BlackBerry Ltd. (TSX:BB)(NYSE:BB) may be lagging behind the implementation of its previously announced normal course issuer bid (NCIB), but current trading conditions seem lucrative for an accelerated execution of the program and could give support to the stock’s valuation.

The company announced a common stock buyback program in June 2017 in which it intended to repurchase up to 31,000,000 of its outstanding shares on the open market, representing 6.4% of the company’s public float at the time. However, by February 28, 2018, eight months after the announcement, BlackBerry had purchased 2,000,000 common shares in the program, just 6.45% of the targeted number.

The program is set to close in a few weeks, or before June 26 this year, and its stated purpose was “to offset a portion of the expected dilution from the company’s equity-incentive plan and from the conversion of the 3.75% debentures.”

It may seem intriguing that the company, which entered an automation agreement with TD Securities Inc., its designated broker, back in June 2017 towards the smooth execution of the repurchase program, could only buy so few shares in over three-quarters of the allocated time.

Could it be that management is backtracking on the program?

There are two possible reasons that could influence BlackBerry executives to encourage TD Securities to throttle the stock-repurchase program.

Firstly, BlackBerry has been an outperforming stock during most of the period since October 2017, until the recent weakness. Executing the NCIB during such periods of high stock valuation could achieve less and cost more for the company, resulting in higher equity charges on the balance sheet per each unit purchased. It rewards more to buy back stock during times of lower valuation, as each dollar achieves significantly more at a lower cost to the company and its remaining shareholders; hence, the incentive to wait for a weaker share price.

Secondly, the NCIB was said to target the offsetting dilution from possible debenture conversion. As it seems, there may not have been any substantial conversions by the debenture holders, mainly Prem Watsa’s Fairfax Financial Holdings Ltd., thus removing the need to spend precious corporate dollars in executing a common stock buyback.

Now may be the time

If BlackBerry’s slow execution of the NCIB has been a result of a strong share price performance (relative to historical performance), then the current valuation weakness may present an opportunity for BlackBerry to “profitably” execute the program. Remaining shareholders will be happy too, assuming the share price will perform better as the company executes for growth going forward.

Further, the company still needs to take off the dilutive executive compensation stock grants that have increased the share count during the turnaround program. Doing so during a period of low-stock valuation will definitely cost less and even provide the necessary valuation support for the shares on the market.

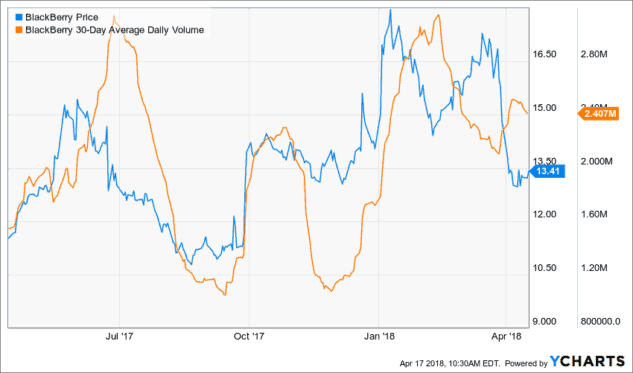

As we can see, the 30-day average daily trading volume for the stock on the TSX is currently relatively high at 2.4 million shares a day, allowing the company to accelerate NCIB purchases at lower prices without violating the TSX’s rules.

While increased trading volume and a declining share price present a bad combination on a stock (it may mean investor exodus), an accelerated NCIB program during these last few weeks of the program window may support the valuation.

Investor takeaway

Share repurchases during a period when the company is making losses may increase the loss per share, and management may not favour such a scenario, so we may not bank on execution of the program.

Furthermore, there is no guarantee that the company will commit to the share buyback as it clearly stated in the NCIB announcement that “the actual number of shares to be purchased and the timing and pricing of any purchases … will depend on future market conditions and upon potential alternative uses for cash resources. There is no assurance that any shares will be purchased under the share repurchase program and BlackBerry may elect to modify, suspend or discontinue the program.”

The NCIB could still be abandoned.