The broader market was trading on a mixed note on Tuesday after ending the previous four sessions in the negative territory. At 11:45 am ET, the S&P/TSX Composite Index was up by 0.1% for the day at 3,289 — without any major change from yesterday’s closing of 3,281.

A recent rise in COVID-19 daily cases in many Canadian provinces is hurting investors’ sentiments. This trend has also raised fears about the second wave of the pandemic.

September market crash

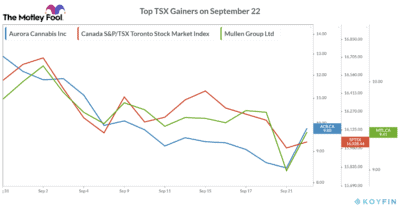

The market is continuing to witness high volatility in September due to rising COVID-19 daily cases in Canada and the U.S. The Canadian stock market benchmark has lost about 6.3% this month while trading with 1.6% year-to-date gains.

On September 22, sectors such as real estate and consumer cyclicals were among the top gainers, and financials and healthcare industries were among the top losers.

Despite the broader market weakness, some stocks were trading on a strong positive note this afternoon. Let’s take a closer look at the top two gainers from today and find out whether you should consider investing in them.

Aurora Cannabis stock rose by over 9%

The shares of Aurora Cannabis (TSX:ACB)(NYSE:ACB) rose by nearly 10% on Tuesday. The company is about to announce its fourth-quarter of fiscal 2020 earnings results after the market closing bell today. These gains could be a reflection of investors’ high expectations from Aurora’s quarterly results.

Wall Street analysts expect Aurora Cannabis to report a nearly 27% year-over-year (YoY) decline in Q4 to $72.1 million. According to these estimates, the company would report an adjusted net loss of $0.53 per share in the fourth quarter.

Interestingly, Aurora Cannabis’s quarterly revenue is expected to decline on a YoY basis in the first quarter.

Its stock already has seen a 72% value erosion in 2020 so far. A fourth-quarter earnings beat could trigger a sustainable recovery in the Edmonton-based cannabis producer’s stock. Investors with a high-risk appetite may consider buying Aurora Cannabis stock if it manages to beat revenue expectations today.

Why this trucking stock rose today

This morning, the Okotoks-based Mullen Group (TSX:MTL) was trading with over 5% gains for the session. These gains came after the trucking and logistics services firm announced its monthly dividend of $0.03 yesterday. It currently offers a dividend yield of nearly 4%.

Note that Mullen Group had to temporarily suspend its monthly dividend from April to June due to COVID-19 related headwinds. The company makes nearly 69% of its total revenue from the trucking segment, while the remaining 31% comes from oilfield services.

At the moment, none of the total 11 analysts covering Mullen Group are recommending a sell on its stock. Nearly 72% of these analysts recommend a buy on the stock with a 12-month price target of $10.39 per share.

However, you wouldn’t want to buy its stock as Mullen Group is expected to report a YoY revenue decline in the next four quarters. The company’s revenue has already gone down in the last couple of quarters while its profitability also has suffered.