Cryptocurrencies have been in free fall. It was only a short time ago when social media was inundated with bulls touting the millions they made on cryptos. Lately? It’s been quiet. Is the love story with cryptocurrencies over?

There are warning signs. The biggest of which was last week’s decision by Goldman Sachs to postpone its plans for a Bitcoin trading desk. This week, the Securities and Exchange Commission (SEC) halted trading in over-the-counter market shares of Bitcoin Tracker One and Ether Tracker One. It’s hard not to be a bear when cryptos have fallen out of favour.

However, I can’t help but be reminded of Warren Buffett’s famous saying, “be greedy when others are fearful.”

It’s not all doom and gloom

In the wake of Bitcoin’s success, a flurry of alt coins flooded the market. Many of these alt coins had, and still have, their own gimmicks. The euphoria blinded investors to potential scams and left many with a significant distaste for cryptos. There are, however, some legitimate cryptos that have bright futures. Bitcoin, Ripple, and Ethereum are a few of the industry leaders.

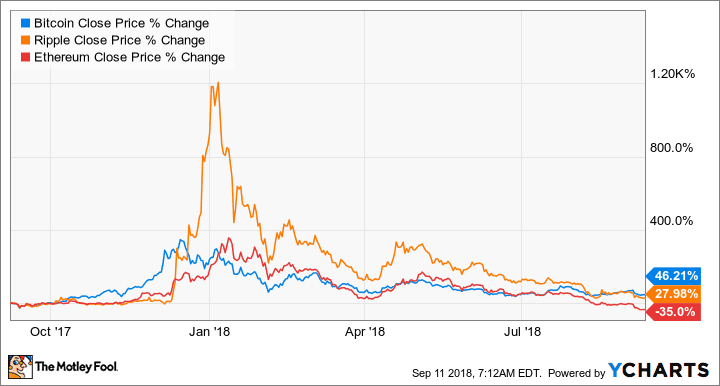

Take a look at the chart below.

Despite the recent downtrend, Bitcoin and Ripple are still in the black year over year, posting returns of 46% and 28%. Ether is the only one in the red.

Best way to play?

It’s not hard to imagine a world in which digital currencies play a prominent role. Likewise, blockchain technology is still in its infancy, and the smart money is still investing in this game-changing tech. It has many uses other than cryptos and its disruptive capabilities are endless. As a result of the weakness in cryptos and crypto stocks, blockchain-related investments have been unfairly punished.

Outside of buying physical cryptocurrencies and individual crypto stocks, there are two good options for Canadian investors: Harvest Portfolio’s Blockchain Technologies ETF (TSX:HBLK) and Horizon’s Blockchain Technology & Hardware Index ETF (TSX:BKCH).

Harvest Portfolio’s Blockhain ETF has lost approximately 31% of its value since it first began trading in February. This is not surprising, as it listed near the height of the crypto craze. The fund invests in equity securities of issuers exposed, directly or indirectly, to the development and implementation of blockchain. HIVE Blockchain Technologies and Riot Blockchain are the fund’s top two holdings.

Horizon’s Blockchain ETF began trading in late June amid the crypto crash. Since it began trading, the company has lost approximately 9% of its value. The fund aims to give investors access to the complete blockchain ecosystem. The company does not have any physical crypto assets, but it has exposure through its stakes in miners, exchanges, and other companies with crypto exposure.

Horizon’s fund aims to replicate the Solactive Blockchain Technology & Hardware Index, which tracks companies focused in three sub-sectors of the tech industry:

- Development of blockchain technology

- Semiconductors

- Relevant hardware and services supporting blockchain technology

Speculative industry

There is no doubt that this is an uncertain industry with a high degree of risk. However, I believe there is value to be had in both cryptocurrencies and blockchain technology. The euphoria this past winter got out of hand, and for many the crash has been painful. As a result, it will take some time for investors to warm up to cryptos once more. In the meantime, this is the perfect time to open a speculative position.