Regular readers know that I take Wall Street opinions with a snowball-sized grain of salt. But when a big bank and I see completely eye to eye on a particular stock, it’s tough for me not to notice.

Case in point: just this past Friday, Bank of America Merrill Lynch upgraded the pipeline giant Enbridge (TSX:ENB)(NYSE:ENB), reflecting much of the same bullishness I’d expressed earlier this month. The stock popped a nice 2.4% on Bank of America’s call, but naturally, I think there’s plenty of room to run.

Let’s take a look at what the analyst specifically had to say.

Electric upgrade

Here are the details of the upgrade: Bank of America’s Dennis Coleman raised his rating on Enbridge from neutral to buy. Along with the call, he planted a price target of US$50 on the stock, representing nearly 40% upside from where it sits today.

That’s pretty juicy for a pipeline play.

But why exactly is Coleman so bullish? Well, there are three main reasons.

First, he now has increased confidence in the company’s key $9 billion Line 3 Replacement project. As my fellow Fool Jason Phillips explained earlier this year, the project is a big deal because it will upgrade a significant chunk of Enbridge’s existing infrastructure, saving millions in costs.

“Line 3 replaces critical infrastructure with the latest in steel technology and construction methods, and it will be a world-class project,” said CEO Albert Monaco in a recent conference call. “Local and regional refiners are assured of reliable supply.”

The second reason Coleman likes Enbridge: it’s becoming less risky. And here at The Fool, we absolutely love it when companies become less risky.

The stock has been weighed down in recent years on concerns over its big debt load. But Coleman thinks that Enbridge’s recently announced asset sales of $7.5 billion serves as solid support for its upcoming spending and debt-repayment needs.

Finally, Coleman thinks the shares are just plain cheap. Given the company’s improving fundamentals, he thinks Enbridge should at least trade in line with its rivals.

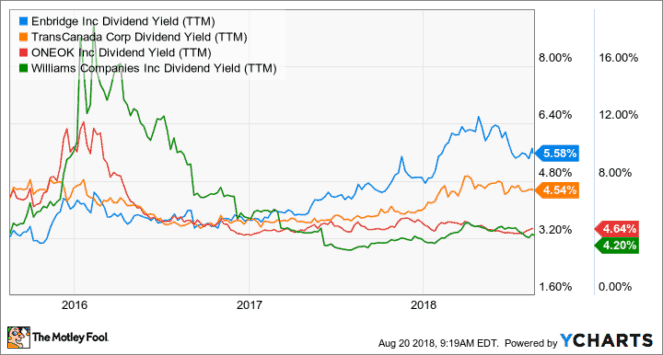

As it stands, Enbridge’s dividend yield of 5.8% is now higher than that of large-cap counterparts like TransCanada, ONEOK, and Williams Companies.

Considering the strong and growing cash flows backing up Enbridge’s hefty yield, I’d fully expect that spread to close over time. After all, Enbridge is a best-of-breed pipeline play and should be priced accordingly.

The Foolish bottom line

There you have it, Fools: three simple reasons why Bank of America likes Enbridge.

While I think the $50 price target is optimistic, I agree wholeheartedly with the bullish reasoning. Enbridge’s improving growth prospects, cost structure, and risk profile all bode well for the long haul. And with the stock still trading at a discount to close peers, it provides solid value as well.

If you’re a conservative investor looking to add a solid dividend play to your portfolio, Enbridge is tough to pass up.