Aurora Cannabis Inc. (TSX:ACB) shares closed 28.66% on Monday, November 13, as the relatively younger but more aggressive marijuana growth stock catapulted past the $2 billion market capitalization mark to reach $2.39 billion, as the current bullish trend in the marijuana sector holds strong.

Aurora has outgrown its closest competitor Aphria Inc. (TSX:APH) this year and was the second Canadian marijuana stock to ever reach the $2 billion market cap mark ahead of the more experienced MedReleaf Corp. (TSX:LEAF), as it solidifies its second position (based on market cap) behind the undisputed leader Canopy Growth Corp. (TSX:WEED).

Aurora received its marijuana cultivation licence roughly 18 months after the other top four marijuana giants.

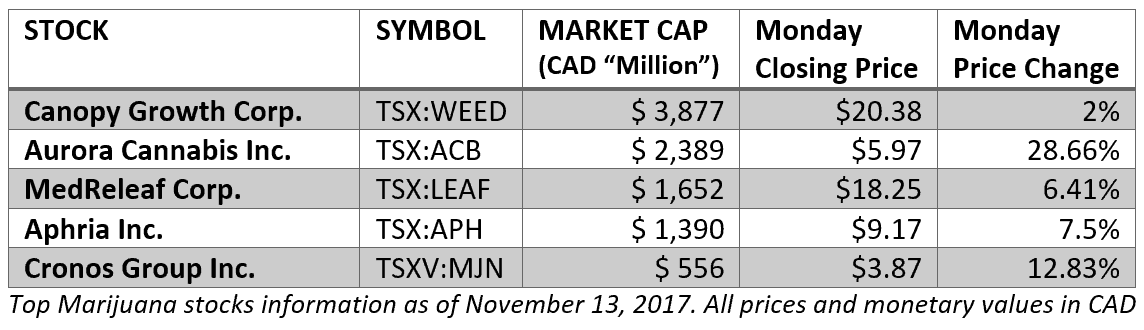

The table below outlines the top five Canadian marijuana stocks by market cap as of close of trade on Monday, November 13, 2017.

Aurora’s impressive stock price gains on the day, close to 29%, were much stronger than any of the other top five cannabis stocks.

This could have been partly fueled by the company’s November 9th announcement that it got the green light from Hempco Food and Fiber Inc. (TSXV:HEMP) shareholders to proceed with an investment option to become the majority shareholder in the hemp-based products manufacturer and distributor.

Hempco shares almost doubled in valuation during the trading day to close 96.15%, up at $2.55 per share. The market evidently believes in Aurora’s strategic investment in Hempco — a deal that will not only bring diversification benefits to Aurora’s business, but that could also enhance business growth and generate economies of scale and profitability gains after recreational marijuana legalization.

The strategic fit of the Hempco deal was previously discussed in my earlier article. As the deal later unfolded, Aurora’s press releases seem to indicate that the marijuana producer has hemp extracts on its business-growth agenda, and its latest deal with Radient Technologies (TSXV:RTI) was crafted with hemp CBD extraction in mind.

However, not all of Aurora’s share price gains on Monday are linked to the Hempco deal.

Aurora announced some good quarterly results on November 9 and delivered the strong revenue-growth surprise I anticipated earlier, which cemented Aurora’s revenue lead over Aphria for the second quarter in a row.

Furthermore, there is a generally bullish sentiment among marijuana investors, as provinces outline their recreational marijuana policies.

Aurora is a clear $1 billion bigger than Aphria today and more than $700 million larger than MedReleaf. The lead on MedReleaf narrowed during Monday’s trading after MedReleaf managed to shake off an early 7% stock price decline after a not so good earnings report to close the day 6.41% higher.

Aurora shares took off on the sustained rally after the company closed its latest equity raise on November 2.

Investor takeaway

Aurora is growing by leaps and bounds, but the company’s growth has also come from a ballooning outstanding ordinary share count, as management raised new equity at low share price levels to finance an aggressive growth plan. Hence, there has been some significant shareholder stake dilution.

However, Aurora has been racing against time towards recreational marijuana legalization and battling against peers for first-mover advantages in emerging international cannabis markets, so it did not have the luxury to wait for a rise in its stock price before raising new financing.

Canopy arguably managed to use a bloated share price as currency in high-priced acquisitions, thereby avoiding issuing too many shares.

While Aurora was my favourite marijuana stock for this year. It’s too early to judge whether or not I’ve made the right pick yet, as several other marijuana stocks have also more than doubled year to date, but Aurora is currently among the best.

The latest rally is marvelous, though.

Congratulations to all marijuana investors, especially those who picked the dips mid-year 2017.