A market crash is coming. There’s no way around it. It looks like those economists predicting a V-shaped recovery are already being proven wrong. After some major growth since March, 2020 could end on another sour note. After reaching share prices not seen since the end of February, the TSX Composite is now headed back down.

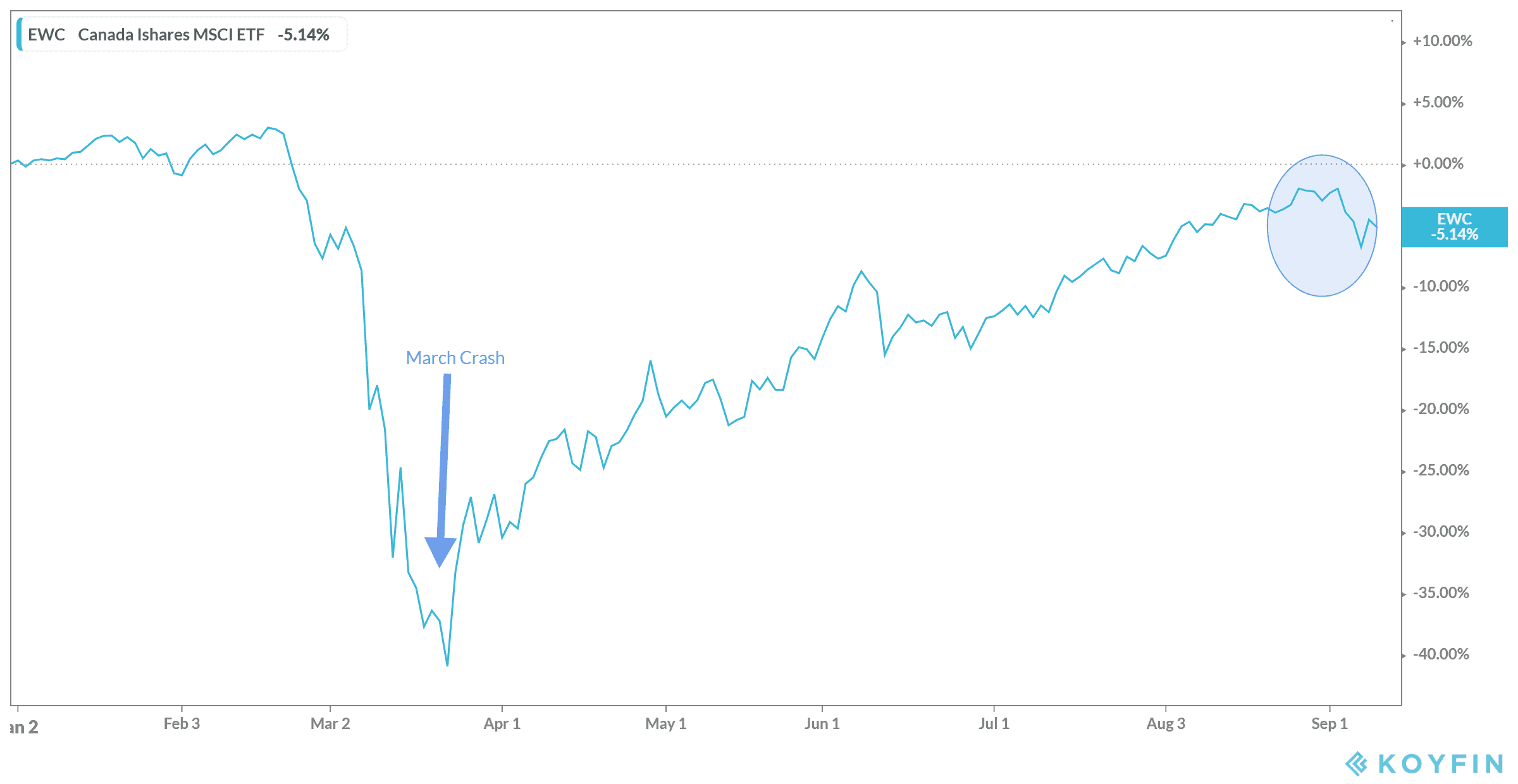

In the last few weeks alone, shares dropped 4%. That might not seem huge, but if you look at how things started in March, it could be the beginning of the next crash. Just take a look for yourself.

As you can see, it took almost a month for the major crash to happen — little by little, with more and more drops that became steeper and steeper, until the crash hit on March 18.

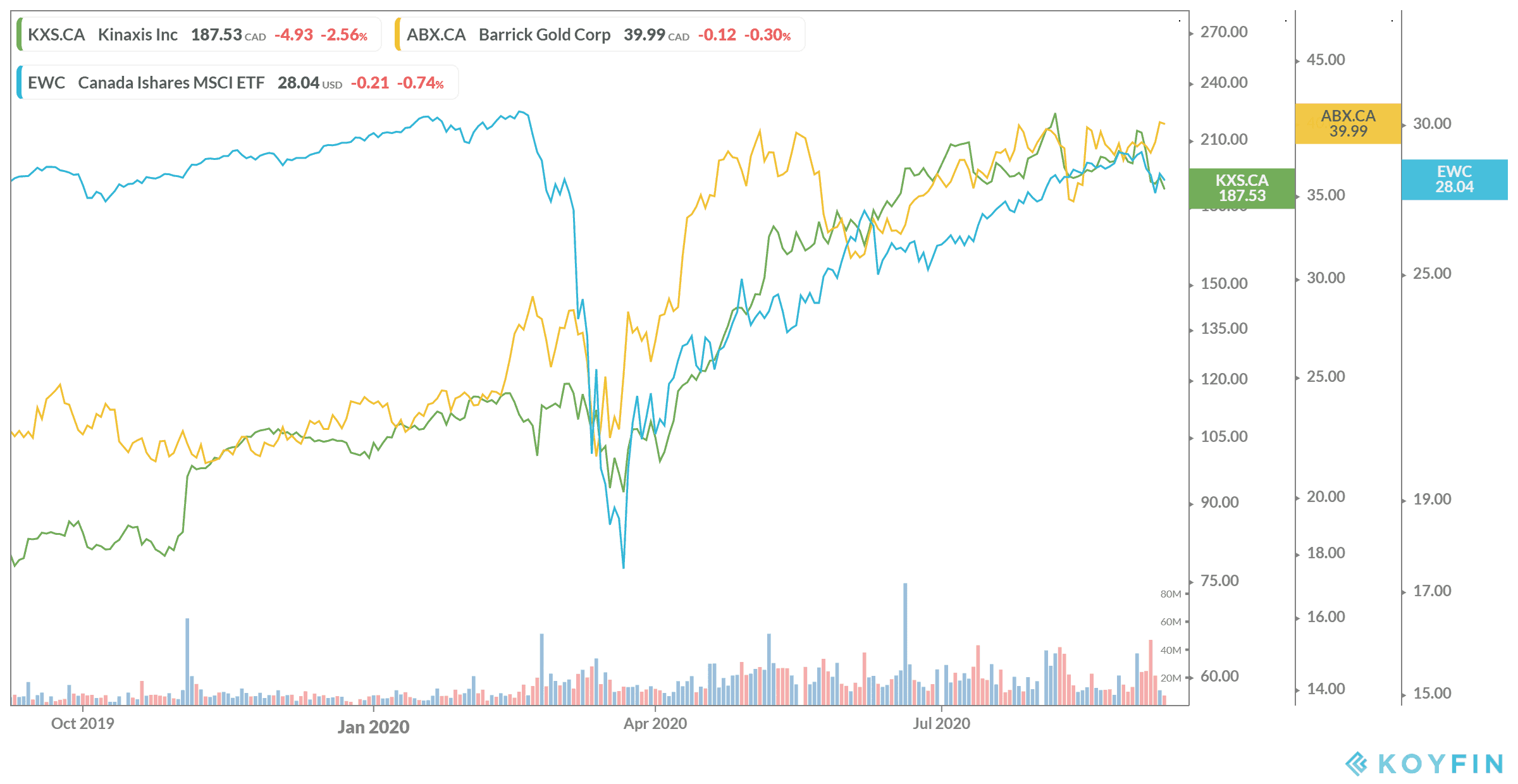

So what should investors do to prepare? Find stocks that outperformed the markets, and then some, to protect their interests during the next market crash. Whether you wait for a market bottom or not is up to you, but you seriously can’t go wrong by investing in companies like Barrick Gold Corp. (TSX:ABX)(NYSE:GOLD) and Kinaxis Inc. (TSX:KXS).

Barrick

On the one hand, Barrick Gold certainly isn’t a steal right now. The stock is trading at heights not seen in years. But there’s a reason. The company is a streaming company providing mines with the funds to start up mines around the world, without the risk of the mines themselves. That means investors can look forward to the benefits of a gold producer, with far less risk.

And of course, gold is having a heyday right now. The price of gold is up about 25% for the year, as of writing, and economists think this will only continue to rise. By 2030, the price of gold could reach $3,000 per ounce! That makes the current price at about $2,000 a steal.

As for Barrick, the company has a five-year return of 406% as of writing, with a compound annual growth rate (CAGR) of 38%. Its future also looks bright. While earnings will be down this year, earnings per share for 2021 are predicted to rise by 28.5% year over year, with sales jumping by 23.5% this year, and 7% in 2021.

Kinaxis

Kinaxis also has a premium price on its shares, but again for a good reason. The world is moving online during the pandemic, more so now than ever before. So companies are looking for software as a service companies, such as Kinaxis, to manage its data. Kinaxis provides supply chain management for large companies, with a wide range around the world.

The company is also way up in the last five years, with a return of 418%, and a compound annual growth rate (CAGR) of 39%. This year alone, the stock is up 134% as of writing, with its earnings per share rising by 31.3% year over year, and sales up 15%. This should only continue to rise as companies big and small sign on with Kinaxis.

Foolish takeaway

As you can see, both of these stocks have outperformed the market in the last while. Only as the market starts to dip again have both of these stocks started to fall a bit. However, this just means you can now get a great price for an amazing stock set to soar even higher.