The battle to conquer the new and potentially fastest-growing medical marijuana market in the budding European medical cannabis space is ever intensifying with new deals being signed and new collaborations being made, while several Canadian licensed producers (LPs) fight it out with other interested parties in the recently opened re-tender for Germany local production contracts.

The Germany cannabis market is full of promise, with broad insurance coverage for medical marijuana prescriptions fueling a rapid product uptake and fast-growing patient numbers across the country and industry insiders contending that market growth is only being limited predominantly by product availability.

Since my last profiling of Canadian LPs that are likely to lead the Germany market last year, the strong contenders lately been the global market leader Canopy Growth (TSX:WEED)(NYSE:CGC) and its aggressive rival Aurora Cannabis (TSX:ACB).

The two have put up an interesting battle for this nascent market. Is one beating the other?

Aurora

Aurora entered the Germany market with a bang last year after its acquisition of the largest distributor of medical marijuana on the European continent, Pedanios GmbH, recently renamed Aurora Deutschland GmbH.

The company’s exports to Germany have been consistently growing, though with a slight drop in the first quarter of this year when management explained that revenue growth in this market was constrained by supply availability due to the Aurora’s only E.U. GMP-certified production facility at the time, Aurora Mountain, running at full capacity, but increased shipments were to be expected during the second half of this year.

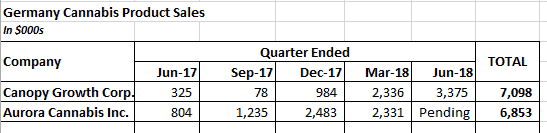

Export sales performance was as shown below.

Until the first quarter of this year, Aurora performed better than Canopy in Germany, but the latter has significantly upped its game this year.

Aurora’s Germany subsidiary has grown its distribution network significantly over a short period from around 500 to over 3,000 pharmacies by mid-year 2018, and the collaboration agreement with Heinrich Klenk GmbH & Co. KG in May this year, in which Aurora supplies a new cannabis brand, Cannabis Klenk, for distribution through Klenk’s network of 25,000 pharmacies across Germany and Europe, provides further growth momentum.

I expect the company’s sales to grow further after integration with MedReleaf Corp., which has a bigger E.U. GMP-certified facility, and the expected introduction of oil sales this year enhances market development.

Canopy

The recent strong export sales performance by Canopy took many by surprise this year.

The leading firm’s June quarter cannabis sales in Germany accounted for 14% of product revenue compared to 2% in the same quarter last year, as the company’s subsidiary, Spektrum Cannabis GmbH grew sales volumes by 42% sequentially while realizing higher prices per gram sold.

Canopy’s higher productive capacity made it a favourite to generate more sales growth in the new export market, while the strong growth in its distribution network facilitated better market reach.

To date, its Germany subsidiary distributes marijuana to more than 1,200 pharmacies across the European country. The network has grown from 400 pharmacies by June 2017 and 200 pharmacies in April 2017.

Whether the company’s sales will continue at recent growth levels remains to be seen, but management calls the recent performance “the beginning of the beginning.”

Foolish bottom line

Canopy and Aurora are growing strong in Germany. The former has recorded the fastest growth rate in this new market lately, but the latter enjoyed an early lead and could accelerate growth after the MedReleaf acquisition, which adds more E.U. GMP-certified product supply, which Aurora will draw from going forward.

Aurora may most likely retain its lead after reporting quarterly results late September, and its intended introduction of cannabis oils to the new market could accelerate revenue growth.

Most noteworthy, Aphria joined the race to Germany after its acquisition of Nuuvera, but management’s choice of U.S. GMP certification is intriguing if it’s serious about a Europe expansion strategy where E.U. GMP certification is a critical requirement.

Further, Tilray has been slow to grow Germany sales after reporting only US$345,000 in export revenue for the last quarter, despite having access to a larger distribution network with access to 16,000 pharmacies and selling higher-priced cannabis oil products.

Investors may need to watch Maricann Group, which made its maiden product shipment to Germany in August this year and intends to run a grow facility there, too.