Companies tend to do a lot of wasteful things with shareholder money. So, I just love it when they put it in my pockets, instead — in the form of fat dividend cheques.

Of course, simply buying stocks with high dividend yields is a recipe for disaster. You need to ensure that a company’s fundamentals can support their payments to you. Otherwise, you’ll be heavily exposed to a stock-punishing dividend cut or suspension.

Well, utility giant Enbridge (TSX:ENB)(NYSE:ENB) declared a dividend last week. And currently, it boasts a mouth-watering yield of 5.8%.

But let’s just see how edible it really is.

Healthy cash cow

Here are the details: Enbridge will pay a quarterly dividend of $0.671 to shareholders on September 1. But you need to be a shareholder of record on August 15 to pick it up.

So, is it worth picking up? In a word: absolutely.

First of all, Enbridge’s most recent results were rock solid. In Q2, adjusted EPS jumped from $0.41 a year ago to $0.65. Earnings were driven largely by its Liquids Mainline System, which moved record average volumes.

But here’s the important part for us income investors: Enbridge’s distributable cash flow (DCF) — where dividends are actually paid from — was just as strong. In Q2, DCF clocked in at $1.86 billion, up nicely from $1.32 billion in the year prior.

Even better, management expects that DCF momentum to continue.

“We’re halfway through the year but based on these results and what we see coming, we now expect that we’ll be in the top half of our DCF per share guidance range, delivering strong year-over-year growth,” said president and CEO Al Monaco in the conference call with analysts. “And we’ve delivered this growth at the same time as we’ve been funding our $22 billion of secured projects and strengthening our balance sheet.”

Specifically, management now sees full-year DCF per share in the upper half of the $4.15-$4.45 range. When compared to Enbridge’s annualized dividend of $2.68, you have a very comfy cushion.

Superior track record

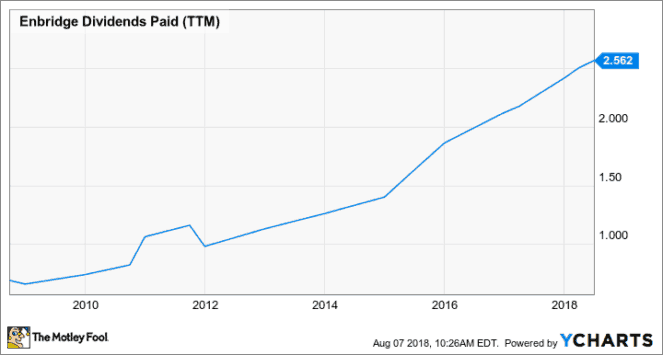

If Enbridge’s current picture isn’t reassuring enough, just look at its dividend history. The company has paid dividends for more than 64 years.

In recent decades, the payout has even grown at an attractive clip. Check it out:

Over the past 20 years, Enbridge has pumped its dividend at an average compound rate of 11.7% — not bad for an old, stodgy utility stock!

And that growth rate is even more impressive considering its very conservative payout ratio. Historically, Enbridge management has targeted a payout ratio of less than 65%.

The bottom line

There you have it: Enbridge’s dividend is as attractive as it is stable. When you couple the company’s current financial picture with its long track record of consistent dividends, today’s 5.8% yield might be too good to pass up.

Fool on.