After rising for five consecutive months, the market started its bumpy ride in September, as the shares of large technology firms saw a massive crash in the first week.

The crash came amid U.S. president Donald Trump’s recent claims — linking his defeat to the market crash. Trump — during a press conference on September 7 — suggested that his defeat to Democrats could lead to the economic collapse. “Stocks will crash like you’ve never seen before,” he added.

Don’t worry about Trump’s threats

Most of you might already be familiar with how Trump exaggerates things and — at times — makes false claims. This time, his words about the market crash sound like a direct threat to investors.

Nonetheless, I still wouldn’t pay heed to his claims, as I know he’s mainly making such statements just to grab attention ahead of the election — without any logical basis for his words. That’s one of the reasons you shouldn’t worry about Trump’s latest economic collapse and market crash threats.

Trump keeps bragging about the stock market gains

The sell-off began just a couple of days after Trump — during a COVID-19 related press briefing on August 31 — called the recent stock market rally “very impressive” and a “tremendous achievement.” He mentioned that “people are very happy with their 401(k)s and with the stocks that they have.”

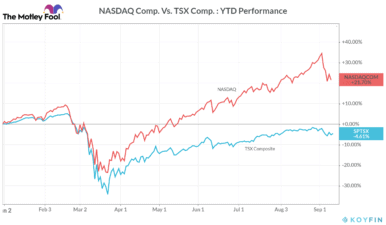

However, investors’ happiness didn’t last for very long as the NASDAQ Composite Index tanked by 11% in just three days between September 3 to September 8. The S&P/TSX Composite Index — the key Canadian market benchmark — slipped nearly 4%.

After a breather on Wednesday, the market sell-off resumed as the NASDAQ, and the TSX fell by 2.1% and 1.2%, respectively, on Thursday.

But you must brace for higher volatility

No matter what the outcome of the U.S. elections would be, the U.S. and Canadian markets are expected to remain highly volatile ahead of the election in November. And you must immediately brace for the expected extreme volatility. So, basically, if your portfolio relies too much on a handful of industries and sectors, you should start adding stocks from other industries to it to make it more diversified.

Opportunities for Canadian investors

In the last five months, the Canadian market didn’t rally as much as the U.S. indexes. The TSX Composite is still far away from its all-time high. I see it as a blessing in disguise for two reasons. First, if U.S. indexes continue to tank in the coming months, you could expect the Canadian stocks to remain relatively stable and fall — if at all — with lower intensity. Second, Canadian investors still have many open opportunities to buy stocks cheap.

While I’ve been arguing against investing in Canadian banks since their latest quarterly earnings came out in August, I expect some other industries — including many tech companies — to see consistent high growth in the near term.

Continue investing in high-growth stocks

Expected high growth and strengthening fundamentals could keep many tech stocks, like Lightspeed POS (TSX:LSPD), afloat in the coming quarters. The Montréal-based software company’s revenue grew by over 50% year over year in the last couple of quarters. This strong revenue growth is likely to help Lightspeed turn profitable sooner than earlier estimated. Despite its impressive sales growth, LSPD stock is still trading with moderate 14.3% year-to-date gains.

Also, the stock is nearly 15% below analysts’ consensus price target of $48 per share. Investors looking for a tech stock that’s not as overvalued as Shopify can consider investing in Lightspeed POS.