When you look at technology companies on the Canadian stock market, the first thing you notice is that there aren’t as many big ones as there should be. Indeed, tech accounts for a fraction of the total worth of the TSX. Granted, tech on the TSX totals $193 billion, but not only is that divided among 421 entities, it’s also nowhere near the TSX’s combined value of $2.2841 trillion.

However, tech seems to be having its time in the sun of late. Is Canada finally enjoying its long-promised tech boom? Well, not exactly. At least, not on the same level as other international stock markets. But Canadian investors do seem to be waking up to the idea that technology stocks should be consumed as part of a varied financial diet. Here are three of the hottest that you should have your eye on.

Ceridian HCM Holding Inc. (TSX:CDAY)(NYSE:CDAY) is a reasonably healthy growth stock and extremely ambitious. It hit the TSX with an IPO of $598 million — one of the 25 highest corporate openings in Canadian history.

A growing asset base, hungry for acquisitions, and with many of its customers signing on for the long term, Ceridian is one of the top human capital management software companies globally. Known for its cloud-based management system Dayforce, Ceridian is one of the highest-growth tech stocks on the TSX.

Wheaton Precious Metals Corp. (TSX:WPM)(NYSE:WPM) has always been a good stock for any investor looking for exposure to gold and silver without the risks involved with exploration and development. A streaming option for the precious metals section of your portfolio, Wheaton Precious Metals was already a good pick.

But its recent development to include cobalt in its asset base means that Wheaton Precious Metals can now provide investors with exposure to the electric car sector — something that Canadian stocks offer only limited options for. And that makes this cobalt-streaming stock one of the hottest tech proxies on the TSX.

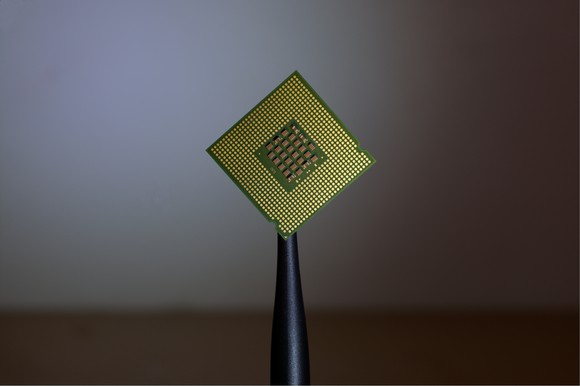

Celestica Inc. (TSX:CLS)(NYSE:CLS) has an impeccable balance sheet and is a pretty good value, which isn’t a bad combination for a tech stock on the TSX, limited as they are. If you want exposure to the semiconductors industry — and who doesn’t? — then you could do far worse that this sourcing, development, and supply-chain management tech stock.

A very healthy stock, Celestica has a low level of debt and a low beta of 0.45. In terms of stats, it’s possibly the best of the three listed here.

The bottom line

Unfortunately (or fortunately, if you already own the stock), Wheaton Precious Metals is overvalued by two-thirds of its future cash flow value — and it likely won’t stop there. Ceridian is better value, though, again, it’s overvalued compared to future cash flow. Celestica is priced about right, though it too is inching towards overvaluation.

Wheaton Precious Metals is a definite buy right now, because it opens exposure to cobalt and thus the entire tech sector — and, most explosively, the electric car industry. The other two? Use your discretion. They’re both high-growth stocks — particularly Ceridian, which is looking at a 115.6% increase in annual earnings; and Celestica has notably good multiples.