Warren Buffett is widely known as the world’s greatest investor. He’s earned the respect of many by earning incredible long-term returns consistently over many decades.

In addition, he employs a relatively simple strategy that’s generally easy to replicate. At the root of it, all you have to do is find undervalued stocks and buy and hold for the long term.

Although many investors research their own TSX stocks, there is still considerable interest in what Warren Buffett is doing and which stocks he’s buying.

This year with all the unprecedented events, it’s been even more interesting watching how Buffett has responded.

Investors were shocked when he sold the airline stocks, although that has, in my view, been the right call. He has trimmed some of his bank holdings as well — another rarity for Buffett. Then there was the news of him investing some money in Japan — another move that raised investors’ eyebrows.

However, most interesting has been his company Berkshire Hathaway’s purchase of Barrick Gold, one of the biggest gold miners in the world.

Warren Buffett buying gold

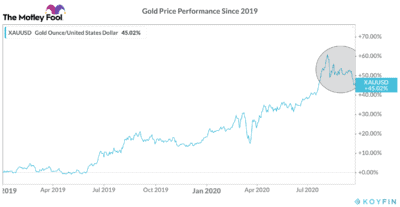

When the news came out in August that Warren Buffett bought a gold stock, that was a major sign. Gold prices have skyrocketed so far in 2020, and by the time Buffett’s stock purchase was announced, gold prices had climbed roughly 30% from where they started the year.

This was shocking, because Buffett has dismissed the idea of gold many times. In the 2011 Berkshire Hathaway annual report, however, he also said something very interesting. Buffett pointed out that “what motivates most gold purchasers is their belief that the ranks of the fearful will grow.”

When you consider that’s his view on the precious metal, and his company makes a significant purchase of a gold stock during this coronavirus pandemic, it gives investors great insight into what the Oracle of Omaha sees ahead.

However, since the purchase of Barrick Gold, gold prices have plateaued; and in recent weeks, without any real news on more stimulus in the U.S., the greenback has been gaining strength, causing gold prices to slip.

As you can see, gold has gotten quite volatile in the last few months. Most recently, however, and roughly since the time Buffett’s purchase was announced, the yellow metal has been trading downward, as we can see in the circle on the graph. So, did Warren Buffett make a mistake?

Gold stocks today

First off, it’s way too early to tell if Warren Buffett was wrong, because he doesn’t make investments for the short term. So, if he’s buying gold stocks, it’s because he thinks there is considerable long-term potential.

The environment for gold has changed rapidly in the last six months, which is why the price has skyrocketed considerably. Gold tends to do well when interest rates are low and massive stimulus is added to the economy. That’s exactly what’s been happening throughout 2020.

While gold may be going through a small dip at the moment as stimulus talks stall, that doesn’t mean it won’t continue its significant rally, especially since at least one more round of stimulus will be needed in the U.S.

Bottom line

2020 has already given investors several reasons to buy gold stocks. Besides the fact that they can offer tremendous growth potential, gold is also a safe-haven asset. And on top of everything else, when Warren Buffett is buying, you know you’re on the right track.

So, make sure you aren’t missing out on this significant opportunity.