The Tax-Free Savings Account (TFSA) is probably the best investment tool Canadians have at their disposal. Introduced in 2009, the TFSA adds more and more contribution room each year. This year, the grand total comes to $69,500. That $69,500 available to invest and make tons of cash, especially on long-term holds.

However, there are a few mistakes that almost every person who opens a TFSA is victim to. Even worse, now that the TFSA has been around for a decade, the Canada Revenue Agency (CRA) has started cracking down. The CRA has been tracking how Canadians use the TFSA, with some shocking statistics. Whether you need to open a TFSA or have had one since its creation, make sure you know these critical statistics.

Maxing it out

Incredibly, a third of Canadians who open a TFSA aren’t even aware there is a maximum. Not only is there a maximum, as I mentioned, but there is a penalty if you exceed that maximum $69,500! Another 40% of Canadians didn’t even know a maximum existed!

The penalty means the CRA now gets to tax you on your investment returns. Suddenly, that tax-free account is no longer tax free! For every month you don’t correct the issue, you will be charged 1% of the overcontribution. That adds up quickly. What you need to know is this: there is more contribution room added every year, and it adds up. So, for 2020, another contribution room of $6,000 was added. However, if you had room from before, then that $6,000 is added up to your existing contribution room.

Don’t worry about doing the math. Simply call CRA, or, even easier, log into the My Account page on the CRA website, and you can find just how much TFSA room you have available.

Contributions going down

While there are likely a few Canadians maxing out, for the most part most Canadians aren’t hitting that max at all. In fact, over the last several years, contributions to the TFSA have been on the decline. As of 2018, there has been a decline of 3% in contributions, with the average contribution hitting $4,800.

But while contributions are going down, the use of a TFSA is still going up. As of 2018, the use of a TFSA grew to 69% from 57% the year before. So that’s something for those who weren’t even investing tax free in the first place.

How to use it

Now, whether your TFSA is new or not, you always should be re-evaluating the portfolio. I’m not saying daily, especially if you have long-term stocks. However, if you have automated payments going towards your TFSA, make sure you’re adding to your watch list to see what a good investment might be.

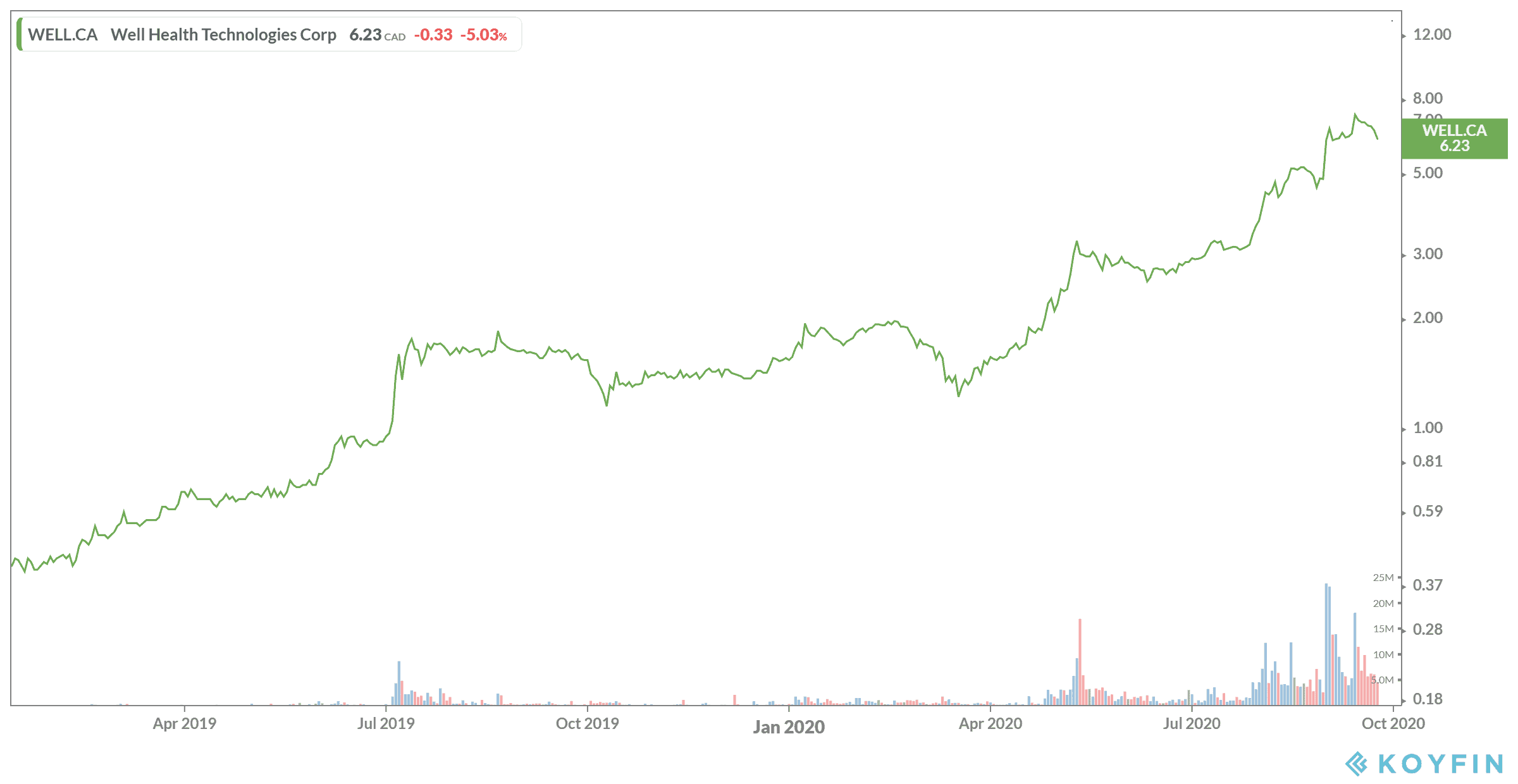

Today, a great option would be WELL Health Technologies (TSX:WELL). The stock has been soaring since its creation last year, up 286% as of writing. This comes from being in the right place at the right time. Health technology is needed now more than ever during a pandemic. The company has seen record-setting revenue as it moves to easier, technology-based approaches to medicine.

In the last quarter, the company set record revenue, bringing in $10.5 million for the quarter and record gross profit of $4.2 million. This represented year-over-year growth of 43% and 88%, respectively. In particular, its software as a service (SaaS) revenue was particularly impressive, growing 1,212% to $2.3 million. There is still a lot of room to grow in this field, making it the perfect long-term hold for investors.

Foolish takeaway

If you take advantage of a poor market, now is the best time to invest in your TFSA. It’s likely many Canadians will see the opportunity as markets rebound. So, buy up a stock like Well Health before it continues to soar even higher.