September has a volatile history when it comes to the stock market. This year, that is shaping up to be the case.

The rally off the March crash has many stocks trading at lofty valuations. As such, a market correction is anticipated. Whether or not the pullback turns into another crash is yet to be seen. However, the dip should be healthy for the market over the long term.

Investors who missed the chance to buy top stocks after the market crashed earlier this year might finally get a chance to pick up some deals in the coming weeks. This is great news for dividend investors looking to buy high-quality, high-yield stocks on the cheap.

Enbridge

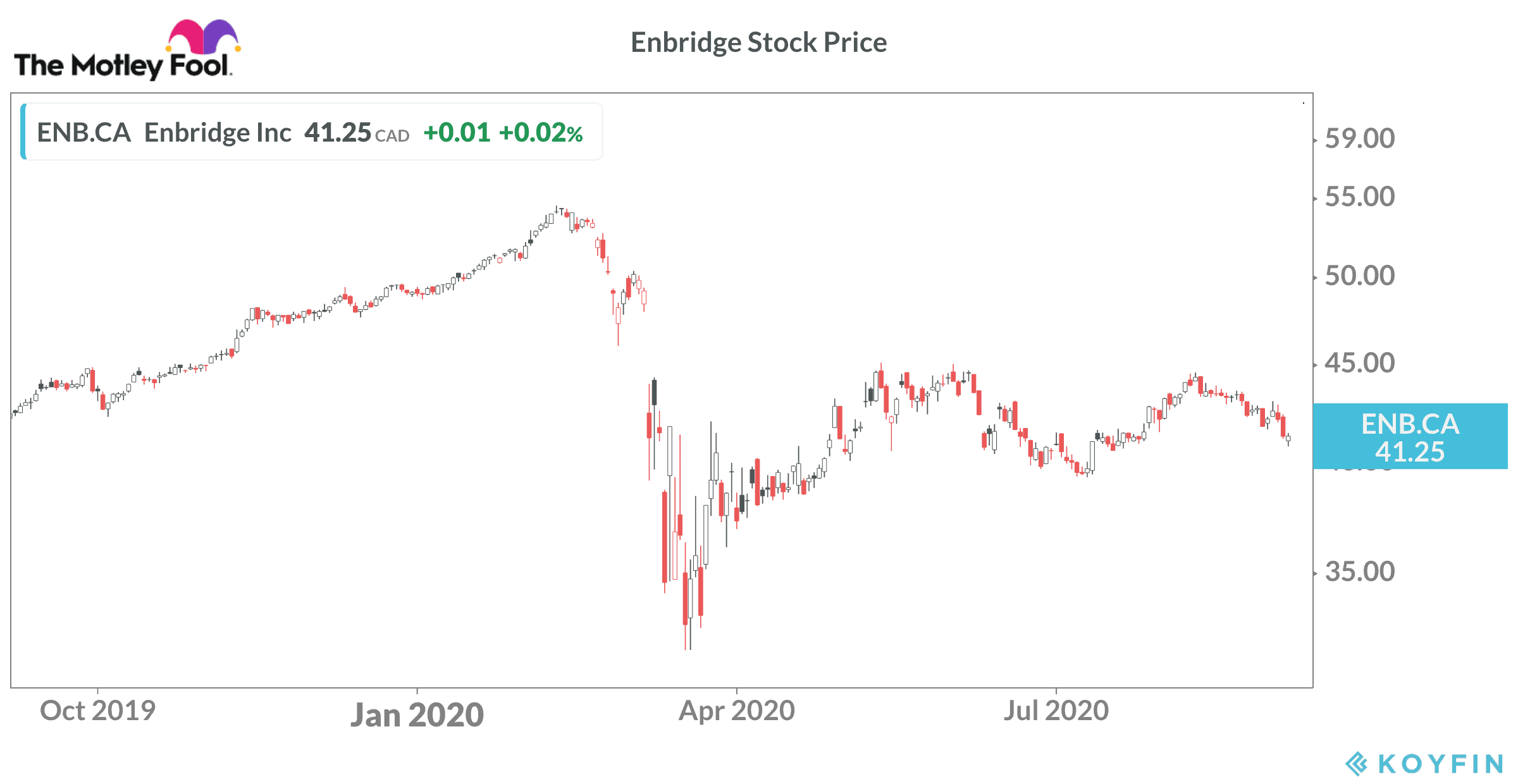

Enbridge (TSX:ENB)(NYSE:ENB) took a big hit in March, then enjoyed a nice rally through the first part of May. Since then the stock has lagged the broader stock market.

At the time of writing, the stock trades close to $41 per share and gives investors a dividend yield near 8%.

Changing oil prices have a limited direct impact on Enbridge. However, fuel demand determines how much crude oil refineries need from oil producers. Enbridge transports roughly 25% of the oil produced in Canada and the United States, so it can see lower throughput when demand wanes.

This occurred through Q2 2020 and investors should see a similar impact when the Q3 numbers come out. Things will improve in Q4 on the reopening of the economy, although refineries take some time to ramp up production.

Looking ahead, the situation should be better in 2021. Health officials expect COVID-19 vaccines to be available in the first half of next year, which should boost demand for air travel and create demand for jet fuel. In addition, companies will start to bring workers back to offices. There is a chance commuters will drive more than before due to concerns connected to sharing public transportation.

Enbridge has a solid balance sheet and continues to work through capital projects that should boost revenue and cash flow to sustain the dividend through the pandemic and support distribution growth in the coming years.

Enbridge looks cheap today and additional downside should be viewed as a buying opportunity.

Bank of Nova Scotia

Bank of Nova Scotia (TSX:BNS)(NYSE:BNS) normally gets about a third of its net income from the international operations primarily located in Latin America. Mexico, Peru, Chile, and Colombia are the main countries. The international division booked a loss in fiscal Q3 2020 due to large provisions for credit losses (PCL) connected to the pandemic.

Bank of Nova Scotia sits close to $55 per share right now an offers a 6.5% yield. The stock trades for less than 10 times expected earnings over the next 12 months. That’s the cheapest price-to-earnings ratio among the largest Canadian banks today.

A popular strategy with Canadian bank stocks is to buy the one that underperforms each year. There is no guarantee this will work in 2020, but the laggard in one year often rebounds and catches up with the others in the following 12 months.

Bank of Nova Scotia remains very profitable and has adequate capital to ride out the downturn. The company’s dividend should be very safe and you get paid well to wait for the recovery. Bank of Nova Scotia traded above $74 per share earlier this year, so there is attractive upside potential from the current price.

The bottom line

Enbridge and Bank of Nova Scotia are two of Canada’s top companies. The stocks appear cheap today and investors get a chance to secure above-average dividend yields with a shot at big capital gains when the economy recovers.