Air Canada (TSX:AC) appears to be a cheap stock today compared to where it traded before the pandemic. The company should survive the downturn, but investors need to consider the near-term risks when evaluating Air Canada as a top stock pick right now.

Second COVID wave threat for Air Canada stock

Air Canada’s passenger numbers dropped 96% in Q2 2020. The Q3 results should be a bit better, but the situation for Air Canada remains dire. Travel restrictions are still in place in many countries. Canada’s border remains closed to international visitors, including those from the United States.

Air Canada reduced its staff count by roughly 20,000 in June, representing more than half of its previous employees. The airline grounded more than 200 planes and burned through cash at a pace of more than $20 million per day in the three months ended June 30. Air Canada reported a Q2 net loss of $1.75 billion compared to net income of $343 million in the same period last year.

The airline needs Canada to loosen the travel restrictions. That might not occur until a vaccine is widely available. In fact, there is a risk that a second COVID-19 wave could send the airline industry into another free fall.

Case loads are rising in several Canadian provinces after reopening efforts enabled more people to interact. British Columbia just closed bars and banquet halls. South of the border, the United States continues to battle with expanding case numbers in several states.

A second wave in the fall could force new lockdowns that would put added pressure on Air Canada and its peers.

Business travel impact on Air Canada stock

The pandemic lockdowns forced companies to conduct meetings and negotiations through video platforms. The success of the virtual meetings over the past six months could permanently alter business travel habits. Sales people and executives who’ve historically traveled around the globe to meet with customers and suppliers might stay home. Business-class seats sell for much higher prices than economy class and accounted for a good chunk of Air Canada’s profits in recent years.

A significant drop in business travel even when COVID vaccines are available would mean lower revenue per flight. Investors have to keep this scenario in mind when evaluating Air Canada as a stock pick.

Public health authorities continue to list flights arriving in Canada or between provinces where people might have been exposed to a passenger with COVID-19.

As long as sick people continue to get on planes, business people will avoid all non-essential travel.

Fuel price impact on Air Canada stock

Fuel costs remain the largest expense for airlines. The industry thrived in recent years on falling oil prices, but struggled in the wake of the Great Recession when WTI oil traded near US$100 per barrel.

Oil is currently cheap, and it might stay that way for the next couple of years. This should help airlines get back to breakeven with less revenue. However, there is a risk oil could surge once the global economy gets back on track. Analysts say the massive investment cuts made by oil producers could result in tight supplies in the next five years. In the event oil prices rally back toward US$100, Air Canada will suffer.

Airline executives don’t expect capacity to return to 2019 levels for at least three years. A surge in oil prices before air travel recovers would put Air Canada and other carriers in a bad situation.

The bottom line

Air Canada has access to nearly $10 billion in liquidity, so it isn’t going to run out of cash in the near term. A successful rollout of COVID-19 vaccines in the first half of 2021 could result in a new surge in air travel. In that scenario, the stock could potentially rally through the end of next year.

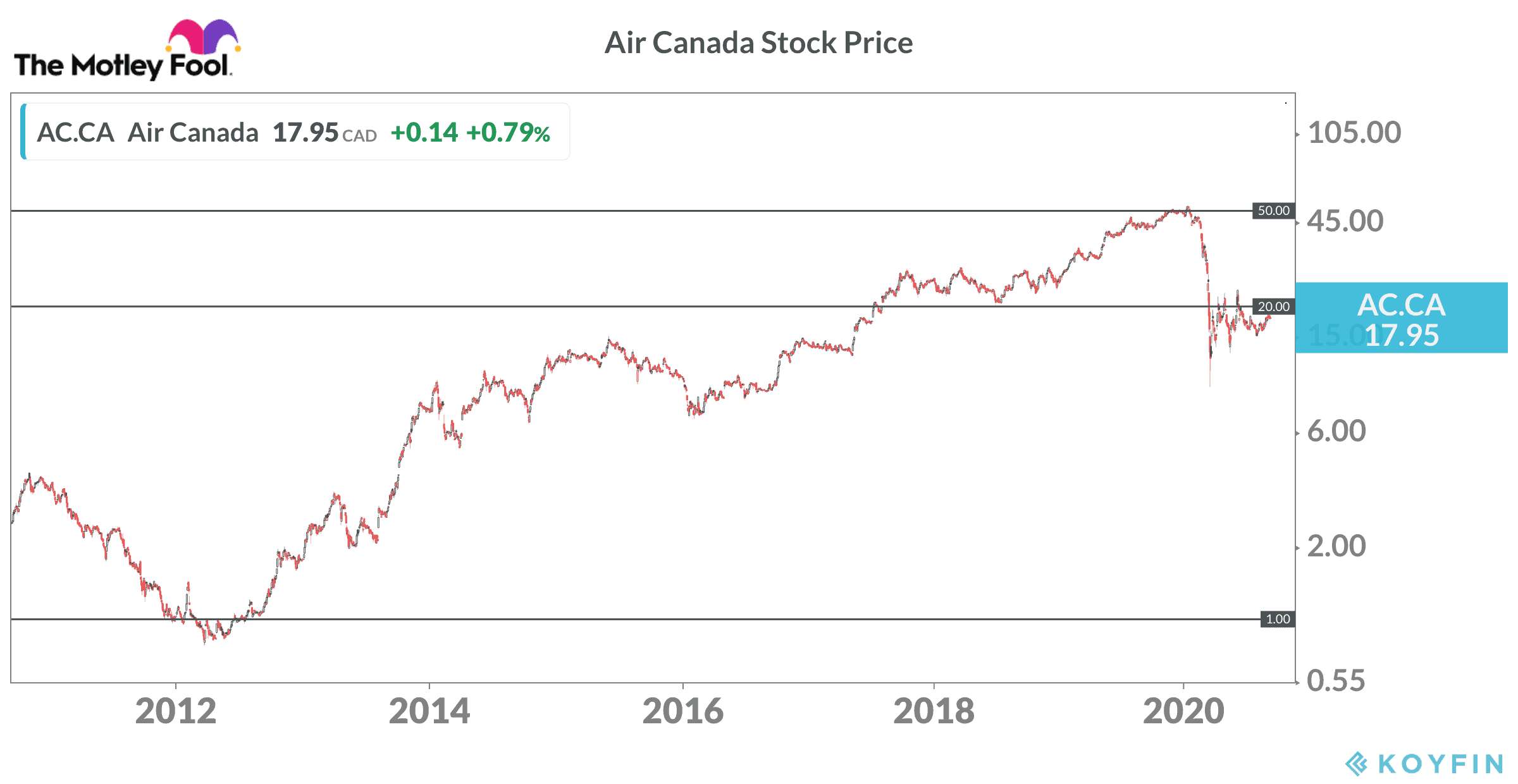

Air Canada trades close to $18 per share right now. It was above $50 before the pandemic, so investor might be tempted to buy the stock at this level. However, Air Canada also went bankrupt after SARS and traded below $1 per share in the wake of the financial crisis.

The stock might have already bottomed in this crisis, but the additional downside risk should be considered. If you decide to take a contrarian position in Air Canada stock today, I would keep it small.