Regular readers know that I love my dividend-growth stocks. Aside from more cash in my pocket, a consistently increasing payout is generally a good sign that management is shareholder friendly.

But here’s the thing: some dividends are just as attractive even if they’re not growing at all.

Take Rogers Communications (TSX:RCI.B)(NYSE:RCI) for instance. The telecom giant just declared a dividend last week … in the exact same amount it’s been for the past three-and-a-half years! Yet despite the flat payout, I think TFSA income investors should seriously consider the stock.

Let me explain.

Appreciation sensation

First, here are the details of that announcement: Rogers said it will pay a quarterly dividend of $0.48 per share on October 3 to shareholders of record on September 14. As I mentioned, the dividend has been at that level for years, with the last increase all the way back in January 2015.

Over the same time frame, main rivals Telus and BCE have raised their payouts multiple times.

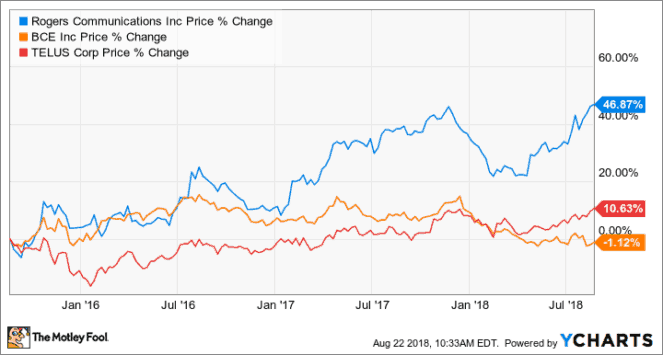

So, why do I think Rogers is a particularly potent income play? Simple: it comes with outsized appreciation potential. Check out the stock’s performance versus that of Telus and BCE over the past three years.

Instead of dividend increases, Rogers has used the extra cash flow to reinvest in the business and pay down debt. And as you can tell by its share performance, the move has been paying off in spades.

In Q2, for example, net additions in postpaid wireless climbed to 122,000 subscribers — a nine-year high for the quarter. Additionally, postpaid churn fell to a nine-year low of 1.01%. Considering the intensely competitive nature of today’s wireless space, that’s especially impressive.

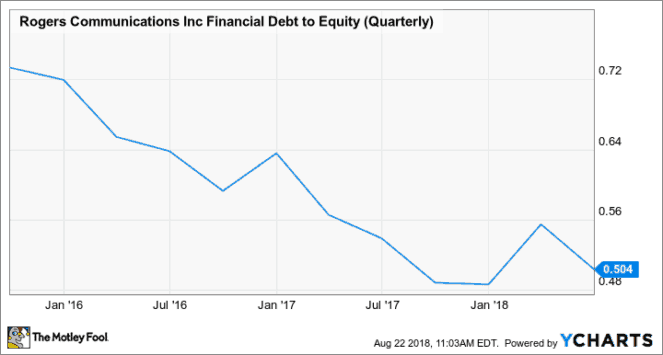

Meanwhile, the company’s use of leverage continues to decline.

Generally speaking, I want my companies to pay big dividends rather than doing something silly with the cash. But given the drastic improvement in Rogers’s fundamentals, management has proven that they can be trusted with it — for now.

“We’ve always said that we think about dividend increases as something that we want to be very careful and thoughtful about because they need to be long-term and sustainable and the metrics continue to come in well that we look at,” said CFO Tony Staffieri in the Q2 conference call. “But as we continue to improve on the fundamentals and continue to improve our balance sheet, we will continually reassess it; there is no change in our thinking on that.”

Considering the stock’s clear outperformance in recent years, it’s tough to disagree with that approach.

The bottom line

As long as Rogers continues to make strong wireless gains and firm up its financial position, shareholders shouldn’t fret over the flat dividend. Bay Street agrees with the direction, and so do I.

Moreover, the stock’s current yield of 2.8% — right in line with the TSX average — isn’t anything to sneeze at. Considering Rogers’s strong operating momentum and ongoing “de-risking,” I’d even say that it’s a relatively attractive yield.

Fool on.