Retirees and other Tax-Free Savings Account (TFSA) investors are taking advantage of the drop in the share prices of top Canadian dividend stocks and REITs to build TFSA income portfolios.

TFSA benefit for seniors

Retirees use the TFSA to shield investment income from taxes. All interest, dividends, and capital gains generated inside the TFSA remain beyond the reach of the tax authorities, so it can all go straight into your pocket.

In addition, the CRA does not count TFSA income when determining potential clawbacks on OAS pension payments. This is a huge benefit for retirees who receive OAS pensions and have net world income that is close to the CRA’s pension recovery tax threshold.

Tops stocks for TFSA income

The TSX Index is home to many top-quality dividend stocks that appear cheap today and offer above-average yield. Stocks come with risk and the share prices can move lower, especially when the broader stock market corrects.

However, several companies with payouts that should be safe look oversold right now.

Is Bank of Nova Scotia stock a good buy today?

Bank of Nova Scotia (TSX:BNS)(NYSE:BNS) trades for close to $54 per share right now compared to $73 at the start of the year. At the current price-to-earnings multiple of about 9.6 the stock looks oversold.

Bank of Nova Scotia’s international operations are dragging the stock down, but that should reverse in the next couple of years once the global economy gets back on track. In the meantime, investors can pick up a 6.6% dividend yield that should be safe through the pandemic.

Should Canadian Natural Resources be a top TFSA dividend pick?

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is a leader in the Canadian oil and gas sector. The downturn in the energy sector hit oil prices hard this year. Natural gas has fared better.

CNRL has the flexibility to shift capital to its best opportunities as commodity prices fluctuate. The company’s West Texas Intermediate (WTI) breakeven price is less than US$31 per barrel of oil equivalent and the balance sheet remains solid with adequate liquidity to support the dividend. The Q2 2020 report indicated the board intends to maintain the dividend through the downturn.

The stock trades close to $21.50 at the time of writing and offers a 7.9% dividend yield. Ongoing volatility should be expected, but you get paid well to ride out the storm.

Is RioCan a safe buy right now?

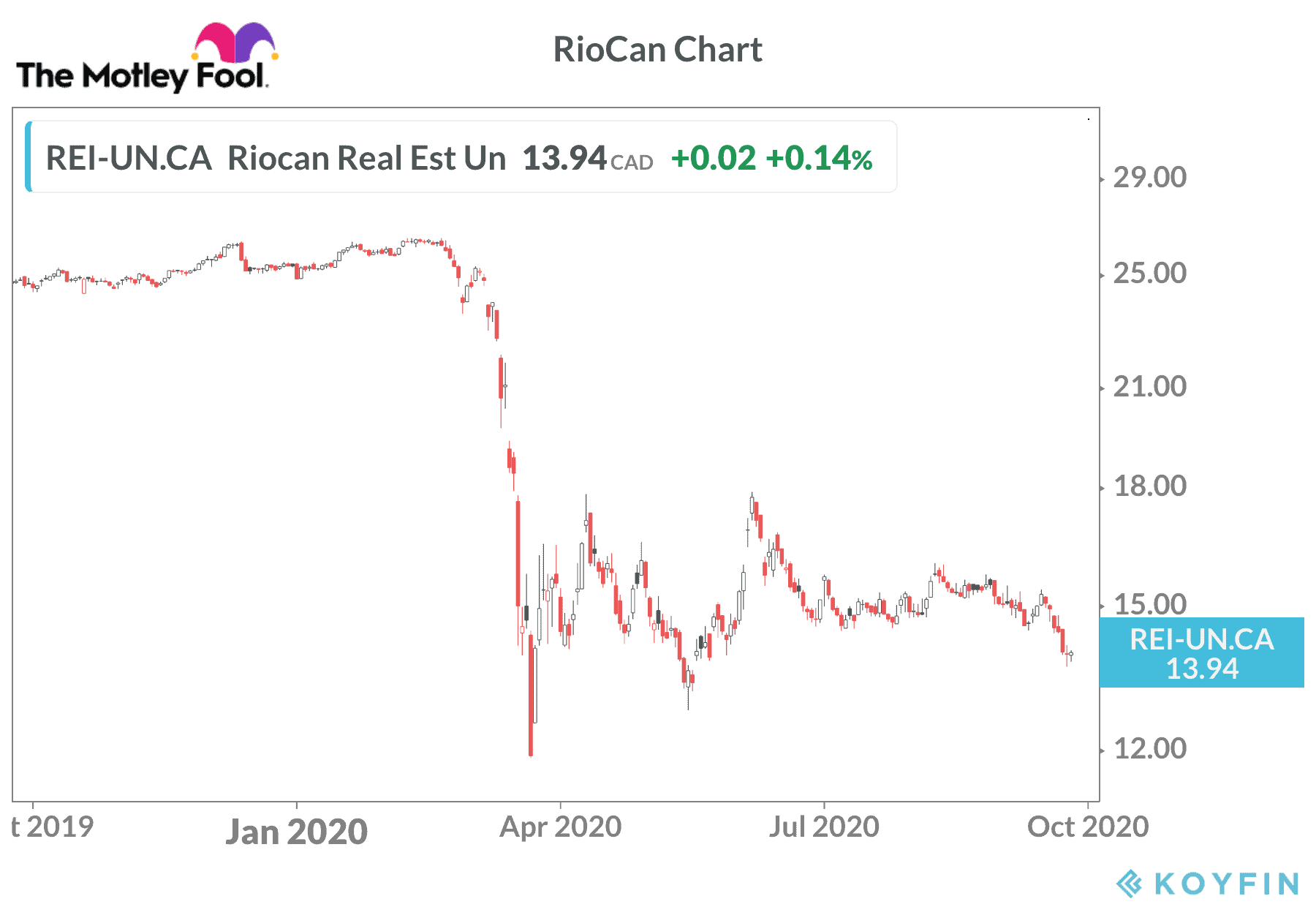

RioCan Real Estate Investment Trust (TSX:REI.UN) is Canada’s largest operator of shopping malls. The pandemic hammered the retail industry in the past six months and rising COVID-19 cases in major cities across the country could trigger a second round of lockdowns.

Near-term risks can’t be ignored, but the threat already appears priced into RioCan’s unit price. The trust units trade for close to $14 today compared to $26 at the beginning of the year.

The CEO recently said RicoCan collected 90% of the rent due from tenants in July and August. Stores continue to reopen and RioCan is getting interest from companies that want to expand their pace or take advantage of vacated spots in top locations.

RioCan’s mixed-use developments continue to move ahead. The buildings combine retail and residential space, offering a more balanced revenue stream.

RioCan has a strong balance sheet and can access funds at very cheap interest rates, so the distribution appears safe. Investors who buy today can pick up a 10% yield.

The bottom line for TFSA income

Stocks come with risk, but the yields on several top Canadian companies right now are so high that they deserve a closer look for TFSA income investors.

GICs only offer about 1% returns right now. That simply isn’t good enough for many retirees who rely on investment income to supplement pension payments.