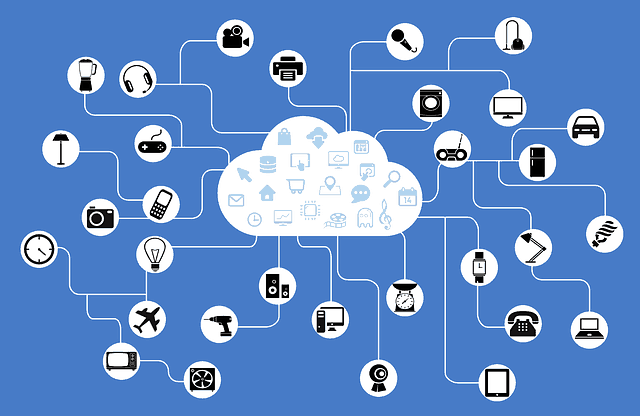

It seems that everywhere we turn lately, we are being overwhelmed with talk of the next evolutionary leap in technology that is about to usher in a wave not seen since the advent of the internet itself. That leap refers to the widespread adoption of IoT-enabled devices, and with it, artificial intelligence.

One of the companies at the forefront of the IoT movement is Sierra Wireless (TSX:SW)(NASDAQ:SWIR). Sierra is frequently mentioned as one of the leaders in the sector, but the company’s recent third-quarter earnings led to a volatile week for the stock and prompted some investors to question whether the IoT pure-play is still a good investment option.

Let’s take a look at what Sierra has to offer and if the company still warrants a position in your portfolio.

Is Sierra still a buy?

To answer that question, let’s start by taking a look at the most recent quarterly results.

When Sierra posted results for the third quarter last week, it sent a very mixed message. On the one hand, the company posted revenues of US$203.4 million, which surpassed analyst expectations of just US$202.2 million and shattered the previous period by 18%. The same could be said of non-GAAP earnings for the quarter, which came in at US$10.5 million, or US$0.29 per diluted share, beating forecasts that were calling for US$0.26 per share as well as the US$7.7 million, or US$0.24 per diluted share, reported in the same quarter last year.

The opportunity that Sierra poses towards the entire IoT sector is huge. As a solutions provider that works on products and services necessary for devices to connect to the internet, the market potential over the next few years is only going to grow. Industry experts have often mentioned that the number of connected devices, which currently stands in the billions, is going to increase significantly over the next few years, fueled by new technology and faster wireless connections, such as the new 5G wireless standard, which Sierra is part of and will begin shipping in mobile devices within the next year.

Additionally, new segments of the market, such as autonomous driving, are also going to tap into Sierra’s lucrative OEM sector, which, as of the most recent quarter, contributed over 70% of the company’s revenue. Sierra has already signed agreements with automotive manufacturers in the past, but even this is not the real opportunity that investors should be looking forward to.

Enter subscription-based recurring revenue

Sierra’s transition from a hardware to a service provider has massive potential, but it’s also a scary thought to contemplate as an investor, particularly in the short term. Subscription-based solutions, such as Sierra’s connectivity solutions that leverage smart SIM cards that can connect to any mobile network on the planet, pose an incredible opportunity that screams of high-margin recurring revenue.

To show just how significant that opportunity is, consider that in the most recent quarter, service revenue topped US$24 million, reflecting a whopping 118% year over year. Granted, that’s still a small piece of the overall revenue puzzle, but it is a rapidly growing segment in a massive market.

While investors can expect volatility around the stock to persist for some time, overall, Sierra remains an excellent long-term growth buy that investors can currently pick up at a discounted price.