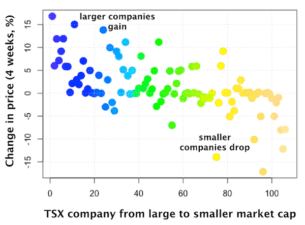

Twenty-one of the largest 100 TSX stocks are up at least 5% in the last four weeks. The majority of +$5 billion market cap stocks have either moved sideways or decreased this month. In fact, 10 of the largest 100 TSX stocks have dropped between 8% and 17%. The biggest drop is from Air Canada (TSX:AC)(TSX:AC.B), which is down 17% in four weeks — something I thought would happen in September. Air Canada’s stock had climbed massively, and the generous run seems over. Don’t feel bad though: Air Canada is still up 66% year to date.

Are there stocks that now trade with decent multiples?

CCL Industries Inc. (TSX:CCL.B) is a label-making company and trades more actively under the non-voting B-class shares. Despite a double-digit run year to date, the stock dropped ~10% recently. There are a couple of things to like about this stock now:

- Price to sales (P/S) is now 2.3, which is just above the five-year average for this metric (P/S is usually two). A lowering P/S means that company sales have caught up to the stock price. Both revenue and sales are holding steady for CCL. The recent quarterly statement reports 10.8% increase in total sales. A further breakdown was recently discussed. The price correction this month is reverting P/S to the mean, which is both healthy and common.

- CCL has yet to fully realize the potential from the 2016 acquisition of a radio-frequency identification-based (RFID) company called Checkpoint. The most recent quarter shows capital spending on this business. An optimistic view would state that sales of electronic labels will, with time, be as lucrative as other, more established parts of the business. The company also forecasts that the Checkpoint revenue will increase on account of the holiday shopping season.

The lumber company Norbord Inc. (TSX:OSB)(NYSE:OSB), which makes wood panels, is down 10% for the month. Is the stock done falling? Possibly not. This sector seems to be a piñata in the NAFTA 2.0 party. Trade deals and tariffs aside, this company has good things going for it:

- Earnings per share (EPS) have been positive for the past two quarters, showing a nice upward trend, which provides momentum.

- Debt levels are below historic norms.

- In October, the company declared a $0.60 per share quarterly dividend, which is a 20% increase, pushing the dividend yield above 5%.

What is the performance of the TSX in the last four weeks?

Will the TSX rally to end the year or is the best behind us? The chart below shows that current gains are coming from larger market cap companies, while many smaller-sized companies are down for the month.

Time will tell which stocks are leading a trend and which are the followers.