At the end of last year, many economists and fellow Fool writers predicted correctly that 2020 would be a terrible time for investors. This was based on countries around the world taking on more and more debt, and all that debt needed to be paid somehow. While we haven’t hit a recession quite yet, there is the likelihood of wave after wave of market crashes.

This, of course, links back to the pandemic. These same countries taking on debt now take on even more to help citizens survive during a global health crisis. So, as wave after wave of the virus hits, so too will market crashes.

The second could have already begun, with the Canadian government warning it could be worse than the first. During the first wave, the government was quick to respond with the Canada Emergency Response Benefit (CERB). Canadians then saw this as money they could use to reinvest and spend to keep the economy going.

Unfortunately, this is our new reality for the next few months at least, and it could be years, according to some estimates. Until a vaccine is created, we are stuck with this new normal. So, the government realized it couldn’t continue paying CERB and instead is keeping on the Canada Emergency Wage Subsidy (CEWS) program for businesses to keep Canadians employed.

If you’re approaching retirement, this time is critical. You simply can’t afford to just save for retirement. You need to continue investing to create cash flow during retirement as well.

Beware these sectors

You’ve likely already heard about the housing bubble. Despite a pandemic, housing remains at all-time highs. However, economists see signs of dropping in cities like Vancouver and Toronto. This could mean that bubble is about to burst. Investing in real estate is fine; just make sure you’re not investing in housing.

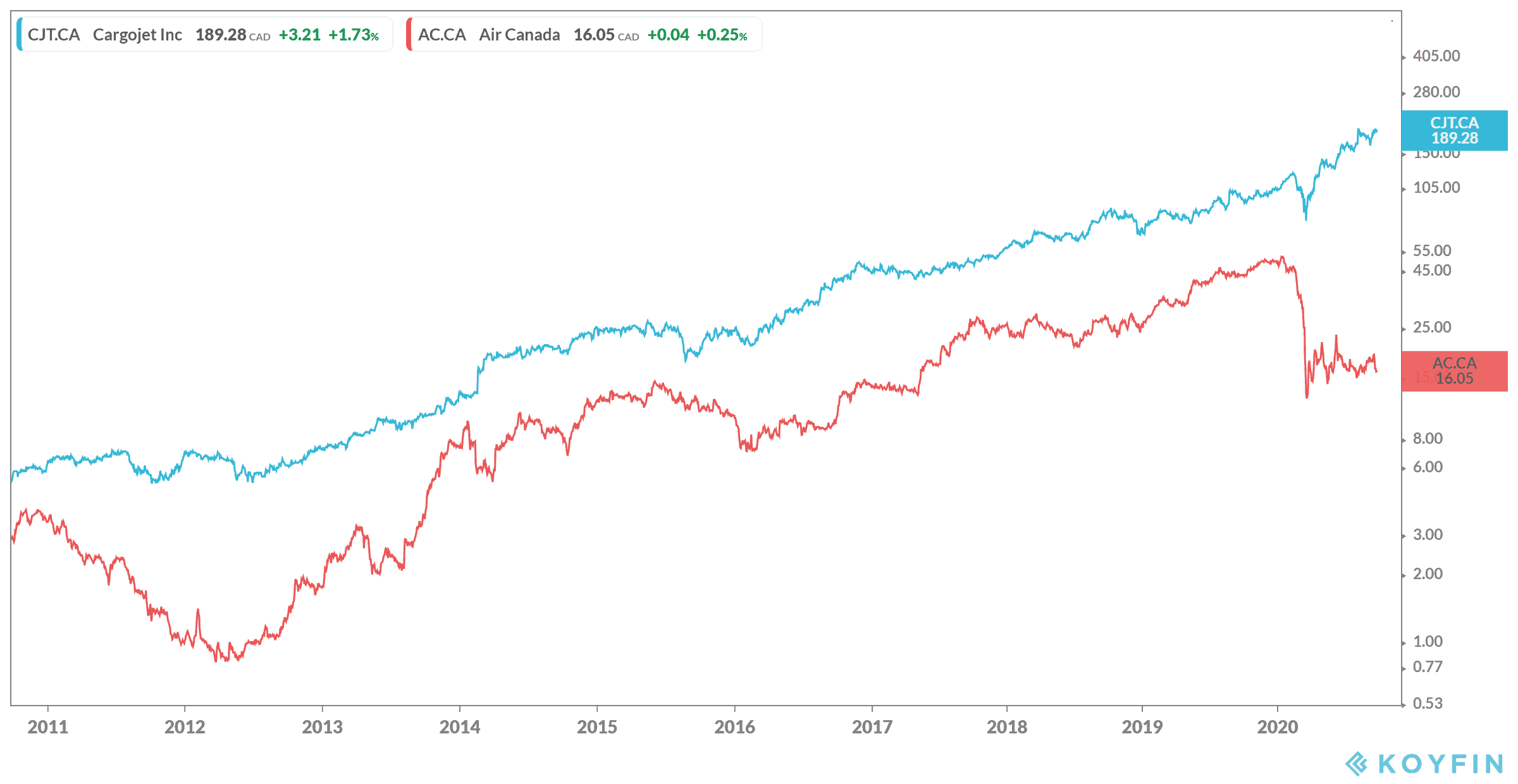

You should also beware of transportation. This is very likely a part of your portfolio from before the pandemic. Further waves could bring this industry to its knees once more. A company like Air Canada (TSX:AC) has taken on more debt than it can likely handle. After years of growth and reinvestment, the company may be pushed to the brink. Even railways could be the next ones hit.

There is one area, however, that continues to do well, and that’s e-commerce. This is also where one transportation company remains solid. That company is Cargojet (TSX:CJT). The company partnered with Amazon last year and since then has seen a huge boost in e-commerce. This comes also from the growth of the work-from-home economy. Cargojet already looked set up to soar, but it came much sooner due to the pandemic.

The company had year-over-year growth of 103% in earnings per share for this year, and that should continue through to 2021. Meanwhile, sales are up 43% for this year, and again that should continue. So, instead of waiting on a rebound from Air Canada, it might be best to put your money towards a strong company like Cargojet that’s set up for when you need to retire. In fact, economists give it an 11% potential upside for this year alone.

Bottom line

If you’re about to retire, you need to be smart. It is a very volatile situation right now, and you need a portfolio that will perform. It might be time to take out your funds first from those companies starting to do poorly. Then, reinvest what you can in companies that are set to continue strong growth in the next decade.