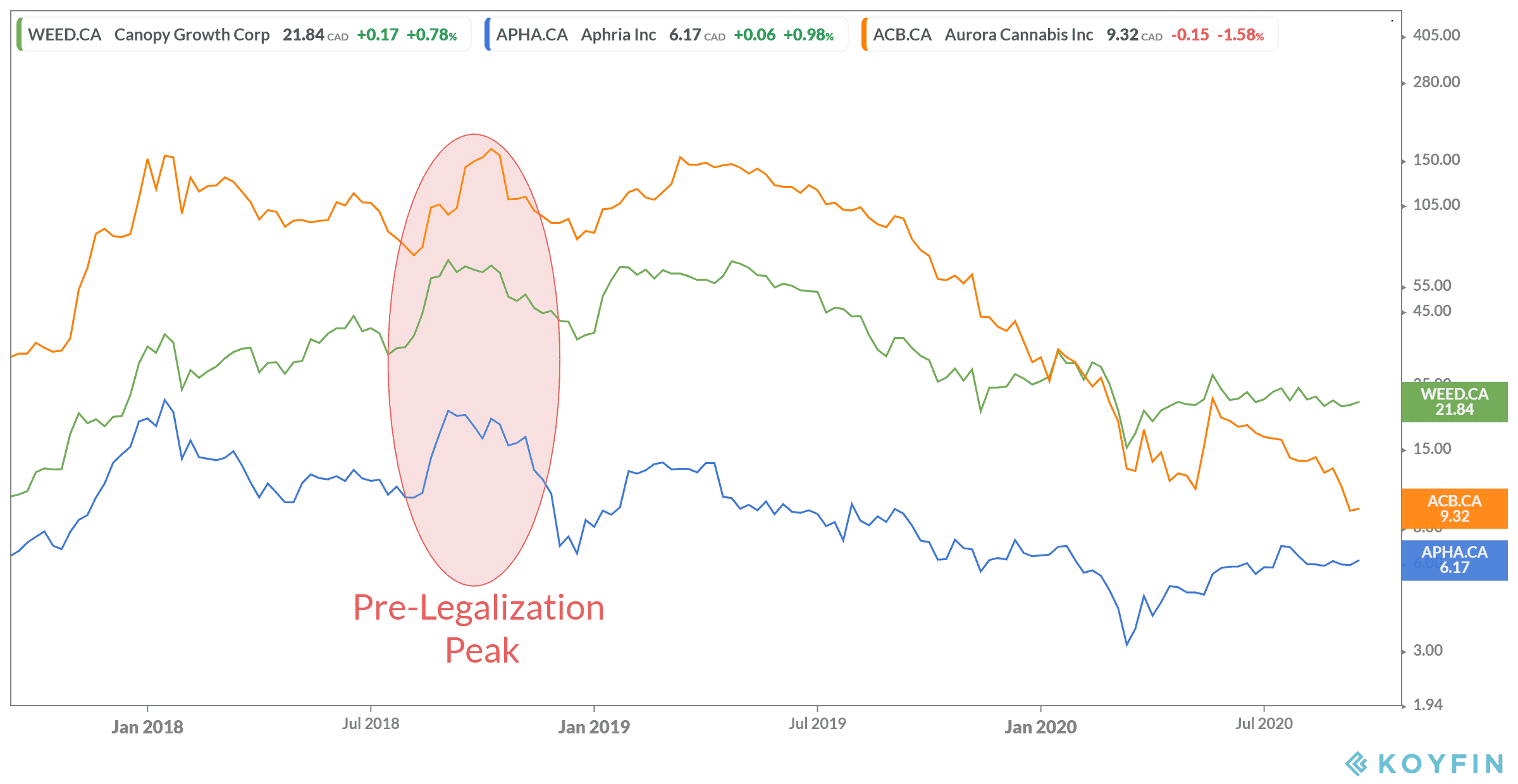

The rise and fall of cannabis stocks has weighed heavily on investors. After soaring back in 2018, pot stocks across the board started to crash after legalization. Since then, shares have fallen to prices not seen since many came onto the TSX, some even lower!

The problem came from lots of acquisitions and little to show for them. As companies bought and bought, investors wanted to see a profit. But this was unlikely to happen for many cannabis companies thanks to all this expansion. So, while investors were quick to buy up companies that looked to be growing rapidly, those same investors sold at high prices once it looked like profit was far off.

That’s what made cannabis the perfect bubble scenario. Since peaks back in 2018, the bubble has burst. But that can mean there is now an opportunity to buy up the winning companies at bargain prices. Let’s look at the top three cannabis companies and see whether these pot stocks have what it takes to deserve your investment.

Canopy Growth

The largest producer out there, Canopy Growth (TSX:WEED)(NYSE:CGC), remains one of the top choices for investors, despite some major setbacks. In the last year, the stock price has seen a loss over about 40% as of writing. Today, shares are at about $22 per share after falling from all-time highs of almost $80 per share.

It could take some serious time for those numbers to come back, as the cannabis company did a lot of buying and has massive debts to pay. Leveraged free cash flow hit a record loss of $1.22 billion back in December 2019. Since then, the company has been taking all its revenue to pay back the debt. Today, that leveraged free cash flow has been beaten back to about $443 million as of writing. While sales are expected to climb to $1 billion by 2023, earnings per share as still expected to remain quite weak during that same time.

Aurora Cannabis

Another heavy hitter, Aurora Cannabis (TSX:ACB)(NYSE:ACB) has the advantage of creating the cheapest cannabis of the pot stocks. But that doesn’t help much if you have too much debt to pay. The company’s shares went under the $1 mark and threatened to remove Aurora from the TSX and NYSE.

The company has over half a billion in debt to pay after its growth strategy. It also doesn’t have the advantage of other cannabis companies of a partnership. Honestly, it still doesn’t even look like the company wants one. Its financial advisor Nelson Peltz remains firm that the company wants to make its own decisions. So, getting cash to pay down debts remains out of reach.

But Aurora is going to have to do something. The company recently warned investors that there is a laundry list of items it has to pay back, and that has come from selling assets as well. Even with sales expected to double in the next few years, earnings will remain low as long as the company’s debts are dealt with.

Aphria

Finally, Aphria (TSX:APHA)(NASDAQ:APHA) managed to be the phoenix from the ashes of all the pot stocks. The company had major issues after short-sellers accused the company of buying worthless acquisitions. But after a report found this unfounded, the company came flying back as the first major cannabis company to turn a profit.

While the share price isn’t exactly sky high, there hasn’t been the fall we’ve seen with other pot stocks. Aphria’s long-term debt is a fraction of Aurora and Canopy Growth at $290.8 million as of writing. The company will still have a long road ahead, but it’s certainly not as bad as its peers. In fact, by 2023 earnings per share could be up 357.6% year over year, with sales up 33.5% to $862 million by that point!

Foolish takeaway

It’s a great time to buy pot stocks, but be careful. Do not go into this thinking you’ll come out a millionaire. That time has come and gone unfortunately. Instead, look for solid companies that stand to make a strong comeback in the years to come. Canopy Growth will take some time, and Aphria will likely come out ahead in the next few years for long-term options. But I would stay away from Aurora, at least for now.