The stock market rally off the 2020 market crash wiped out most of the top deals in recent months. However, a number of high-quality cheap stocks still exist that could produce massive returns in the next two years.

Is Suncor stock too cheap to ignore?

Suncor (TSX:SU)(NYSE:SU) stock trades near $18 per share at the time of writing. The stock started the year above $40 and hit a March closing low around $15 per share.

Weak oil prices hurt margins at Suncor’s oil production divisions in recent months. The oil sands giant is a major producer in Alberta. Suncor also has offshore production facilities in the Atlantic.

WTI oil traded above $60 in January. At one point in April, the futures contracts went negative. May through the end of August saw WTI oil prices rebound above US$40 per barrel. Chinese demand helped fuel the recovery along with ongoing cooperation among OPEC+ members to limit supply to support prices.

Suncor’s share price rallied above $28 in early June on initial recovery optimism but steadily trended lower over the past three months. The company reported rough Q2 2020 results and recently reduced production guidance for the year due to a fire at one of its sites and weaker-than-expected demand.

This all sounds negative, and near-term volatility is expected, but the outlook over the next two years should be better. Stimulus efforts by governments and the likelihood of COVID-19 vaccines widely available by the middle of 2021 should boost economic activity and drive fuel demand higher.

That bodes well for the price of oil. It would also be positive for Suncor’s refining and retail operations.

The current dividend should be safe and provides a 4.6% yield. At $18, Suncor stock looks cheap, and it wouldn’t be a surprise to see the share price hit $36 by the end of 2022.

Does past performance make Teck Resources a cheap stock to buy today?

Teck Resources (TSX:TECK.B)(NYSE:TECK) is a partner with Suncor on the Fort Hills oil sands site. The companies recently announced the restart of the second train at the facility and intend to ramp up output through the end of the year.

Teck’s oil investment is not its core operation. The company is best known as a producer of steel-making coal, copper, and zinc.

The base metals enjoyed nice rallies in the past six months, and the market is just starting to realize this could have a meaningful impact on Teck’s results in the coming quarters. In addition, prices for steel-making coal are starting to drift higher.

Why?

China’s steel mills are back producing steel in a big way. New buildings, bridges, and railways are part of stimulus programs designed to get the economy back on its feet. Around the world, unprecedented government spending efforts should put a nice tailwind behind demand for the base metals and steel over the next three or four years.

Cooper is a key component in the manufacturing of wind turbines, solar panels, and electric cars. These sectors will continue to grow, supported by government initiatives.

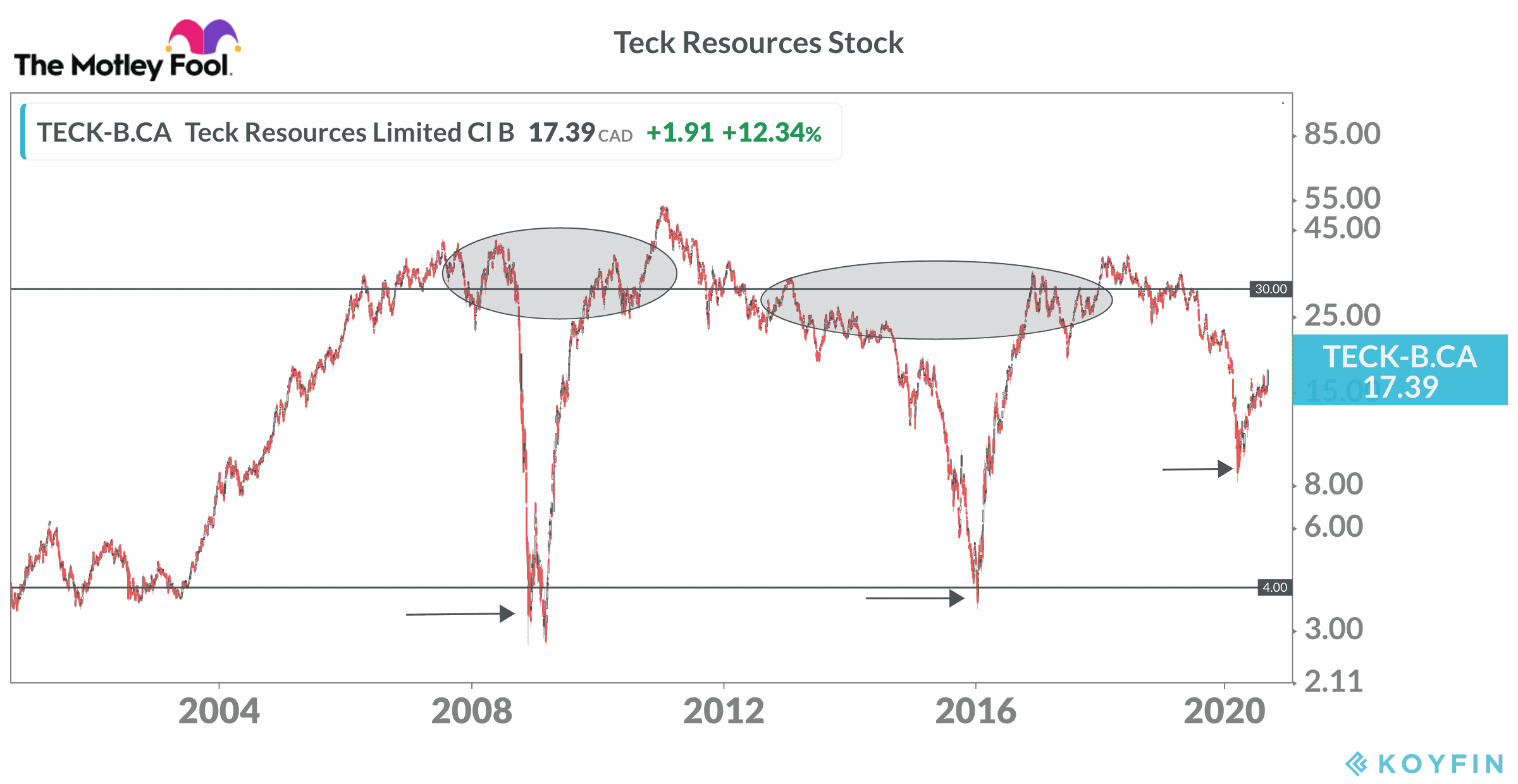

Teck’s stock has a history of delivering massive gains to investors who buy near the bottom of the cycle. It happened three times in the past two decades.

The low point is likely behind us in the current crisis. Teck bottomed out near $9 in March. A continued recovery to the 2018 high around $38 is possible in the next two years.

The bottom line

Suncor and Teck appear oversold right now and could deliver big gains to investors who have the patience to ride out the pandemic. If you have some cash on the sidelines, these stocks deserve to be on your radar.