There’s something special about investing in tech stocks. Whether it’s the promise of some new revolutionary product, or a leap in technology that will make some task in our daily lives obsolete, finding a great tech investment with huge prospects is an incredible feeling.

Fortunately, Canada is blessed with an abundance of talent, and there are several tech companies in the market today that are hoping to completely re-shape parts of our lives in the future.

Go for a drive … thanks to BlackBerry

Most people will recognize BlackBerry Ltd. (TSX:BB)(NYSE:BB) as the manufacturer of keyboard smartphones, and the company coincidentally announced its most recent flagship device for the year earlier this month. While BlackBerry’s name may have been plastered around the announcement, the company doesn’t manufacture those devices anymore; BlackBerry shuttered its hardware division last year and signed a series of partnership agreements with companies around the world to design and manufacture a new line of phones.

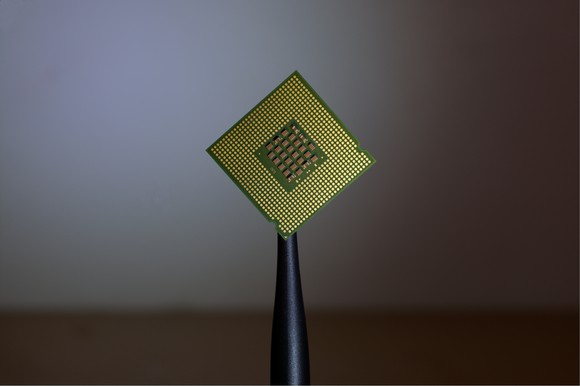

Those agreements allowed BlackBerry to focus on where the company is making huge advancements — in the field of autonomous driving and securing communications for the enterprise sector.

All new vehicles coming to market lately have an array of new safety features and sensors, such as cross-traffic alert, active cruise control, and others. All of these features are components of what will eventually become an autonomous driving experience, and BlackBerry’s QNX solution is likely to be the central brain of that system, connecting all those sensors in real time.

QNX is already used in over 60 million vehicles worldwide, powering the infotainment systems of those vehicles, and BlackBerry has already forged agreements with some automotive manufacturers to integrate QNX further.

Set up your online presence with Shopify

To say that online e-commerce solutions are becoming more prevalent would be an understatement. Even legacy brick-and-mortar retailers have come to the realization over the past few years that online e-commerce is not a passing fad, but the future of retail. Shoppers do their browsing online instead of in stores and have no problem comparing prices and shopping from multiple stores from the convenience of their living room.

This is where Shopify Inc. (TSX:SHOP)(NYSE:SHOP) and the opportunity it poses begins to materialize.

Shopify is an e-commerce platform that is fully configurable and can be set up in a fraction of the time that a traditional e-commerce development initiative would take. The fully configurable solution can be scaled up or down relatively easily and has additional plug-ins and hooks to enable other features, such as chatbot or social media integration. It is no coincidence that the platform is in use by over 600,000 businesses around the world with over $55 billion traversing the platform.

So, where does the opportunity with Shopify lie?

Earlier this year, the stock took a tumble, at one point dropping nearly 20% as a result of concerns with Shopify’s primary marketing channel through Facebook Inc. While those issues have since subsided, Shopify’s incredible growth has resumed.

While critics note that a slowdown or pullback on Shopify could occur over the short term, over a longer period the stock is only going to keep soaring.