On Monday, the market traded on a negative note as the S&P/TSX Composite Index fell by nearly 2%. The Canadian market benchmark has fallen by 6.9% in 2020, with about 3.8% losses in September. I warned investors on the very first day when the stocks started falling on September 3.

Nonetheless, the ongoing market crash could give a buying opportunity in many great TSX stocks — I believe. Before we talk about a stock, I’m keeping a close eye on during the ongoing broader market sell-off — let’s quickly look at the worst-performing Canadian sectors this week.

Worst-performing sectors

Unlike the market sell-off earlier this month, the Monday crash wasn’t driven by the technology sector. In fact, tech stock under the TSX Composite benchmark rose by 0.8% on September 21. Instead, academic and education services, healthcare, basic materials, and consumer cyclical were among the worst-performing industries this week.

The shares of First Majestic Silver Corp, Hudbay Minerals, First Quantum Minerals, and Vermilion Energy tanked by nearly 9% yesterday. Due to a sell-off in airline stock across North America, Air Canada stock also lost more than 8% for the day as airline industry investors remain worried about the second wave of the pandemic.

1 top TSX stock to watch during the market crash

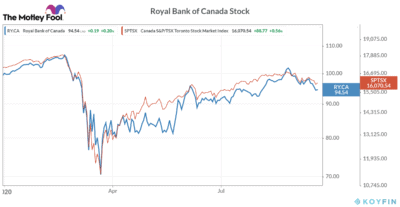

In the last five days, the shares of Royal Bank of Canada (TSX: RY)(NYSE: RY) have lost 5.3%. On a year-to-date basis, the stock is down by 10.5% compared to a 6.3% decline in the TSX Composite Index.

While bank stocks are not among my favourite stocks to buy list right now, I would want to keep a close eye on large banks during the ongoing market crash — mainly to find a buying opportunity if they fall much lower than their fair value.

Expectations of a gradual recovery in their core banking operations — mainly due to easing COVID-19 related restrictions — could boost bank investors’ sentiments in the coming quarters.

Lower dividends than peers

Royal Bank of Canada currently offers a 4.6% dividend yield – slightly lower than many of its peers. Toronto-Dominion Bank’s and Canadian Imperial Bank of Commerce’s dividend yield is at 5.2% and 5.7%, respectively.

I still find the Royal Bank of Canada stock more attractive than other large bank stocks. Its stable fundamentals — along with its continued focus on digitalization — make me more optimistic about RBC’s future.

If we look at the 10-year return of major Canadian banks, the Royal Bank of Canada has outperformed its peers. Its stock has yielded nearly 80% return in the last 10 years, while the shares of TD Bank and CIBC have risen by 64% and 39%, respectively.

Foolish takeaway

As I’ve mentioned in some of my recent articles, bank stocks might continue to face tough times as the ongoing pandemic has devastated their core banking operations. Also, a weak economic outlook could add to banks’ worries in the near to medium term. These are the reasons I don’t want to buy any bank stocks for the short-term.

But if the ongoing sell-off allows me to buy a great dividend stock like Royal Bank of Canada really cheap, I’d definitely consider adding it to my portfolio and hold it for the long term.