently underperforming its top Canadian marijuana peers, and the company’s market capitalization has been shrinking of late. MedReleaf has fallen from being the second-biggest cannabis play behind Canopy Growth Corp. (TSX:WEED) to fourth place.

The company currently ranks behind Aphria Inc. (TSX:APH) and Aurora Cannabis Inc. (TSX:ACB) going into the weekend of July 15.

MedReleaf’s market cap stood at $741 million at the $8.20 closing share price for the weekend, while the equity in Aphria was valued at $795.73 million, and Aurora’s market cap had shot up to $865 million, while Canopy lead at $1.29 billion.

Excluding the attempted price recovery from the deep discount from the $9.50 initial public offering (IPO) price on the first trading day, during which the stock commenced trading around $7.50, the company has gone on to shed shareholder value and has underperformed the other big cannabis growers, as shown in the graph below.

Could it be because of the falling margins?

It is possible that investors were put off by the falling margins reported in MedReleaf’s latest financial results after being expected to continue the stellar performance during the company’s private days before the IPO.

However, some investors might feel that the IPO was overpriced at $9.50 considering that the listing was done during a protracted general cooling off of the marijuana sector. This could be evidenced by the deep 21% discount to $7.50 on the first trading day.

I wouldn’t want to believe so though, but if that is the case, then the stock might touch the $7.50 price point again some time.

Something else could explain MedReleaf’s underperformance.

If we set the overpriced IPO thesis aside and forgive the disappointing falling margins (even Canopy disappointed on this front), there are just two other possible reasons left to ponder.

MedReleaf could have underperformed on the back of positive market news that has been boosting its competitors’ stocks while it suffers from being relatively unknown to investors.

Aphria and Aurora stock prices have shown promise with details of international expansion programs.

Aphria also reported faster revenue growth and stronger operating earnings growth than MedReleaf earnings, which showed declining margins.

Furthermore, Aphria has shown some massive productive efficiency improvements as we head towards a bigger recreational market. The company reported the lowest cash costs per gram in the whole industry and had its revenues boosted by oil sales.

Aurora’s possible success in obtaining a local production licence in the promising Germany market could have buoyed the stock, while Canopy is still an investor favourite to lead the local recreational market after its local expansion program update.

Meanwhile, there hasn’t been much talk from MedReleaf, which is still a relatively unknown stock. The company’s stock might have been hoarded by traders who might have expected the company to maintain its high margins during its private days, or investors may be losing interest because of lack of hype on MedReleaf.

Investor takeaway

While a further price decline on MedReleaf stock is possible, investors need to consider the upside potential, too.

The main reason for MedReleaf’s public listing was to raise expansion capital. It has managed to generate the most profits as a marijuana player in the country and has a methodical and professional management team that waited for confirmation of market growth forecasts before embarking on an ambitious and risky expansion program.

The company could outperform in the future if it manages to maintain its low production costs.

Momentum seems to be returning to marijuana stocks, and the “obscure” MedReleaf might still be yet to find favour from the skeptical investing public. The company’s relative underperformance may just be temporary.

Let’s wait and see how the market judges MedReleaf’s prospects going forward.