I don’t care much for momentum stocks.

As a dedicated value investor, the idea of chasing gains makes me cringe. I usually can’t shake the feeling that, at some point, traders will eventually clear out and leave me “holding the bag.”

Of course, there are times when quick gains on a stock are completely reasonable. This happens when a rally correctly reflects the long-term improvement in a company’s fundamentals.

In that situation, it might make sense for a few investors — who can handle a bit more risk — to jump on the momentum.

Precision decision

Take Precision Drilling Corp. (TSX:PD)(NYSE:PDS), for instance. The stock is now up about 9% over just the past two days.

Why the excitement? Well, the company said on Monday that it won a five-year contract award to build a ST-3000 drilling rig in Kuwait. The contract also has an optional one-year extension. While financial terms weren’t disclosed, this is a key development.

First, Precision already has five active rigs in Kuwait. So, this sixth rig — which will start operations in Q3 2019 — allows management to leverage that scale with no additional overhead. For a company looking to turn profitability around, that’s a big deal.

Second, the news sends a signal to the market that drilling activity might finally be picking up. If that’s the case, the recent surge in Precision stock could just be the start of a prolonged turnaround.

But it’s not the main reason I like the stock for the long haul.

Declining debt load

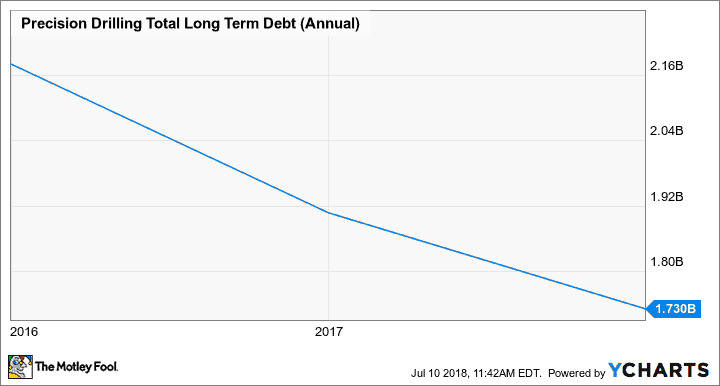

The main reason I like Precision comes back to a key strategic priority in 2018: debt reduction. Management wanted to specifically reduce debt by a minimum of $75 million in 2018. And they’ve already managed to do that within the first half of the year.

In fact, debt has been steadily declining over the past few years.

Furthermore, management now expects to fund all capital expenditures for the year with free cash flow.

Thus, the recent contract win, in combination with Precision’s improving financial picture, is why investors might want to climb aboard the rally — but only those that have a long time horizon.

With a beta of three, Precision shares are basically three times as volatile as the overall market. If you’re nearing retirement or are already retired, that kind of price action can prove to be painful.

So, if you want to own Precision stock, you need to be prepared for stomach-churning moves. And you need to be able to hold on for the long haul.

The Foolish bottom line

I tend to shy away from stocks making big gains in a short period of time. But in the case of Precision shares, an improving balance sheet and sector outlook might leave plenty of room to run.