Economists around the world continue to spout bad news. The pandemic threw the world for a loop, but that wasn’t the only problem. Countries around the world were already racked with debt, and a recession was bound to happen.

However, now things are much, much worse. Not only should we expect another market crash, but there could — and likely will — be multiple market crashes. Now is the time to prepare the best way you can.

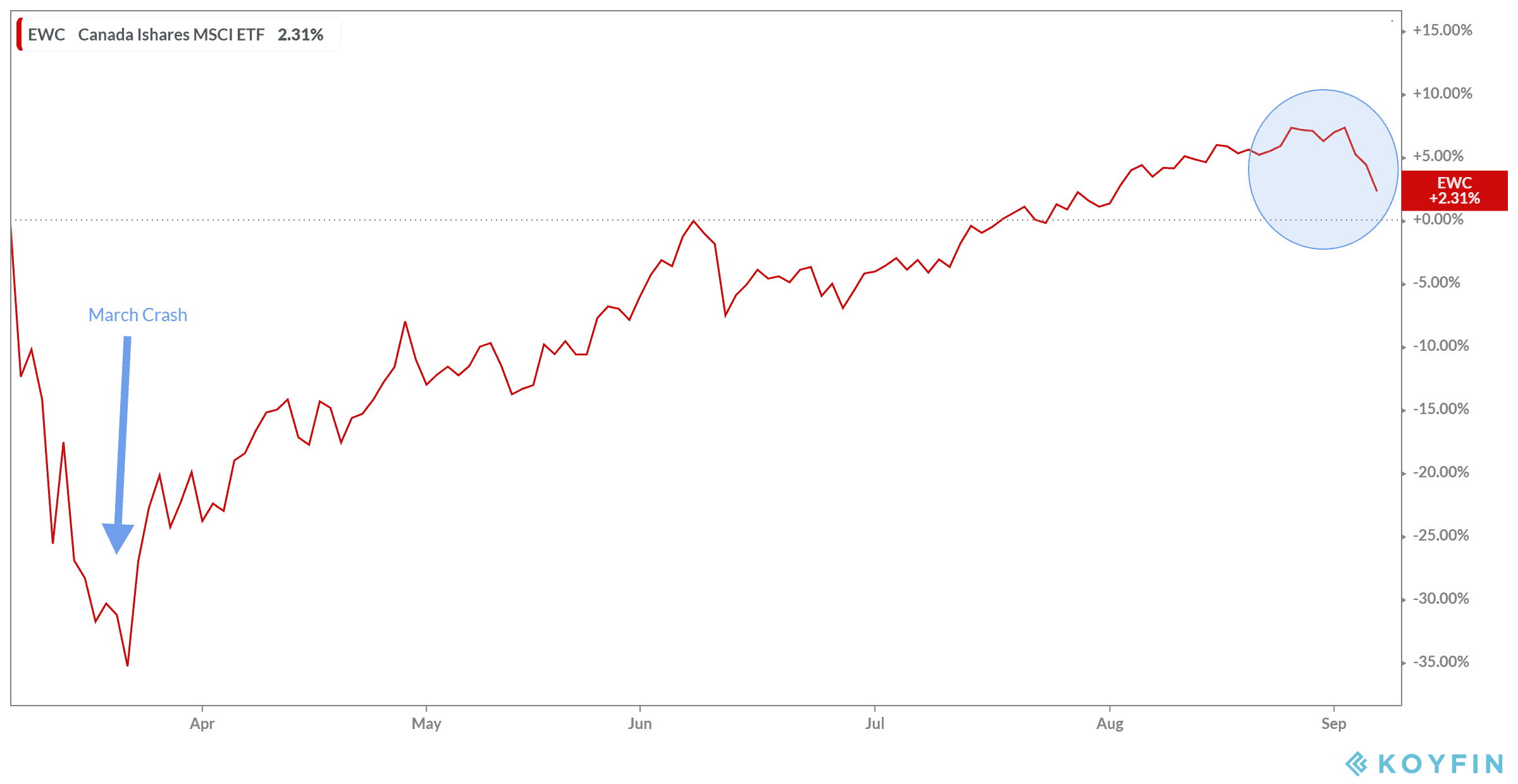

There are a few theories out there about when we should expect these market crashes, but the first is likely to be in the next month or so. In fact, it could already be underway. As you’ll see below, after a strong and stable rally by stocks and industries across the board, it seems the market is taking a dip.

What does this mean for investors? Be prepared. And there are a few ways to do that.

Buy stability

It can be scary looking at these stock market crashes and seeing your investments flounder. But remember: if you have stable stocks, you shouldn’t worry. Stability comes from companies that have a long standing of stable gains. This should come from both share price and other financial technicals, such as revenue growth.

To find these stocks, you’ll want to look to companies that have decades of growth behind them. Not only that, but these companies should be household names of the industry, with plenty of future opportunity left for growth. These are known as “blue-chip companies.”

One of the best places to look are within the financial sector, and specifically Canadian banks. The Big Six Banks have been around for over a century and are likely to continue to stick around for the long haul. These companies usually continue to find new and diverse ways of bringing in growth, mainly through expansion.

Buy dividends

So, that keeps your finances safe for the long term, but what about the short term? As you see your stocks fall, you’ll want a company that will give you something for sticking around. That comes in the form of dividends.

Dividend stocks are perfect during a recession, because the funds come in like a paycheque, no matter what. If you’ve chosen a blue-chip company, it’s likely the dividends won’t be cut or even decrease during these market crashes. That means you can look forward to these dividends every quarter, or even every month, like clockwork.

Again, banks are a great place to look for dividend stocks. The banks have trillions in assets to fall back on, so it’s likely dividends won’t be something the bank will have to cut. Meanwhile, banks are well known for steady increases in dividend yield, making that paycheque even sweeter each and every quarter.

Buy CIBC for both!

The perfect stock then to buy up right now has to be Canadian Imperial Bank of Commerce. The bank has decades of growth behind it but still has much more it can do. The bank is fairly focused on Canada right now but is starting to expand. This leaves room for plenty of strong share growth in the years to come.

But the bank is also the top dividend producer of the Big Six banks. As of writing, the dividend yield sits at 5.61%, bringing in $5.84 per share in dividends each quarter. If you were to use $60,000 of your Tax-Free Savings Account (TFSA) contribution room, that would bring in about $3,405 in dividends each year!