Baytex Energy Corp. (TSX:BTE)(NYSE:BTE) stock’s graph is getting incredibly interesting, what with oil prices taking off and hitting multi-year highs. Baytex stock had one of its best weeks in recent months last week when it soared 18% and hit its 52-week highs.

Not all oil stocks are jumping as much as Baytex, despite the rally in oil prices. Rival Crescent Point Energy Corp. (TSX:CPG)(NYSE:CPG), for example, has clocked less than half of Baytex’s gains so far this year. Clearly, there’s more to Baytex stock’s rally than meets the eye. Here’s what you need to know.

Why Baytex is back on investors’ radars

There was no news from Baytex’s end last week. In fact, the last significant announcement the oil company made was in March when it released its fiscal 2017 earnings report, and that may have a lot to do with why Baytex shares are soaring.

Baytex has been reeling under the pressure of low oil prices, net losses, and heavy debt since 2014, which was also the year when the company acquired Aurora Oil and Gas for a hefty price of $2.8 billion.

At the time of closing the deal, Baytex increased its monthly dividend by 9%, fueling investors’ hopes that the company is ready to reward shareholders richly in coming years.

Sadly, Baytex cut its dividends soon after, and the stock tumbled.

Not surprisingly, Baytex’s encouraging numbers and cash flow projections last month have gotten investors excited, as the worst seems to be over for the energy company.

Key numbers to know

In 2017, Baytex’s per-day oil equivalent production improved 1% to 70,242 barrels, and its petroleum and natural gas sales jumped almost 40%, backed by 34% higher realized prices. Baytex turned a profit of $0.37 per share compared to a loss of $2.29 per share in 2016. Comparatively, Crescent Point incurred losses in each of the past three years.

Baytex’s cash flow numbers are even more important for investors to know.

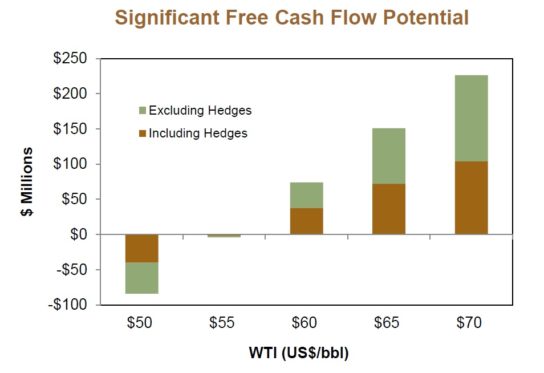

At an oil price of US$55 per barrel, Baytex expects to break even on free cash flow (FCF), which means it’ll have generated enough cash flows to keep its production running. Anything over and above can be reinvested into the business on growth projects, used to pare down debt, or distributed among shareholders in the form of dividends or share repurchases.

With oil prices rising, Baytex foresees “significant” FCF potential ahead.

This cash flow growth potential comes at an opportune time, as Baytex has nearly $688 million in debt maturing in 2021 and also needs funds to pump into its Eagle Ford, Peace River, and Lloydminster oil assets.

What you should do with Baytex stock now

Baytex’s humongous debt of $1.73 billion as of December 31, 2017, is a concern, but the company is making efforts to expand production and cut costs to boost cash flows. Baytex’s operating netback, for instance, was at its strongest in three years during the fourth quarter. Operating netback is a key metric to gauge the profitability of an oil company.

Because 80% of Baytex’s production is weighed towards crude oil and natural gas liquids, it goes without saying that oil prices above US$60 mark have brightened the company’s prospects. With Baytex also cutting costs, keep an eye on this stock.