TSX stocks at large outperformed their U.S. counterparts in the recent broad market weakness. The Canadian stock market fell 4%, while the S&P 500 has lost almost 10% in September. The tech sector, which mainly drove these markets lower, seems to be calming recently after weeks-long softness.

Shopify

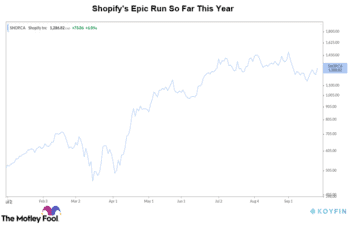

The tech giant Shopify (TSX:SHOP)(NYSE:SHOP) soared more than 8% last week. The quick recovery was much expected, particularly after its steep decline this month. The stock has soared 150% so far in 2020. It is currently trading at $1,287, down about 14% from its all-time high early this month.

It seems like investors have long been ignoring valuation concerns of the tech stock. Shopify stock has gone too far too soon and continues to look expensive at the moment. However, investors continued to run towards Shopify, being one of the biggest winners of the pandemic. Additionally, its second-quarter results double-highlighted its growth story and drove the stock price further higher.

Shopify stands at the second place with a 6% market share in the U.S. retail e-commerce sales, behind Amazon’s 37%. This shows the immense growth potential for the Canadian e-commerce titan. Interestingly, the stock might continue to soar, given its potential to become the next Amazon, despite stretched valuation.

Facedrive

The shares of Facedrive (TSXV:FD), the Canadian climate-friendly ride-sharing company, have been substantially volatile in the last few weeks. The stock lost 18% last week and closed at $12.1. The current price suggests a discount of almost 60% against its lifetime high of $28 in July.

Facedrive offers riders options to choose from EVs, hybrids, and conventional gas-powered cars. The company has seen a meteoric rise in its top line in the last few quarters, considering its environment-friendly business model. However, established ride-hailing companies modifying to the cleaner fleet will likely create a grave threat to Facedrive.

Facedrive has been aggressively expanding in verticals like food delivery and corporate ride-hailing. Whether it continues to report superior revenue growth for the next few quarters remains to be seen. The stock might continue to exhibit above-average volatility and remains a high-risk high-reward play.

B2Gold

Canadian top mining stock B2Gold (TSX:BTO)(NYSE:BTG) fell almost 8% last week. The stock is still sitting at a hefty gain of 65% so far this year. Gold miner stocks have been rallying this year on the back of higher yellow metal prices.

Canadian miner B2Gold has achieved a notable production growth in the last few years. It operates three mines in West Africa and one in the Philippines. Interestingly, despite recent tensions in Mali, its key asset in Africa, the company has expressed its expansion plans in the area. The company management is aiming for acquisition opportunities and intends to achieve higher output from the existing mines.

B2Gold is some of the attractively valued stocks among the Canadian miners. The stock will likely see a notable upside if gold once again resumes its upward march. Even if gold prices stabilize around these levels, it could remarkably uplift miners’ earnings and their stock prices.