The “Oracle of Omaha,” the world’s most renowned investing guru, Warren Buffett, in his latest annual letter to Berkshire Hathaway Inc. (NYSE:BRK.B) shareholders, lamented about a serious valuation problem that troubled him and prevented his team from making acquisitions in 2017. BlackBerry Ltd.’s (TSX:BB)(NYSE:BB) CEO John Chen complained about the same challenge during the past year.

Buffett and his executive management team, including long-time partner Charlie Munger, could not make any sizeable standalone acquisitions throughout 2017, as a result of the very high equity valuation premiums across the world’s investment markets that were too rich for their liking.

“In our search for new standalone businesses, the key qualities we seek are durable competitive strengths; able and high-grade management; good returns on the net tangible assets required to operate the business; opportunities for internal growth at attractive returns; and, finally, a sensible purchase price,” wrote Buffett, stating that the last requirement proved a “barrier to virtually all deals” reviewed in 2017 as prices for “decent, but far from spectacular, businesses hit an all-time high.”

Chen made some similar comments about the technology sector last year.

BlackBerry intended to make some acquisitions during 2017 to boost its market reach and enhance revenue growth, but it was not prepared to pay the substantially high valuation premiums on tech sector acquisition targets and would wait patiently instead for a market correction.

“I am patient. We will build organically while we wait and when the valuation expectation starts getting back to earth, I will pull the trigger,” said Chen in June 2017 in a BNN interview soon after the company had reported a quarterly revenue miss and suffered a 12.8% plunge in a single day. “I hope that we could pull some triggers this year, sooner rather than later.”

Today, nine months after this interview, we know that little happened on the BlackBerry acquisition front in 2017.

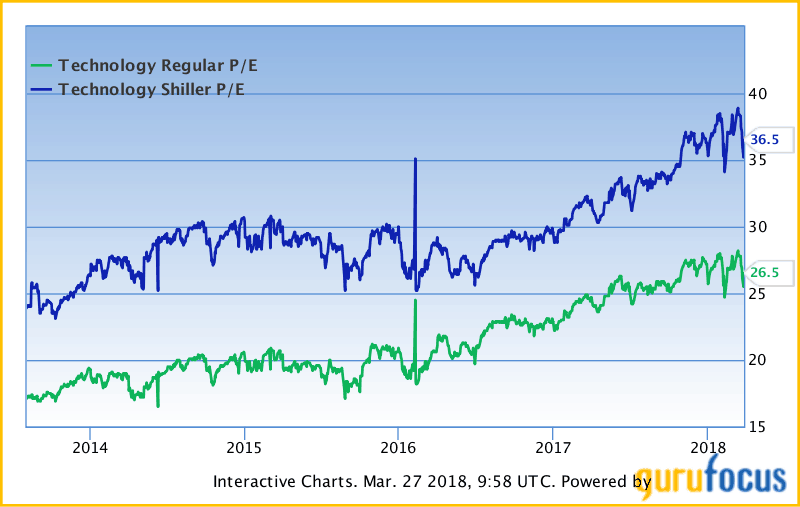

Technology sector price-to-earnings (P/E) multiples continued to hit record highs in 2017, even on a Shiller P/E basis, which adjusts the regular P/E for business cycle sensitivity, and finding bargains in this market has proven to be an insurmountable task for Chen and team.

Does BlackBerry have a choice?

There has been some significant hope in BlackBerry’s recovery chances, with a possible bottoming out of revenues for 2018, but analysts predict the near-term revenue trend may continue on the negative.

BlackBerry may need to make an accretive acquisition sooner rather than later to strengthen the core revenue and profit-generating capacity of its software growth portfolio. The executives know this, and in December 2017, Chen revealed that BlackBerry is looking at spending at least $500 million in mergers and acquisitions to help drive “organic growth.”

I’m not sure if we can term growth through acquisitions “organic,” but the addition of a new revenue source to BlackBerry’s portfolio may be accretive to growth and potentially present some cross-selling opportunities and create “synergies.” (Warren Buffett doesn’t value synergies in his models, and this makes sense when making an acquisition — it lowers the acceptable purchase price.)

Indeed, the bull market in stocks has been raging on for some good number of years now, and the recent volatility in the stock markets may be scary in the short term, but global economic fundamentals remain strong, though are under threat from a global trade war.

The availability of cheap debt may further fuel purchase activity, as leveraged deals usually boost per-share earnings. Valuation premiums may continue elevated, and BlackBerry, though very patient, may find itself making an acquisition or two even at current levels.

It may require more than the recent trade war-induced volatility or a massive market correction for valuations to return to their 2015-2016 levels again (a time when BlackBerry was active in the acquisitions market.)

Investor takeaway

Warren Buffet indeed made “one sensible standalone purchase” in 2017 and several small “bolt-on” acquisitions last year, and I bet BlackBerry, which arguably needs more top-line growth than Berkshire Hathaway right now, will deploy some of its US$1.6 billion net cash wallet in the acquisitions market this year to accelerate revenue growth.