News on Wednesday was that the U.S. International Trade Commission had overturned import duties on Canadian newsprint that had been earlier imposed by the U.S. Commerce Department this year, and the biggest winner on the day was none other than the world’s largest producer of the affected product, Resolute Forest Products (TSX:RFP)(NYSE:RFP). However, the flat trading on the stock on the day seems to have done further injustice to the stock.

Resolute is a leading player in the global paper and pulp industry that sells newsprint, specialty papers, and market pulp, among other wood products from its facilities in Canada, the United States, and South Korea, and I believe current industry trends and latest news may still propel the company’s stock higher through September and over the remainder of 2018.

Revenue trend preserved?

The latest reversal of punitive duties on the company’s products will evidently allow the company to maintain and probably accelerate its newly found valuation growth momentum as it removes the demand suppressing effect of free trade barriers like tariffs and duties that the federal government south of the border has fallen in love with under the Donald Trump administration.

There is potential that the firm could still maintain the latest revenue-growth momentum shown over the past three quarters after this removal of duties, while paper markets are expected to remain favourable in the third quarter as the industry continues to benefit from rising product prices.

That said, the August 30th announcement of the $55 million sale of a pulp mill in Fairmont, West Virginia, could potentially slow down sales growth; further research is needed, but the boost in free cash flow is favourable.

Strong profitability growth

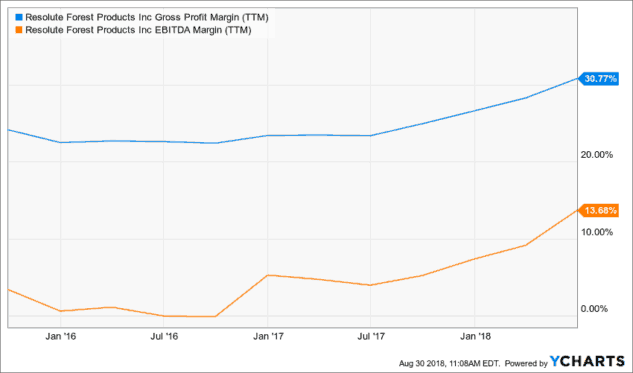

Resolute has reported an ever-improving gross margin and operating profit margins as measured by earnings before interest, tax, depreciation, and amortization over the most recent three quarters, and net losses have been narrowing since 2015.

Resolute’s operating margin has risen faster than the gross margin growth, and the impressive growth in margins in the company’s consolidated business has fueled a rally on the stock over the past 12 months. Investors could enjoy further price gains going forward as valuation multiples improve.

Further, the sudden jump in bottom-line profitability during the second quarter of this year was an impressive feat for the firm, signalling a strong come-back to profitability, and the 20% jump in the share price on August 2 was warranted.

The recent credit rating upgrade from Moody’s on August 14 to Ba3 with stable outlook was a welcome vote of confidence on the company’s improving financial condition, even though its debt offerings are still three notches below investment grade rating.

Stock still looks undervalued

Even after the impressive 178% jump in stock price over the past 12 months, Resolute’s shares still look undervalued relative to industry peers operating in North America.

The stock trades at a significant discount to book value today, with a price-to-book ratio of 0.73 times, which is even lower than recently beaten-up Clearwater Paper, which trades at a price-to-book multiple of 0.81. Domtar, another strong player in the same market which generated good price returns last year, trades at 1.32 times book value, while Verso Corp shares are priced at 1.42 times their book value today.

There is a good chance that Resolute equity’s valuation discount could vanish over the coming months, and there isn’t much justification as to why the stock’s multiples should plot that far below peers, especially after the massive return to profitability in the second quarter and strong free cash flow growth reported recently.

In fact, Resolute could easily pay down its long-term debt in under 18 months from quarterly free cash flows should the latest cash flow generation level be maintained — a much better position than Domtar, which may require two years, and Clearwater, which could need three years to achieve the same result.

Investor takeaway

Resolute Forest Products stock has outperformed the broader TSX so far this year, and there is further room for the stock to trade higher and hit new multi-year highs going forward as valuation multiples expand.