Short-term price moves aren’t the biggest concern for us Fools. But we don’t want to bury our heads in the sand, either.

It makes sense to peak at larger moves, just in case they have a bearing on the longer-term thesis — positive or negative.

With that in mind, I’ll highlight three stocks that flew high last week. Will they keep climbing? Or will investors quickly take their profits off the table?

Let’s take a closer look.

Energy Fuels

Uranium miner Energy Fuels Inc. (TSX:EFR)(NYSE:UUUU) finished the week up about 12%. But it wasn’t exactly the smoothest of rides.

Check out the extreme bumpiness that shareholders have had to endure over the past five days:

What’s sparking all this volatility?

As I wrote last week, it all centres on the U.S. government’s announced probe into uranium imports. The probe could lead to tariffs which, in turn, would help domestic miners like Energy Fuels compete with state-sponsored producers in Russia.

Mr. Market is clearly still trying to grasp the situation — hence the craziness in Energy Fuels stock. But given the strong long-term outlook for uranium, I think there’s still big upside left for aggressive investors.

Nevsun Resources

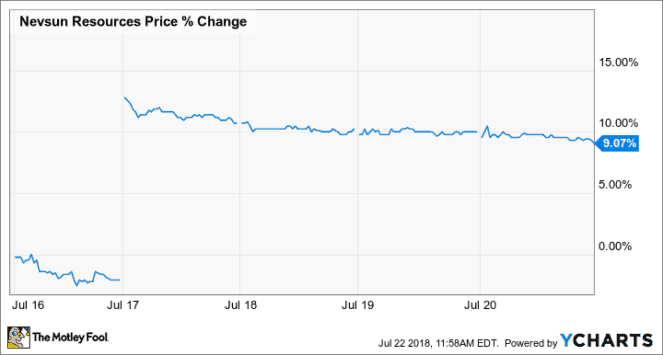

Precious metals miner Nevsun Resources (TSX:NSU)(NYSE:NSU) is up 9% over the past five days. Most of that pop came on Tuesday when Lundin Mining Corporation offered $1.4 billion in cash for it — or $4.75 per share.

It’s the second formal offer from Lundin. Nevsun rejected Lundin’s first because it was too low and too complicated — it included stock of both Lundin and its partner Euro Sun Mining.

So, what do investors do from here? Considering the fact that Nevsun now trades at $4.69 — a mere 1.3% away from Lundin’s offer — I’d do nothing. If you own the shares, maybe sell some.

There’s a chance that Lundin can boost its bid. But it can also walk away. At this point, the risks outweigh the rewards.

Aimia

Our final high-flyer is Aimia Inc. (TSX:AIM), which soared 18% on Friday alone.

What has Bay Street so excited? Well, the company — which owns and operates the Aeroplan program — made a huge announcement: it’s getting into the airline business.

Earlier this year, Aimia crushed investor spirits when it lost its partnership with Air Canada. But by launching its own airline, management hopes to regain a good chunk of that lost business and to fuel growth long term.

Aimia shares have been pummeled in 2018, so management’s new vision was very much needed:

That said, I’d seriously consider using this recent optimism to sell.

The airline business is notoriously difficult — cutthroat, even. While Aimia could very well succeed in its new venture, I’d have a tough time betting money on it.

The Foolish bottom line

There you have it, Fools: three stocks that popped last week. No matter how you decide to respond, make sure to do your due diligence first.