One industry that continues to do well amid the COVID-19 pandemic is cannabis. Sales are up in Canada and south of the border and many states are seeing record numbers. People are stocking up on pot, whether it’s for medicinal reasons or just because they’re bored and staying at home, and that’s translating into some great performances by many marijuana companies.

One company that’s coming off a great quarter is Arizona-based Harvest Health & Recreation (CNSX:HARV). The vertically integrated marijuana company released its second-quarter results for the period ending June 30 and sales totaling US$55.7 million grew by 109% year over year and 26% from the previous quarter.

More positives from the company’s financials

Sales growth alone isn’t all that exciting, especially from U.S.-based cannabis companies where many of them are still in their early growth stages. But what’s perhaps even more important is that Harvest Health’s adjusted EBITDA of US$4.1 million was positive and a big improvement from the US$3.6 million loss that it incurred in the first quarter. Its total net loss of US$18.3 million was also a slight improvement from its Q1 loss of US$20 million.

Another encouraging figure was that the company’s gross margin, excluding biological adjustments, came in at just over 42%, slightly higher than the 41% margin it achieved in Q1. With stability in its margins and financials, Harvest Health has an advantage over many other cannabis companies that are still deep in the red and showing little (if any progress).

What’s more is that with more revenue growth, Harvest Health’s financials can continue to get stronger, especially if its margins remain intact. And the company’s optimistic about the rest of the year. In its earnings release, Harvest Health announced it was raising its revenue guidance from US$200 million for 2020 up to a range between US$215 million to US$220 million.

At the top end of that range, that would represent a year-over-year sales growth of 88% from the US$117 million in sales that Harvest Health generated in 2019.

The company’s financial position is also improving, with cash and cash equivalents of US$61.7 million on June 30 rising from the US$22.7 million that Harvest Health reported at the end of 2019. With a good cash position, growing sales and positive EBITDA, Harvest Health ticks off many of the checkmarks that cannabis investors are looking for in a good pot stock today.

Is Harvest Health a buy?

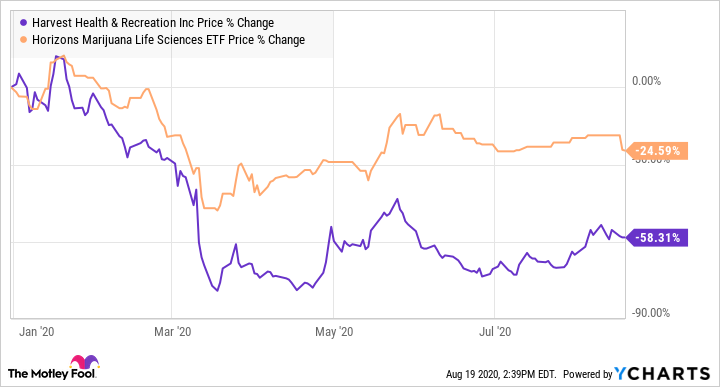

Year to date, Harvest Health’s underperformed the Horizons Marijuana Life Sciences Index ETF (HMMJ.TO):

However, with a depressed stock price, now could be an advantageous time for investors to invest in Harvest Health. As you can see, it compares favourably against many of its peers and top pot stocks:

HARV PS Ratio data by YCharts

Investors who buy shares of Harvest Health aren’t paying much of a premium for it today. And with a low price-to-sales to go along with some strong financial numbers, it may be one of the better cannabis investments out there today, especially with the industry doing so well in the U.S. amid the COVID-19 pandemic and showing no signs of slowing down just yet.