Here at The Fool, we generally don’t pay much attention to short-term price moves.

Instead, we prefer to take the approach of long-term business owners. So, company fundamentals are what matters most.

But sometimes it’s useful to take a closer look at big moves, just in case they impact the longer-term story.

With that in mind, here are three stocks that had big gains last week. If the stocks are being fueled by sound reasoning — instead of pure emotion — they could very well keep flying.

Let’s take a look.

Alimentation Couche-Tard

One of the TSX’s biggest winners last week was Alimentation Couche-Tard Inc. (TSX:ATD.B). Shares of the convenient store operator are up about 12% over the past five trading days.

Of course, most of that gain came on Tuesday when the company posted blowout Q4 results: diluted earnings per share surged 42.9% on merchandise and service revenue growth of 25%. Solid. Couche-Tard also pumped its dividend by 11%.

But is there more room for the stock to run? I think so.

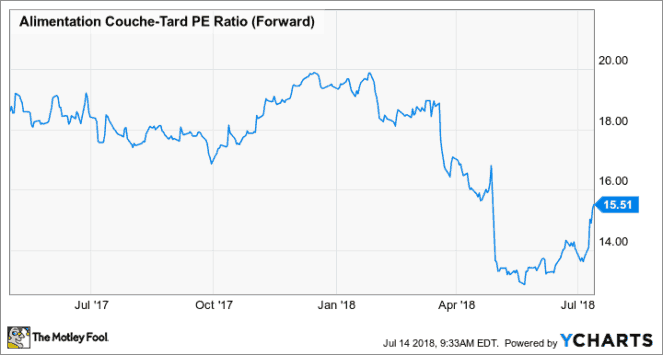

Despite the recent rally, Couche-Tard shares haven’t exactly broken out in recent years. And right now, the stock trades at a forward P/E in the mid-teens. Historically speaking, that’s still relatively low.

Considering Couche-Tard’s strong operating momentum, I’d say that it still represents good value.

Precision Drilling

Precision Drilling Corp. (TSX:PD)(NYSE:PDS) investors also had a good time last week, watching their shares climb about 7%.

All the fun started on Monday when the drilling company won a big five-year contract in Kuwait. That bullishness then carried into Friday when Morgan Stanley upgraded the stock from Equal Weight to Overweight. Morgan expects Precision to keep seeing strong pricing and increased drilling activity in its U.S. land business.

I tend to agree.

So, when you combine that outlook with the fact that Precision shares are still well off their five-year highs, this rally could easily keep going.

As long as you’re comfortable with volatility — which should lessen as management continues to reduce debt — I think the stock is particularly enticing.

Aritzia

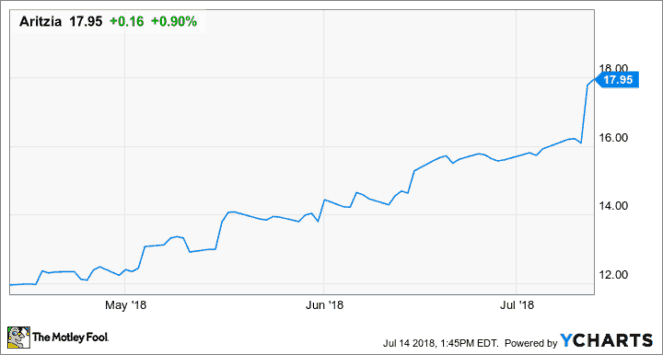

Our final high-flier is Aritzia Inc. (TSX:ATZ), whose stock jumped 11% on Thursday.

Why was Bay Street so pumped? Well, the company posted superb Q1 numbers. Net income soared 51% on strong revenue growth of 15%. Moreover, same-store sales — a solid indicator of a retailer’s health — grew nearly 11%.

Kudos to fellow Fool Ambrose O’Callaghan, who called Aritzia her top clothing stock this summer — just days before the earnings release.

But is the stock nearing its ceiling? Maybe.

After last week’s pop, the stock is now up a whopping 50% over just the past three months. Naturally, that kind of run makes me nervous.

Of course, if Aritzia’s earnings stay on the current growth trajectory, its forward P/E of 23 seems pretty reasonable.

The Foolish bottom line

There it is, Fools: three stocks that performed well last week.

Predicting short-term moves is a losing game. But there’s good reason to think that these momentum plays can keep running.