Before I begin, a bit of clarification. When it comes to V-shaped stocks, it’s more likely you’ll hear the phrase “V-shaped recovery.” This refers to the broader market place, where after a stock market crash happens, there is a quick rebound. The result is — you guessed it –a V-shaped dip in the markets.

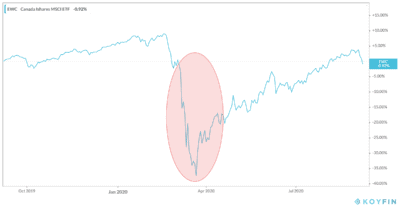

However, it’s not very common. The last two V-shaped recoveries happened in 1920-1921, and 1953. This is pretty much the best case scenario for the markets. But if you look below, you’ll see exactly what I mean. The market crash happened back in March, but there was a fairly quick rebound. This resulted in many stocks making a fairly quick and stable recovery.

However, most stocks are still not at pre-crash norms. And it’s unclear whether this can be classified as a V-shaped recovery, as there could be future crashes ahead. Yet there are a few V-shaped stocks out there that have both rebounded to pre-crash levels, and continue to rise. Two I would highly consider are Open Text Corp. (TSX:OTEX)(NASDAQ:OTEX) and Cargojet Inc. (TSX:CJT).

Open Text

Open Text has the benefit of being a tech stock with a lot of history behind it. Shares in the company have grown almost 2,000% in the last two decades for the information management software company. But that growth should continue in a post-pandemic world.

As businesses continue to need employees working remotely, Open Text is set up to make a killing. The company already has major partnerships, including with Alphabet, which is using Open Text for its Google Cloud services.

During the market crash, this company was the definition of a V-shaped stock. Shares dropped by 33%, then rebounded almost immediately by 30%. Since that time, shares have remained stable, growing at a comfortable rate. For investors looking for stability as the world continues to go online, Open Text is the perfect choice.

Cargojet

Another company benefiting from a rise in the work-from-home economy is Cargojet. The company was already doing well before the pandemic, but after the crash things exploded. This comes from the company’s partnership with Amazon. The e-commerce giants has a 9.9% stake in Cargojet today. However, if it brings Cargojet $400 million in business in the next few years, that ups to 14.9%.

With the huge increase in demand for products, Cargojet has had no trouble with that goal. In fact, not only did this prove to be another V-shaped stock during the market crash, it has soared past to reach all-time highs. The company fell by 45% during the crash, but has since skyrocketed by almost 150% at writing.

However, the company has fallen by 16% since reaching all-time highs nearing $200 per share, indicating that the next crash could be under way. So it might be time to watch a company like Cargojet very closely to reach share prices you might not see again.

Bottom line

Both of these companies came out strong during the last market crash. While it would be nice to think that we will see a V-shaped recovery, it just doesn’t seem likely. Economists believe further crashes are down the line — and could be happening as we speak. If so, you’ll want these two V-shaped stocks in your portfolio to give you the best chance of recovery.

If you used your Tax-Free Savings Account (TFSA) contribution room towards both of them today, you could see another rebound similar to the last crash. That could turn your initial $69,500 total investment into $96,878 after a rebound.