Since Covid-19 broke out, U.S. stocks in the S&P 500 have been annihilated.

The Dow lost all of its post-Trump gains and the Russell 2000 index plunged almost 40% in four weeks. But if you’re thinking now is a good time to buy, you may want to think again.

Despite these losses, U.S. stocks still look massively overvalued in my opinion – for one very good reason:

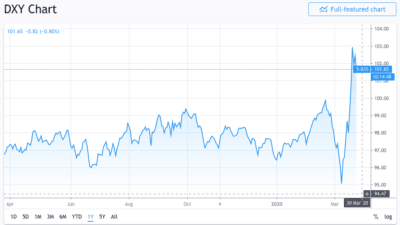

The dollar cannot stay this high forever

While stock markets crashed, the U.S. dollar surged against virtually all currencies.

Why?

Source: TradingView.com

For starters, big institutions and traders are having to meet ‘margin calls’. That is: pad their accounts with collateral against falling dollar-based assets.

This demand for dollars is only temporary.

Another reason could be the dollar’s reputation as a ‘safe haven’ currency. Historically, when the sky is falling, this is the place to run. But that reputation now looks shaky.

U.S. Federal debts are $23.5 trillion – more than double 2008 levels.

Meanwhile, the Federal Reserve is pumping trillions of new dollars into the markets.

Even if S&P 500 stocks are now cheap (and I don’t think they are), the dollar has never looked so risky. Buy now and you could suffer a double crash – first in stocks, then in currency.

There are some wonderful U.S. companies. My favourites are Disney, Waste Management, Starbucks. I would love to own these stocks, and I believe a time will come to buy.

However, no matter how far they’ve fallen, I don’t think that time is now.

Where to buy instead?

Currency could play a much bigger role in this crash.

Central banks are experimenting with extreme policies that have never been tried before. So instead of the S&P 500, I’m focusing on emerging markets, whose currencies have already been hit, and could benefit from a falling dollar.

India offers some extraordinary long-term opportunities, because the population is so young. Corporations aren’t saddled with pensions like those in western nations.

India is the only major economy with a growing workforce and increased urbanization. It means more wealth going around the economy. And because cities are growing, productivity is rising too.

What happens in India today or tomorrow, I’m not certain. As for the long term, I expect India to roar with a new wave of prosperity. This is like investing in America back in the late 1970s.

Don’t forget commodity countries, either

Commodities have been clobbered all through this bull run.

Then came the recent oil shock. Again, commodities were kicked while they were down. It’s hard to imagine an area that’s more unloved, battered and bruised.

Which is why I think commodities could have a very bright decade ahead.

One stock I’m watching closely is Lundin Mining (TSX:LUN), a well-run Canadian copper miner with a very strong balance sheet.

Lundin’s liabilities are low, with a debt/equity ratio of 0.06. As I write this, it is even trading at a price/book ratio of 0.60. Broadly speaking, it means this stock could be seriously undervalued. You are effectively getting a dollar of assets for every 60 cents you invest.

And remember: those are Canadian dollars that aren’t being propelled to unsustainable heights. I feel safer there than anywhere in the U.S.